Fans of renewable energy such as solar and wind have had a lot to cheer about in recent years. For example, since 1985 solar energy production in the US is up over 4,000% (a 33.14% annual growth rate) while wind energy production is up a staggering 14,931%, (39.29% annual growth rate).

US Solar Energy Production data by YCharts

This phenomenal growth is due to several factors, but one of the most important is the amazing decline in the cost of solar and wind energy.

For example, according to the U.S. Solar Energy Industries Association (SEIA) and GTM Research the cost of installing a solar photovoltaic system declined by 50% between 2010 and 2013, with the price of solar panels declining by 60% just between 2011 and 2013.

Residential solar installer SolarCity Corp (SCTY +0.00%) expects this cost to decline by another 17% by 2017.

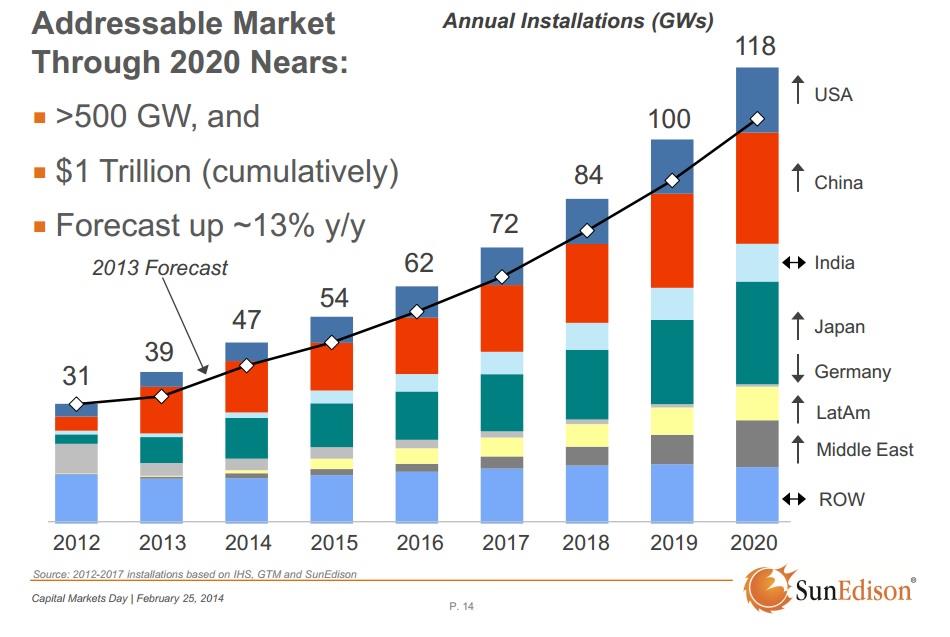

This steep price drop explains why solar panel manufacturers and system installers such as Sunedison Inc (SUNE +0.00%) predict that global solar installations are expected to hit over $1 trillion in value by the end of 2020 alone.

Source: SunEdison Capital Markets 2014 Investor presentation

Even Warren Buffett's Berkshire Hathaway Inc (NYSE: BRK-B) is getting in on the action, as fellow Fool Matt DiLallo explains in a recent article, in which he analyzes Buffett's $15 billion investment in solar and wind energy, an amount the Oracle of Omaha says he's willing to double.

Wind costs also plummeting

According to a recent report by the US Department of Energy and Lawrence Berkley National Laboratory the cost of wind energy has declined by 20% to 40% since 2008. These cost reductions are partially due to larger, more efficient turbine designs by leading manufacturers such as the General Electric Company (GE +0.01%) -- which recently bought Alstom, another leading wind turbine manufacturer -- Samsung (NASDAQOTH: SSNLF), and Siemens AG (SIEGY 0.01%).

According to this report the cost of wind power has now declined to a record low of 2.5 cents per KWhr, making it competitive with natural gas and coal power plants.

Thanks to these dropping costs 43% of all new power generation capacity installed in 2012 was from wind, and today 4.5% of America's power comes from wind energy from its 61 GW of installed capacity.

Trouble for clean energy is brewing

However, despite the successes, wind and solar have three major risk factors that threaten their continued growth, at least in the U.S.

The first risk is growing opposition to new solar and wind projects from local residents who see these projects as a source of noise, declining property values, and/or a threat to wildlife. For example, in Forest, Wisconsin opponents of a $250 million, 44 turbine project organized, took over the town council, and are now suing to halt construction. "We are here to protect our property values, our eagles, our health and our town," said Brenda Salseg, the leader of the opposition forces.

Meanwhile, the Cape Wind offshore wind project, a $2.5 billion project that would install 130 turbines in Nantucket Sound, (off Martha's Vineyard) and provide 75% of the area's power, has faced furious opposition from residents who fear "visual pollution" could lower property values. The project was first proposed in 2001, and though it is still moving forward, completion of the project is now not expected until 2016.

