Image source: star5112

Ebola! The Federal Reserve printing money for years and now they may stop! The Dow Jones Industrial Average dropping 400-plus points before snapping back 300 points!

Changes! Panic! Volatility!

Everyone, hold on a second. The world isn't coming to an end, and just to prove it, I've got a stock for you that is absolutely crushing it. It's immune to ebola, doesn't do business internationally, and it is positioned to boom when the Fed raises rates.

The little bank that dominates them all

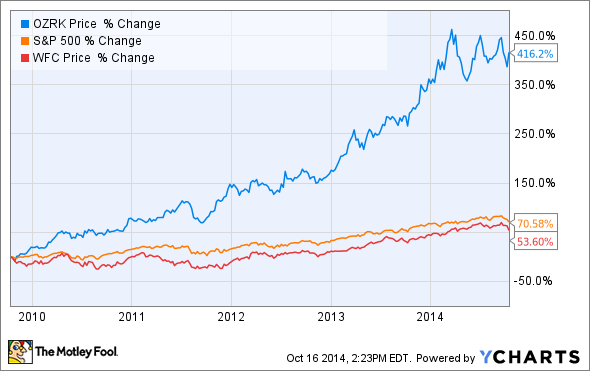

This past Tuesday, the Bank of the Ozarks (OZRK 1.18%) released its results for the 2014 third quarter. They were stunning to say the least.

Profits were up 21% from the third quarter of 2013. Diluted earnings per share increased 11% over the same period. For the full nine months ended Sept. 30, 2014, the bank reports an increase in profits of over 25% and an increase in diluted earnings per share of nearly 19%.

The bank's return on average assets, a powerful measure of its ability to generate profits from every aspect of its operation, was a truly remarkable 1.98%. The FDIC reports in its most recent Quarterly Banking Profile that the industry average ROAA was 1.07%. Return on tangible equity was just shy of 17% at Bank of the Ozarks versus 9.54% for the industry.

But to comparing Bank of the Ozarks to the rest of the industry isn't quite fair. To be the best, you have to compete with the best. And to do that, we must compare the bank to what most experts agree is the top dog in the industry, Wells Fargo (WFC 0.01%).

Wells reported return on average assets of 1.4% and return on equity was about 13%. Strong numbers yes, but they pale in comparison to the results Bank of the Ozarks is putting up.

Listen to the pundits and experts and you'll hear that Wells Fargo is the best run bank in the country. Looking objectively at the results though, it seems to me that Bank of the Ozarks not only keeps up, but flat out wins in a head to head comparison.

The key to Bank of the Ozarks success is in running an exceptionally efficient operation and squeezing more profit out of every dollar than anyone else. For example, the bank's efficiency ratio was 43.9% in the third quarter.

The efficiency ratio is a measure of the bank's non-interest expenses divided by the sum of its net interest income and non-interest income. Put a bit more simply, the lower the ratio the lower the banks costs are relative to its total income. Lower is better, and Bank of the Ozarks ratio is lower than the industry average at 61% in the second quarter, and Wells Fargo at 57.7% in Q3.

Part of that efficiency is managing operational costs like employees, facilities, and administrative expenses. The other aspect though is managing the net interest margin -- the difference between what the bank pays out to depositors and what it charges on its loans. For the third quarter, Bank of the Ozarks reported a net interest margin of 5.49% -- 1.8 times better than Wells Fargo and 1.7 times better than the industry.

There are a lot of great companies, why this one in today's crazy market?

The talking heads on the major networks have pointed to four primary reasons why the market has behaved so erratically.

I'm only going to address three here though, because if the threat of an ebola outbreak is tempting you to pull out of the markets then you should instead consider preparing your portfolio for a zombie apocalypse.

First, there is a growing consensus that the Fed will raise rates soon. When the cheap money ends, the theory is that investors will move capital away from the higher yielding stock market and into safer assets. That may be true in general, except that higher rates will actually help banks like Bank of the Ozarks. When rates rise, expect to see the bank's net interest margin grow even larger. That means even higher profitability.

Second, analysts point to a general overvaluation in the markets. If that is the case, then what we are experiencing now should be viewed more as a market correction instead of a serious risk to your long term investment success. If the market is going to take a dip, that's the best time to buy the best companies at a discount. Companies like the Bank of the Ozarks.

Third, there is a growing concern over growth in the international economy. Russia continues to stir up trouble in eastern Europe and troubles in several other emerging markets have investors worried that a global slowdown could hurt the U.S. recovery. Bank of the Ozarks though has no international exposure. It's an old fashion bank that makes loans to U.S. businesses and individuals. It's a pure play on the U.S. market without concern for what happens overseas (and a 1.4% dividend yield to pay you for your patience, per S&P Capital IQ).

Foolish takeaway

Bank of the Ozarks is a very, very well run bank that is well positioned to do well as a business over the long term. That's what this thesis is all about. I don't know if the stock will go up or down. No one does.

It's not about timing the markets. It's not about looking into a crystal ball. It's about recognizing a business that is putting up incredible numbers for its shareholders.

Those are the kind of businesses that I want to invest in and own for the long term.