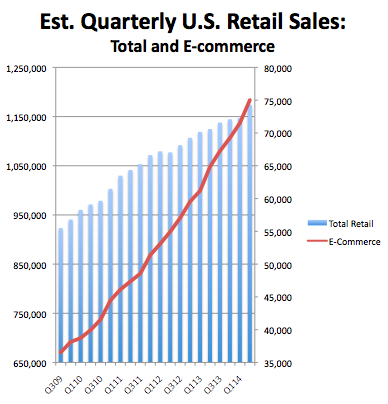

According to the U.S. Census Bureau, second quarter e-commerce retail sales surged 15.7% from the year ago period and now accounts for more than 6% of all retail sales, or $75 billion on a seasonally adjusted basis. According to comScore, in the first quarter of the year at least, 198 million consumers bought something online, or more than three quarters of the population of the U.S., which Business Insider says surprisingly splits fairly evenly between men and women.

No longer just dialing for dollars, consumers are accessing the Internet in ever-greater numbers to spend their money. Data: U.S. Census Bureau

Regardless of who's doing the buying, that's a lot of spending going on online.

Why hassle with parking, crowds, and limited stock selection when there's virtually an unlimited inventory of clothes, goods, and services at your fingertips, whether it's on you desktop, laptop, or mobile device?

Small fish, big pond

And since e-commerce still represents such a relatively small portion of all retail sales, there remains a huge runway before the industry to grow and expand further. Online sales may be losing some of the benefits that attracted people to Internet shopping in the early days -- i.e., lower prices (though often they're still cheaper), no sales taxes to be paid, etc. -- convenience remains key.

Free shipping is still a big lure retailers use to attract customers to their site, along with permutations of the offer, such as free in-store pickup that's been popularized by brick-and-mortar retailers like Wal-Mart (WMT 1.03%) and Target.

But even as shippers like UPS and FedEx are forced to raise their rates to cover their own costs, which may imperil free shipping policies at some e-tailers, the overall trend to buying what you need, whether its food, clothing, or a local repairman, will continue to move online.

And the survey says!

Those who can navigate these shifting sands will continue to grab mindshare with consumers and the folks at Prosper Insight & Analytics have once again compiled those companies that are head and shoulders above the rest when it comes to getting people to make a purchase on their website. Surveying 6,246 adult consumers and examining differences among them by age, income level, and gender Prosper Insight compiled the Favorite 50 list of e-commerce websites ranked by the consumers who use them.

Without offering any suggestions that might nudge them to one retailer or another, the participants were asked just two questions:

- What website do you shop most often for apparel items?

- What website do you shop most often for nonapparel items?

This just gets right to the number of the matter and the rankings were determined by those mentioned most. Although some, like Groupon, aren't really retailers, because respondents considered them such and named them they were rightfully included.

The usual suspects

Coming in at the No. 5 spot on the survey was a name you might have guessed, electronics retailer Best Buy (BBY 1.13%). Nearly done in a few years ago by the online "showrooming" effect of consumers trying out products at its stores and then turning around and purchasing them on line, the big box electronics seller embraced the concept and has remained a popular destination ever since, and indeed, last year placed in the same position in the survey as well.

The top three spots were also filled with names you might expect. Third was online auctioneer eBay (EBAY 3.03%), which really has grown far beyond its roots as a place to bid on Pez dispensers and offers a full-fledged marketplace where buyers and sellers come together.

Perhaps also not causing any eyebrows to be raised was Wal-Mart's placement as the No. 2 online destination. Online sales continue to ramp higher and its e-commerce revenues rose 24% from last year, but of equal importance, the average ticket size -- or how much consumers are spending when they shop at the site -- rose 1.1% as well.

Top dog again

That means you likely guessed Amazon.com (AMZN +9.58%) was the online retailer that continues to grab the most mindshare among consumers. It was far and away the e-tailer that consumers named most as their favorite with more than 56% of the respondents assigning it the top spot. That's well ahead of Wal-Mart, which enjoyed just 12.7% of the respondents naming it as their favorite destination.

But that also probably explains why Amazon's net sales jumped 23% in the second quarter to $19.34 billion, and lead Prosper Insight & Analytics to conclude the online site "has become almost a de facto search engine for a lot of consumers."

If those were the usual suspects filling in four of the five top spots, a company that didn't make the list is really more interesting than one that did.

Guess who's not here

According to the e-commerce industry site Internet Retailer, it's the second largest e-retailer in North America behind Amazon in terms of both sales and SKUs and last year embarked on a program to expand its presence and increase its product selection by at least 400%.

Once the overhaul is complete, the website will join the ranks of five of the top 10 online retailers also hosting a marketplace where third parties can sell their wares through its portal, a clubby group that includes, of course, Amazon, but also Wal-Mart, Best Buy, and Sears.

With those hints given, take a guess...

The surprising online site not included

If you said Staples (SPLS +0.00%), take a bow!

Selling online stuff you need everyday to keep the office running is not as easy as you think. Photo: Flickr user Derek Jensen.

The office supplies retailer is also a huge online seller and all thens pens, paper clips, and sticky notepads add up to a lot of individual items. But most people don't associate the biggest office supplies store with e-tailing, and in fact, Staples not only didn't place in the top five spots of the consumer survey, it didn't rank anywhere in the top 50! And now it's campaign to branch out further into the ethereal world of e-commerce presents new challenges for it.

For one, it's moving beyond reams of paper and ink toner, and entering a market typically thought of as the purview of maintenance, repair, and operations specialists like MSC Industrial Direct and Grainger, providing everything from hard hats and goggles to tools and cleaning products.

The changeover seems to showing strength even though total revenues fell almost 6% last quarter because it suffered a 4% decline in customer traffic and a 1% decline in average order size. Online sales, though, jumped 8% based on increased business customer acquisition, improved customer conversion, and that expanded product assortment beyond office supplies.

Click bait

Oh, so what company was the fourth favorite online retailer? Kohl's! Some 6.2% of the survey's respondents chose it as their favorite, just beating out the 6.1% who named Best Buy.

Particularly as we head into the start of the Christmas shopping season, e-commerce will continue to expand its sphere of influence in retailing. More than likely you'll head over to Amazon.com instead of Staples for the holidays, but day in and day out the office supplies retailer will be plugging away selling a ton of items, even if you never really remember when it comes taking surveys.