Similarly, the Ivanpah concentrated solar project in California, as well as the proposed Palen project (which would be the largest such project in the world) are being opposed by Federal wildlife officials who fear that these projects could slaughter birds, including endangered eagles, by the tens of thousands.

A second risk factor is competition from cheap shale gas, courtesy of America's fracking revolution. Daniel Yergin, vice president of IHS CERA, an energy research and analysis firm, explains, "In the energy sector, it all comes down to scale," and gas can be scaled up quickly to supply both a healthier source of energy and a consistent base load of power. Similarly, Anthony Alexander, CEO of Ohio utility FirstEnergy Corp, recently told the US Chamber of Commerce, "Microgrids, rooftop solar, and demand reduction are examples of what 'sounds good' ... [but] they are not substitutes for what has worked to sustain a reliable, affordable, and environmentally responsible electric system."

However, the largest threat to the growth of renewable energy in the US comes from an elimination or reduction in the tax credits that have been so vital to fueling their growth.

Tax credits are integral to clean energy's growth

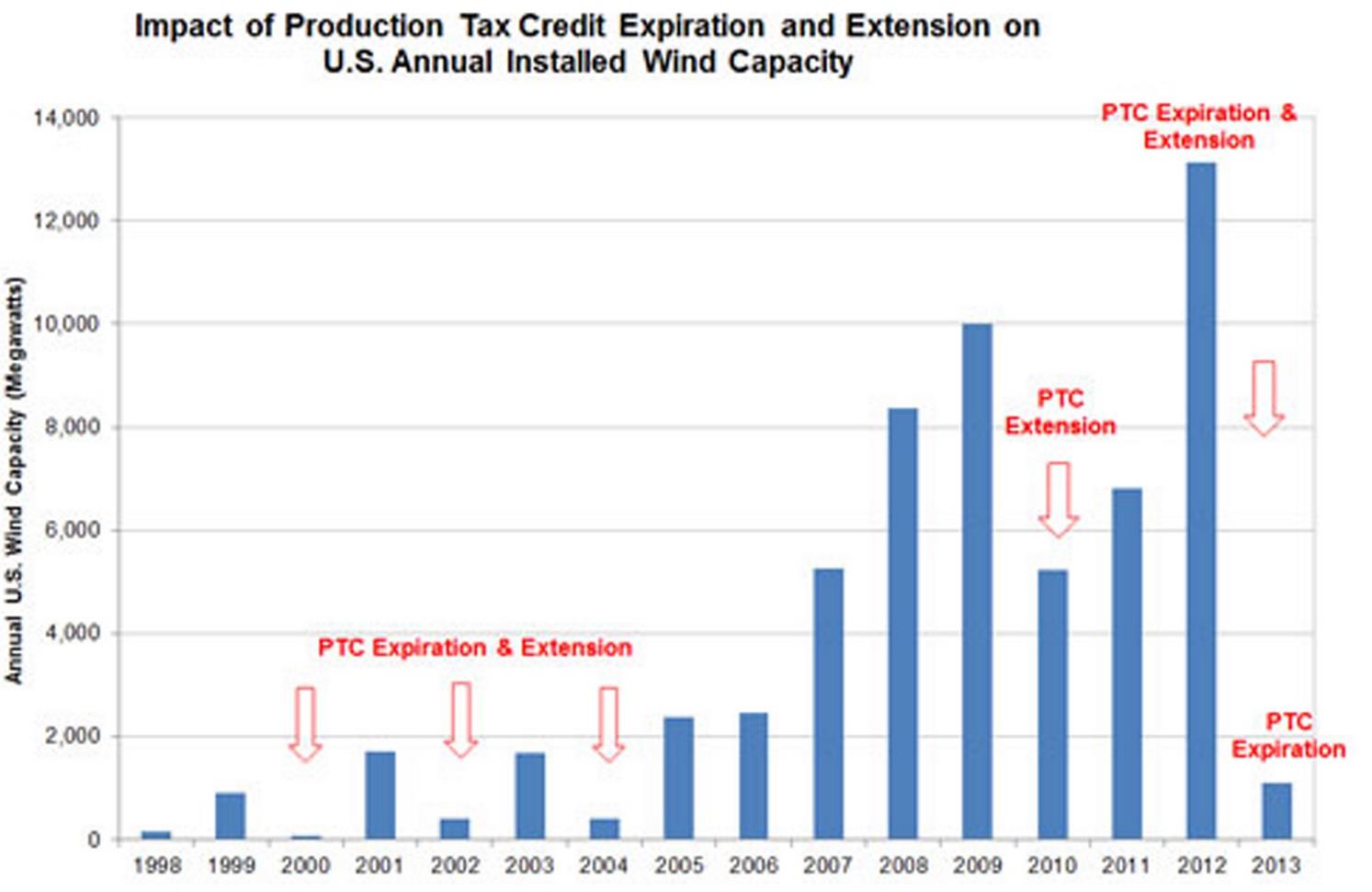

First passed in 1992, the Production Tax Credit (PTC) currently stands at 2.3 cents/KWhr and as this graph from the American Wind Energy Association (AWEA) shows, its existence is vital to the continued growth of US wind energy.

