It's no secret that when diners go out to eat these days they prefer the fresh ingredients, customizable menus, pleasing restaurant environs, and reasonable prices that fast-casual chains are providing. They're the one segment of the restaurant industry that's provided consistent growth since the recession.

It's "salad days" for fast-casual chains like Chipotle, but a few casual-dining eateries are enjoying a smorgasbord of customers, too.

And their popularity hasn't abated. U.S. Census Bureau data shows sales in U.S. food and drinking establishments are up 4.6% over the first seven months of 2014 compared to last year, and fast-casual chains like Chipotle Mexican Grill are responsible for a good portion of the growth. Chipotle, for example, saw revenues surge 26% last quarter as comparable restaurant sales -- driven by large gains in traffic -- jumped 15.5% year over year.

Casual-dining restaurants, however, continue to suffer from declining customer counts. The market researchers at NPD Group found the mid-level, full-service dining market encompassing both midscale eateries -- which typically have a breakfast daypart menu (think IHOP or Denny's) -- and casual-dining restaurants -- more commonly serving only lunch and dinner -- is still on the wane, with the segments losing 4% and 3% of their customers from the year-ago period, respectively..

Data: U.S. Census Bureau.

It's an industrywide phenomenon, really, as lower traffic has led to lackluster performance everywhere. The folks at Black Box Intelligence & People Report note that the industry hasn't posted a single quarter of same-store traffic growth since the recession. Obviously, as Chipotle's numbers above suggest, that doesn't apply to everyone.

Setting the table

Even within the casual-dining segment there are pockets of light. The restaurants as a whole might be hemorrhaging sales and customers, but there are individual chains that are actually doing quite well. Here's a challenge: Try to guess which casual-dining restaurant is actually still growing and wins rave reviews from customers across North America.

There's a broad selection of restaurants to choose from, to be sure, so I'll give some hints.

One of the primary reasons customers have turned to Chipotle, Panera Bread, or Zoe's Kitchen is the perceived quality of their food ingredients, their freshness, and how that translates into healthfulness. It's no different, really, when it comes to casual-dining chains, and this top chain got far and away top marks when it comes to its food quality.

Similarly, it was at the top of the list again when it came to its food being perceived as healthy and offered in pleasant surroundings. Considering those are some of the key hallmarks of the fast-casual segment, there may be something to this restaurant ranking so high with customers. It exhibits some of the best qualities of the fastest-growing restaurant niche, even if the experience itself is very different.

With these factors in mind, go ahead, take your best guess...

The customer's favorite casual-dining restaurant

If you said Cracker Barrel, Red Robin Gourmet Burgers, Ruby Tuesday, or Buffalo Wild Wings, good job! You've chosen Nos. 2 through 5 of the largest restaurant chains offering a general menu -- these four got high overall scores from patrons.

However, if you said Cheesecake Factory (CAKE +1.41%), go ahead and take a bow.

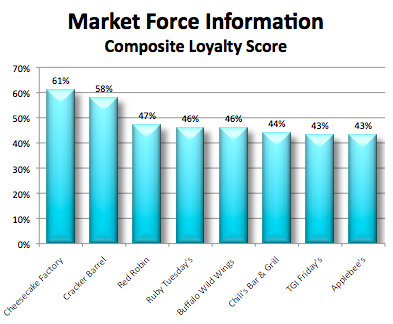

In an April 2014 survey of 6,100 consumers by Market Force Information, Cheesecake Factory was ranked No. 1 for food quality, food healthiness, and atmosphere, gaining a composite consumer loyalty score of 61%, putting it far enough ahead of second-place Cracker Barrel with 58%.

According to Cheesecake Factory's latest quarterly report, revenues jumped almost 29% from last year as comparable restaurant sales increased more than 17%, one of its strongest performances ever and its 18th consecutive quarter of positive comps growth. That certainly bucks the trend of the rest of the dining category!

Part of what helps the chain outperform its rivals is the fact that it has 170 restaurants spread out across the U.S., many in regions less affected by the headwinds that have assaulted the rest of the industry, such as last winter's harsh weather. The weather still played a role in those restaurants located in the Northeast and Midwest, such as those located in Chicago, but the company still hasn't had to resort to promotions or discounting to get patrons to come in. It continues to gain market share despite the environment remaining constrained for consumers and restaurants.

Data: Market Force Information.

Where Cheesecake Factory excelled was in food quality, besting both Cracker Barrel and Red Robin, as well as tying with Applebee's and Ruby Tuesday on healthy menu offerings, and tying again with Cracker Barrel on atmosphere.

Interestingly, though, it didn't even rank in the top five in terms of being kid-friendly, having fast or friendly service, or in being a good value. Cracker Barrel, on the other hand, ranked high in all seven categories, making it a worthy runner-up.

Now that's rich

Not that everything is running as smooth as custard. Cheesecake Factory's high-end chain, Grand Lux Cafe, saw its comps fall 2.7% last quarter. In fact, the chain has only had a couple of quarters in which same-restaurant sales were in positive territory. Of course, with only 11 Grand Lux restaurants, it's not a particular problem, but it may eventually make for an asset that will be put up for sale.

With the restaurant industry as a whole facing a tough economic environment, and casual-dining in particular being buffeted, the ability of Cheesecake Factory to continue to forge ahead makes it one dining experience that investors just might want to pull up a seat at.