SunPower's headquarters in San Jose, California. Image source: SunPower.

If you were looking for a blowout third quarter from SunPower (SPWR +0.00%) it may be a disappointment that the company merely soundly beat both top and bottom line expectations. One of the solar industry's leading panel makers and system builders keeps chugging out profit but is doing very little to wow the industry the way a high-growth competitor like SolarCity (SCTY +0.00%) might do.

Still, revenue of $704.2 million on a non-GAAP basis and earnings of $46.4 million, or $0.30 per share, make it one of the most profitable solar companies in the world. Results also soundly beat the estimated $628.7 million in revenue and $0.24 in earnings per share Wall Street had expected. But not even that could keep shares from falling 4% in mid-day trading.

In baseball terms, SunPower is like the steady singles hitter who may hit a double from time to time rather than the home run hitter who makes the headlines but also strikes out on a regular basis.

Slow and steady wins the race

SunPower's strategy has long been slowly building value in a diverse number of end markets rather than betting the farm on one hot market. That's resulted in companies like SolarCity taking a large share in the U.S. residential market, where SunPower could compete more aggressively while pursuing projects around the world. You can see how SolarCity's aggressive growth has resulted in a much larger position in the U.S. residential market in the table below.

|

SunPower |

SolarCity | |

|---|---|---|

|

Contracted Payments |

$756 million |

$3.3 billion |

|

MW Booked |

202.5 MW |

756 MW |

|

Cumulative Contracts |

24,749 |

128,933 |

Note: SolarCity's figures are as of the end of Q2 2014. Source: Company earnings releases.

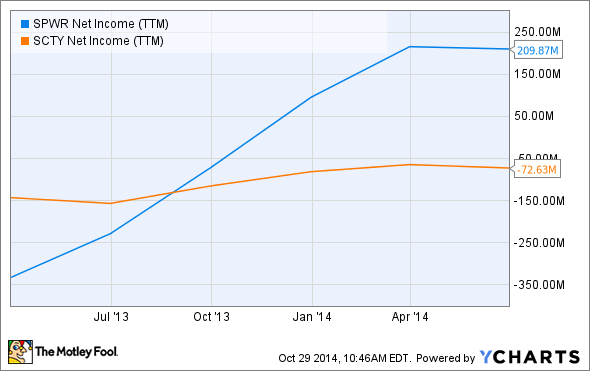

But there are advantages to SunPower's approach as well. It is one of only a few major solar companies that are currently profitable, as you can see in a comparison with SolarCity below.

SPWR Net Income (TTM) data by YCharts

SunPower also isn't reliant on one market for its future profits. In fact, the YieldCo/HoldCo strategy SunPower is building includes assets in more than a dozen countries around the world.

Prepping for a YieldCo launch

One of the most under-appreciated components of SunPower's business is the prep work going on for a YieldCo that could be launched next year. SunPower is building solar projects on its balance sheet instead of selling them and has 640 megawatts of solar-power systems under contract. Most of these projects could be pushed down to a YieldCo if it is launched or sold to another entity if the price is right.

This is key because instead of selling projects to book revenue and earnings today the company is holding them on the balance sheet to gain more value tomorrow. The impact, both depressing short-term earnings and boosting long-term earnings, is nothing to sneeze at either.

An aerial view of Solar Star, which will be the world's largest solar plant at 579 MW. Image source: SunPower.

If we just use SunEdison's (SUNE +0.00%) TerraForm Power (TERP +0.00%) YieldCo as a proxy we can estimate the value of this pipeline. TerraForm Power has a $3.75 billion enterprise value -- including equity and debt value -- and 807.9 megawatts of projects both built and in its pipeline. That indicates the market is currently valuing its projects at about $4.65 per watt, which is a rough calculation of value.

SunPower's projects should be worth more given lower degradation and better durability of panels, but even this baseline indicates the value proxy of the pipeline of projects could be worth around $3 billion.

Still a value among solar stocks

One of the reasons I've liked SunPower stock for over two years is that the value it generates continues to grow each quarter. I've outlined above how around $3 billion of solar projects are sitting on the balance sheet, but that's on top of a business that's expected to earn $1.20 per share in net income this year.

Even a modest 15 P/E ratio would give those earnings a $3 billion valuation based on the current diluted share count. It's easy to see $6 billion in total value today, which would be more than a 50% upside for investors.

And then there's growth opportunities. SunPower is building a 350 megawatt plant and has indicated that another expansion on the order of 700 megawatts to 1 gigawatt would be on the way following that plant.

Even slow and steady results like we saw in the third quarter show lots of value for shareholders, and there's upside potential if expansion plans accelerate in the future. But it'll still take time for expansions to show themselves on the top and bottom line, especially if SunPower is stashing away value on the balance sheet.

SunPower is a very nuanced company, and as long as it's seeing strong demand, high margins, and sizable profits for its high efficiency solar panels I think investors are getting a great value in the solar industry. It's not the sexiest solar stock out there, but sometimes slow and steady wins the race.

For today though, even beating expectations wasn't enough to please the market.