Source: General Mills.

If you're looking for dividends, you have probably noticed this class of stocks is selling for a premium right now, and that's pretty much the case with packaged foods maker General Mills, (GIS 0.74%). That being said, if yield is your thing, the current interest rate environment leaves stocks as pretty much the only game in town.

Which of course begs the question: Is General Mills a dividend stock worth buying today? The short answer is yes, and there many reasons why. However, a handful are most compelling. Let's look at the top three.

1. Global food demand is only going to increase

Demand for packaged foods will grow with the global middle class. Source: Lyzadanger via Wikipedia.

The world's population is set to increase by more than 1 billion people over the next 20 years, and the bulk of that growth will be in the middle class. The driving factor? Industrialization and modernization in developing countries. This has historically led to increased demand for energy and for better foods, especially more convenient packaged foods.

For General Mills, this is a good reminder that slowing sales is temporary, and largely a product of a weak global economy. The long-term trend should create a sustained tailwind for steady and dependable, though not massive, growth.

2. Management's effective capital allocation

One of the most important aspects of any company is also one most investors don't take the time to explore: How well does the management team allocate capital? In a recent article discussing General Mills' stock buyback program, I considered the three key things management can do with excess capital:

- Invest in acquisitions.

- Buy back shares.

- Return to shareholders (dividends).

In the end, my analysis indicated that General Mills' leadership has done a relatively sound job of managing and allocating capital. While the $3 billion in stock buybacks over the past three years has partly coincided with the stock trading at a historically high valuation, the long-term benefit of a reduced share count in terms of earnings-per-share growth, and the dividend cost, will more than likely make up for the premium paid for the stock.

GIS Shares Outstanding data by YCharts.

Furthermore, management hasn't made poor acquisition decisions in an attempt to grow the business, instead focusing on relatively small buys in key growth areas, like the recent purchase of Annie's Homegrown in the fast-growing natural and "better-for-you" packaged foods segment.

3. Per-share returns should be relatively steady

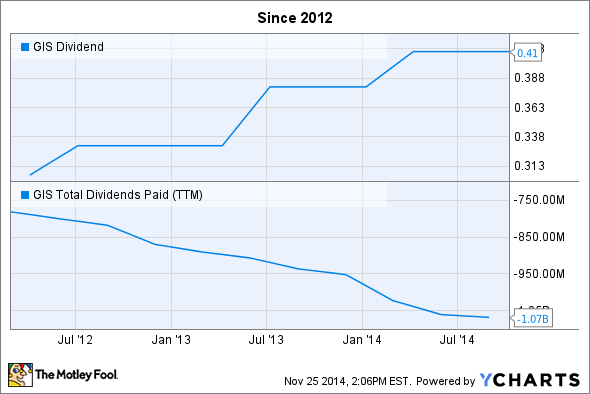

Since 2012, General Mills has increased its dividend by 35%, while it has reduced shares outstanding by about 7%. The result? With about 40 million fewer shares, the total dollars in dividends paid has increased less than 30%. In short, each dollar earned is now worth more in per-share value.

This is directly attributable to management's execution of a share buyback strategy and regular dividend increases as the key focus for shareholder value, versus hit-or-miss acquisitions on a larger scale. General Mills has a steady and dependable business, and the long-term trends indicate that will remain the case for decades to come. Management is using a conservative and reliable approach to create value for shareholders.

The company will probably never see 10% annual revenue or earnings growth again, but per-share returns, due to the dividend and buyback programs, and key, small acquisitions, are likely to remain steady.

Long-term outlook: Remember the power of compound growth

While General Mills is far from a sexy growth stock, it can be part of a market-beating portfolio if its management team continues to steadily buy back shares and increase the dividend based on cash flow growth. Furthermore, the long-term trends tend to support a path of steady growth over the next decade and more.

Is the stock a pricey today? Based on historical valuations, maybe a little bit, but the stock has fallen about 6% since June, a reflection of the short-term macro softness. For long-term investors, this could be a reasonable time to open or add to a position. If steady and predictable dividends are what you are looking for, General Mills should deliver that for years, with a high likelihood of regular payout increases as well.