Source: AWEA

As seen above, 2013 saw a 90% decline in new wind installation, and that was simply from a temporary expiration of the PTC. This time a coalition of both Republicans and Democrats, including Senator Joe Manchin, (D-W.Va) and Senator Jeff Flake (R-AZ) are supporting the complete elimination of the tax credit. "Wind power generation is no longer an infant industry. It's no longer in need of federal support," said Senator Flake during a May debate.

The risk of the PTC (which expires at the end of the year) not being extended, which the current Senate Majority Leader, Harry Reid (D-NV) has pledged to do through 2015, would likely increase if the November elections give the Republicans a majority in the Senate. That scenario has a 58% likelihood of happening, according to Nate Silver and Fivethirtyeight.com.

Just how bad would the elimination of this tax credit be? Well according to Ryan Wiser, a co-author of the DOE/ Berkeley Laboratory report, it would raise the cost of wind power by 60% to four cents/KWhr.

That increase in price would be devastating to the US wind industry, especially if the PTC was allowed to expire for several years. This is because, according to Rob Gramlich, senior vice president for public policy at the American Wind Energy Association, "Utilities are looking for a good deal, and often they're looking at a knife-edge situation between one resource and another ... so they very much do tend to buy power when one is effectively at a discount."

Solar tax credit also in jeopardy

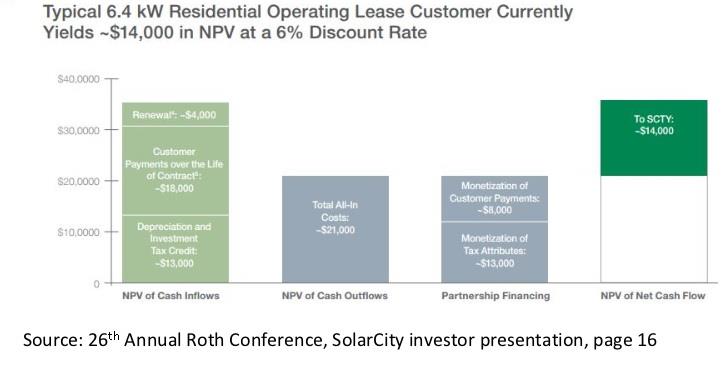

The boom in US solar has largely occurred because of the Federal Investment Tax credit, which allows a company to deduct 30% of the cost of a solar system through an accelerated depreciation schedule called the Modified Accelerated Cost-Recovery System.

At the end of 2016 this tax credit is set to go to 0% for residential systems (such as those installed by SolarCity) and 10% for utility scale systems, such as those built by SunPower Corporation (SPWR +0.00%) and First Solar Inc (FSLR 0.02%) and which Berkshire Hathaway Energy (Warren Buffett's company) has invested $6.02 billion in through three major solar projects.

How much of an effect would this tax credit being allowed to expire have on the US solar industry? Well given that it currently covers the cost of 40%-45% of a system's installation, potentially very large indeed -- and for SolarCity, even more so.

As this slide from SolarCity shows, 62% of the cost of a typical residential system is funded by the tax credit, through tax equity investment funds.

If the Investment Tax Credit is not renewed, the likelihood of which increases if the Senate switches hands, then SolarCity's access to tax equity funding will vanish and the company will have to resort to securitizing the systems it already has in place (ie solar bonds).

While this might provide the company with additional funding, it would be at the cost of a mountain of debt that, in a future of rising interest rates, would likely greatly reduce the company's growth rate. This in turn would devastate the stock price, which at 25 times sales, is trading on the assumption of rapid growth for many years to come.

Bottom line

America's solar and wind power industries have enjoyed massive growth in the last few years thanks to favorable regulations and generous tax credits. However, mounting opposition to renewable energy projects, competition from cheap shale gas, and the elimination of these credits in the future, pose a very real risk to the future of America's renewable energy sector. Investors in renewable energy companies should be aware of these risks and allocate their holdings in companies such as SunPower, Sunedison, First Solar, and SolarCity accordingly -- and as always, hold them only as part of a well diversified portfolio.