Seadrill (SDRL) stock has struggled versus the overall market over the past year as a weak offshore drilling market caused the industry to sell off. Despite that weakness on the stock market, Seadrill just reported earnings of $1.24 per share for the second quarter, which is significant given the industry's weakened condition at the moment.

SDRL Total Return Price data by YCharts

So, is this stock a value for investors or a risk that's too big to take?

Well positioned in the market

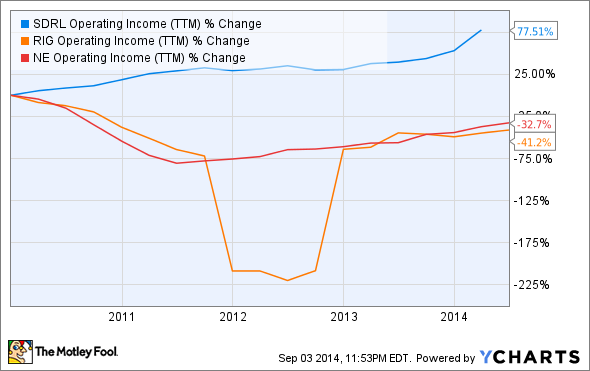

Over the last few years we've witnessed the value of Seadrill's fleet of young ultra-deepwater drilling rigs. While competitors have seen operating income fall Seadrill has grown significantly.

SDRL Operating Income (TTM) data by YCharts

In 2014, as the drilling market has slowed, Seadrill has maintained a high utilization rate in its floater fleet. For 2014, the fleet is 97% covered by contracts and even 78% of 2015's available days are contracted. This gives strong visibility to cash flows and shows high demand for the rigs in Seadrill's fleet.

Source: Seadrill earnings presentation.

What differentiates Seadrill is that it can offer higher specifications and improved safety versus older rigs in the global fleet. Over half of the deepwater rigs currently in operation are over 25 years old, and they're just not in demand like newer vessels.

A big time dividend

Seadrill's position in the market is important because investors buying shares today are counting on a strong dividend payment for years to come. At the moment, the stock is yielding an incredible 11.1%, and that alone could make this a good investment if it continues.

But Seadrill needs to keep cash flow coming in to pay for $12 billion in debt and a dividend each quarter. In the first half of this year, cash flow from operations was $881 million, and dividends alone amounted to $925 million in cash outflow. That's a poor ratio if it were the full story, but it's looking in the rear view mirror instead of at the future of Seadrill's cash flow.

Seadrill has either received or will soon receive four new drillships, and the three that are contracted are commanding dayrates of $567,000 to $655,750. So, by the end of 2014 Seadrill will add at least $161.6 million per quarter ($646.4 million annually) in revenue and likely more if the fourth rig finds a contract. So, it's likely the dividend funding gap will dry up next year and Seadrill will be able to finance the dividend through operations once again.

The gap may close, but investors need to know that there's significant risk if cash flow falls in 2015. Seadrill is barely able to pay for the dividend and interest on its debt as it is so any decline in cash flow will likely lead to a dividend cut.

Seadrill is a risk, but one worth taking

If the offshore drilling market collapses or Seadrill's rigs don't command the premium management expects we could see further downside in the stock. But given the fact that most new oil reserves are in ultra-deepwater and big oil companies will have to pick up exploration spending to keep production up I think Seadrill is well positioned.

The leverage on the balance sheet is worth keeping an eye on, but the company is well positioned to benefit from growth in ultra-deepwater drilling long-term.