We're just days away from General Electric (GE 2.71%) officially spinning off the consumer-focused portion of GE Capital, Synchrony Financial, and there are three reasons why I am considering buying shares.

1. Powerful industry dynamics

One of the most fascinating things about Synchrony Financial is the industry position it finds itself in. Like Discover (DFS +0.00%) -- which is a company I think very highly of -- it offers banking and financial products to customers without the need for branches -- known as direct banking.

I mention Discover because it's a powerful example of the success direct banking can have. During the last year, it has seen its deposits rise $1.9 billion, to stand at $44.5 billion, and its loans rise by 7%, to $65.9 billion.

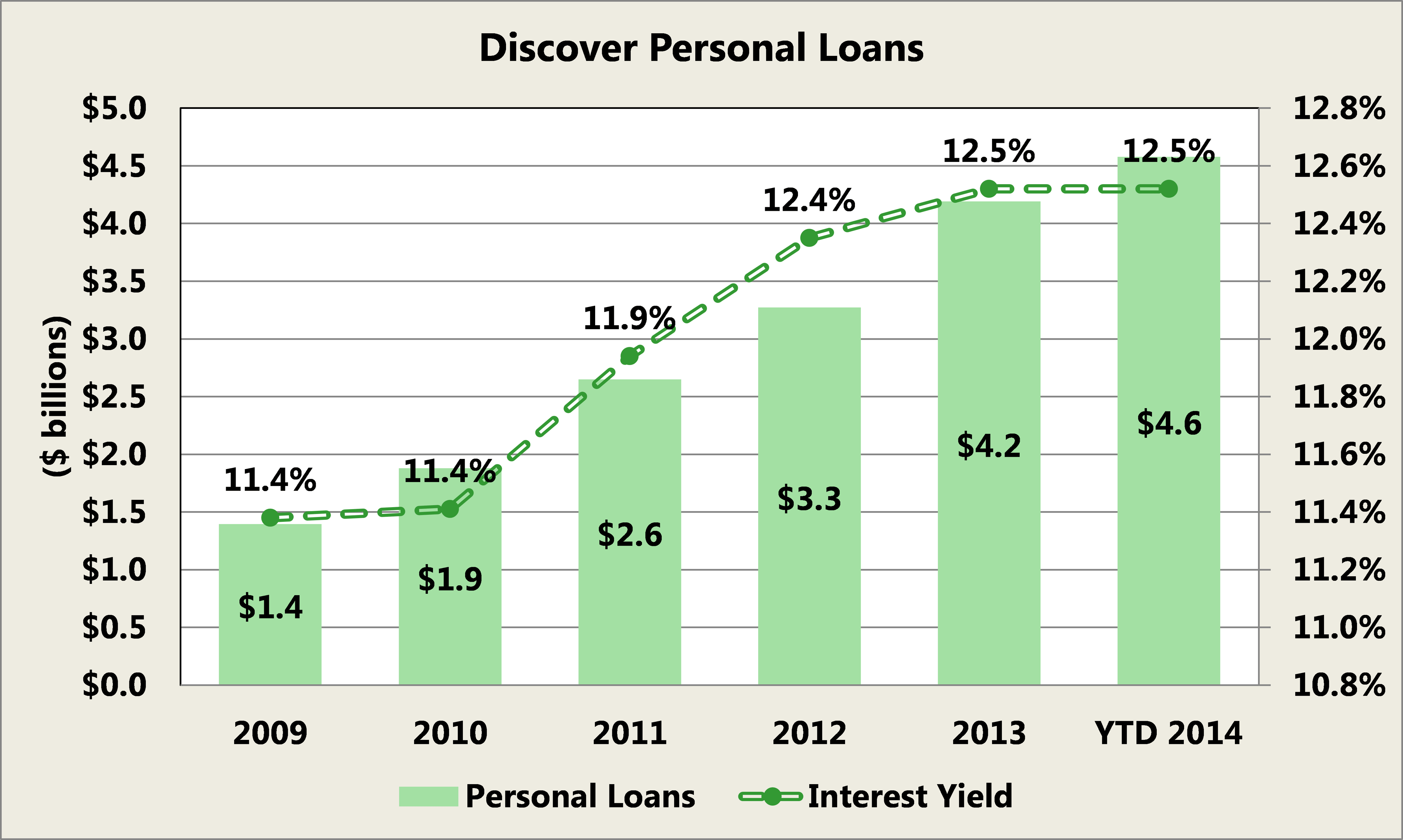

But what's truly impressive with Discover is the fact that its personal loans -- those used to help individuals consolidate debt -- rose by an impressive 26%, or $949 million, during the last year, to stand at $4.6 billion. And it hasn't just been the last 12 months in which this growth has been impressive, but truly, the last five years:

Source: Company Investor Relations.

As you can see, these loans aren't just growing in size -- they've more than tripled since 2009 -- but they've also grown in yield.

At first, the thought of a bank without branches for investors may be a bit concerning; but customers prefer it -- a poll recently showed 61% of people would prefer avoiding a branch altogether. Discover is a prime example of how a bank without branches can have incredible success; therefore, the industry Synchrony finds itself in is very attractive.

2. Strong value proposition to partners and customers

Unlike Discover, though, the main business of the GE spinoff isn't a standard credit card that can be used anywhere and everywhere. Instead, it offers what are known as "Retail Cards," which are private-label credit cards that a retailer offers -- but it's really through Synchrony.

Source: Flickr / JefferyTurner.

One of the most attractive things about its business isn't just the big names it partners with -- including Amazon, Chevron, Lowe's, and Wal-Mart, to name a few -- but the benefits it provides to both the partners and the customers.

For the retailers, unsurprisingly, these cards lead to more sales. But in addition, they also strengthen customer loyalty, and allow for greater marketing capabilities. There are also financial benefits. Interchange fees -- the fee charged between the bank of a customer and the bank of the retailer -- no longer exist, and Synchrony offers payments when the performance of the cards exceed pre-set expectations.

Not only are the benefits available to the firms it partners with, but also the customers who receive the cards. Often, the cards provide discounts at stores, and loyalty rewards. In addition, there are also promotional offers when the card is opened.

Since Synchrony offers compelling value to both merchants and their customers, it doesn't just find itself in an attractive industry, but provides unique and key benefits to all parties involved.

3. Compelling results

Source: Company Investor Relations.

According to the latest results in which the details are provided, Synchrony, in the first quarter, saw its earnings jump more than 55% over the first quarter of 2013, to stand at $558 million.

A big reason for this was a massive reduction in what it expects to lose on its loans -- known as provision for loan losses -- falling by $283 million. But it still saw solid growth in its revenue, which rose by $105 million, or roughly 5%.

Speaking of impressive growth, it isn't just Discover that has seen this, but in just three months' time, Synchrony saw its deposits rise by 6.4%, or $1.6 billion. At first glance, its business operations are clearly doing well.

The Foolish bottom line

As you can see, there are a wide range of things to like about Synchrony. But remember the words of Warren Buffett, who once said, "A business with terrific economics can be a bad investment if the price paid is excessive." Ultimately, the investment decision will come down to where the company's price stands following its IPO.

It isn't a company that I will blindly put my money into; but depending on where its price stands, I'll definitely consider it.