Logo: Las Vegas Sands Corp.

Shares of Las Vegas Sands (LVS 3.69%) have dipped in the last two quarters, down nearly 30% since their high of $87 in April 2014. The reason this stock has been beaten up lately is the decline in revenues in Macau, an issue Wynn Resorts (WYNN 3.45%) and MGM Resorts International (MGM 4.53%) are also facing. Yet regardless of the declines in year-over-year revenue, I haven't spent much time considering selling my shares of LVS, because the long-term growth potential for this company, especially in Macau, still look like a strong bet.

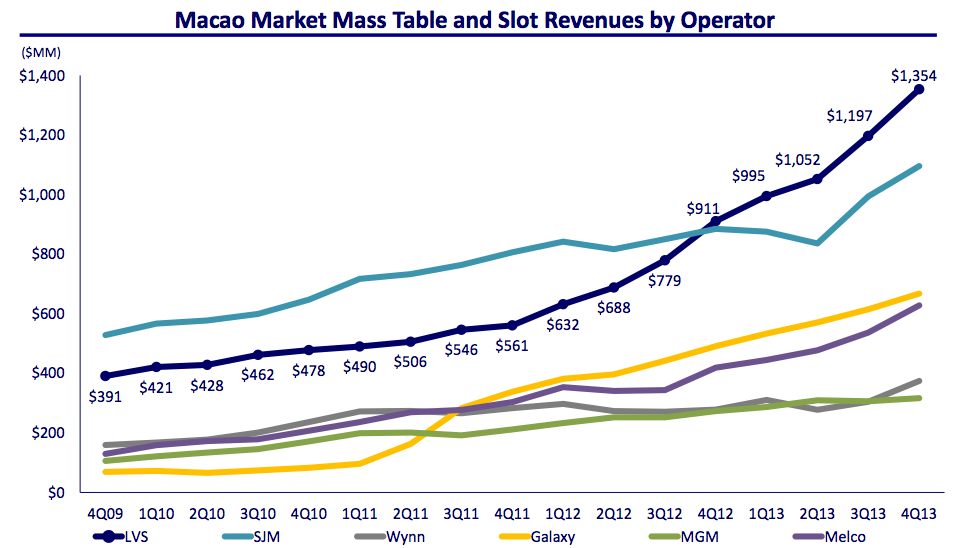

However, there is one metric that I'm watching closely, and seeing it slip would prompt me to consider getting out of this investment. That metric is the mass market growth in Macau that Las Vegas Sands is the current industry leader of. This is the basis for my long-term bullish outlook for Las Vegas Sands and the reason that this company still looks like the best bet in this industry.

Declining revenues are not a reason to sell

Las Vegas Sands' third-quarter earnings were disappointing, with total revenues down 1% over the same period last year. Still, Las Vegas Sands earnings for the quarter weren't bad. Total EBITDA increased 0.6% during the quarter year-over-year, 3.2% in Macau alone. Regardless of revenue decline, the company was able to post adjusted earnings per share growth of 2.4% year-over-year.

The reason that revenues are down is the lowered VIP gaming segment in Macau. With the government more heavily regulating the use of "junket operators" (companies that bring high-net worth players to Macau), this segment, which was the traditional cash cow of Macau, is seeing a massive decline in gaming revenues so far this year.

However, long term, the shift away from VIP gamers is ultimately a good thing for gaming companies. As the VIP segment is diminishing, the mass market segment is expanding, paving the way for long-term growth and more stability in Macau. For each of these companies in Macau, the mass market segment represented a highlight of their Q3 earnings, but the winner in this segment is still Las Vegas Sands.

The potential for mass market growth in Macau

Mass market growth is going to be the defining factor that pushes more growth in Macau for years to come. The trends that support this not only include an increasing number of visitors to Macau following transportation and infrastructure improvements, but also that the average length of stay per visitor in this segment is beginning to increase as Macau is seen more as a vacation spot for Mainland Chinese families, instead of just a day trip out of Hong Kong.

Progress on The Parisian as of Q3 2014. Source: Las Vegas Sands

Macau is made up of multiple separate areas, with the old Macau side and the more modern Taipa side connected by a set of bridges. While old Macau was the area's gaming center in the past, the Cotai strip on the Taipa side is where all the casino resort growth is happening now. Each of these companies is building a new resort to open on the Cotai strip in the next one to two years.

The Parisian Macau is slated to open in late 2015/early 2016. This massive integrated resort, featuring an additional 3,000 hotel rooms and suites, about 450 gaming tables, 2,500 slots, a retail mall, and a replica of the Eiffel Tower at 50% scale, will help Sands to continue making a huge bet on Macau's mass-market growth. The added hotel rooms at this resort alone will keep Las Vegas Sands well ahead of Wynn and MGM in the number of mass-market guests it can host.

What would make me sell Las Vegas Sands stock

Las Vegas Sands is the leader in gaining on this mass-market trend, and looks to be the best bet on this for the foreseeable future. During the recent quarter, Sand's mass-market revenue increased nearly 15% year-over-year.

While based on year-over-year percentage growth alone, this seems to be less than the 36% growth in Macau mass-market revenue reported by Wynn, there are two important points to consider to shed more light on these numbers. First, these percentage increases are based on year-over-year numbers, and Las Vegas Sands did very well in the mass-market segment in 2013, so even though the company is doing even better now, the percentage increase doesn't look as large as that of Wynn, which didn't do as well in 2013. Second, Las Vegas Sands' total Macau revenue, at $2.33 billion in the recent quarter, is still well above that of Wynn or MGM at $942.3 million and $794 million, respectively. So this increase in Sands revenue, at a lower percentage than Wynn, still accounts for a much higher total revenue.

Sands was the leader in mass-market revenue through 2013, and is on par to be so in 2014 and into the future. Graphic: Las Vegas Sands 2013 10K presentation

While Sands is the leader in mass-market revenue in Macau now, I am betting most of my faith in this stock on the belief that the company is able to continue growing revenues from this segment well into the future, making up for the declining VIP segment and pushing profits higher in the long term. Mass-market growth is a metric that I'm watching very closely.