Consumer Reports had a lot of nice things to say about Buick recently, including high praise for the sporty Regal sedan. But that wasn't the only high praise that Buick has received. Source: General Motors.

General Motors (GM +0.92%) got a one-two hit of good news for its resurgent Buick brand last week.

First, Buick was the one and only U.S. car brand to reach the top 10 on Consumer Reports' latest annual reliability report card. Buick's Regal also beat out BMW and Audi to become the magazine's top pick among sports sedans.

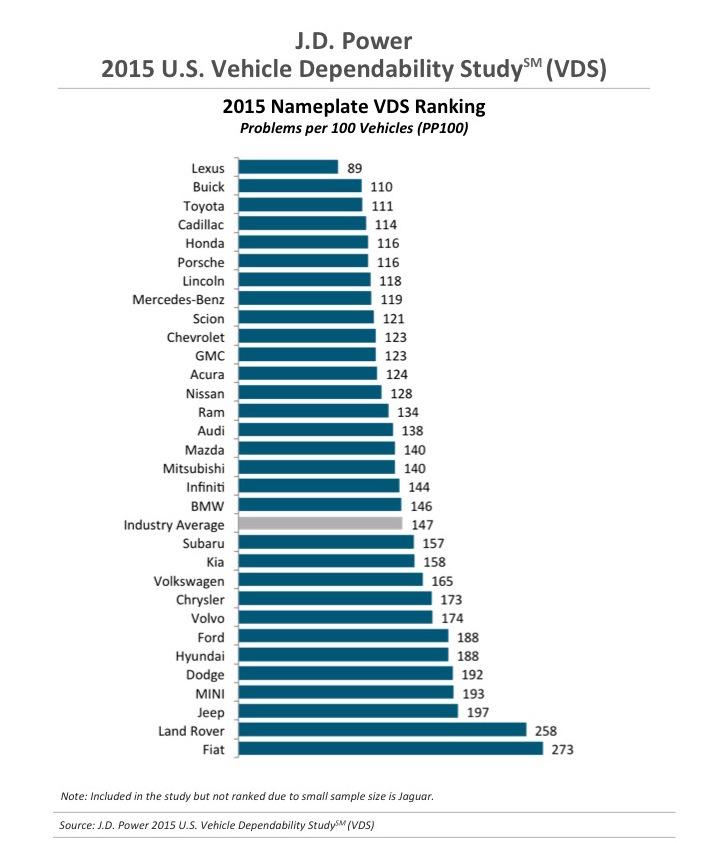

Those were big coups: Detroit has long fared poorly in the magazine's ratings. But they weren't flukes. Just a day later, influential analytics firm J.D. Power and Associates released its important 2015 Vehicle Dependability Study, and ranked Buick second among all car brands.

Yes, second: ahead of Honda (HMC +1.57%) and mighty Toyota (TM +0.74%).

Only Toyota's luxury brand Lexus outdid Buick. What's going on here?

A big surge in quality for... General Motors?

First, we should note that this isn't just a Buick story, it's a GM story. As you can see in this chart from J.D. Power, GM's Cadillac and Chevrolet brands also cracked the top 10 in its new study, and GMC was right behind in 11th place.

To be clear, this survey doesn't reflect results from GM's (or anyone else's) newest models. J.D. Power compiles these rankings by looking at problems in 3-year-old vehicles. Owners of those vehicles respond to surveys detailing problems the cars have had over the past 12 months.

That's different from the other widely cited J.D. Power measure of automotive quality, the Initial Quality Survey, which looks at problems that crop up in new cars during the first 90 days of ownership. (That report is due out in June. Buick was about average last year, but GM overall did well on that measure.)

But this survey is nonetheless an important measure of how well recent cars and trucks are holding up over time. By that measure, GM -- and Buick in particular -- looks quite good.

That's a big change from the not-so-old days. How did GM raise its game so far, and so quickly?

These good results have been many years in the making

The improvements reflected in these results have actually been in the works for years -- no surprise in an industry where it can take three years or more for a new product to reach the market.

Former GM Vice Chairman Bob Lutz began pushing GM's quality expectations over a decade ago. Some of the cars developed under Lutz, such as the first Chevy Volt and the 2008 Cadillac CTS, represented huge steps forward for GM's long-maligned product-development teams.

But it was under Lutz's successor as GM's product chief, now-CEO Mary Barra, that the improvements really began to accelerate. General Motors has long had the talent and institutional knowledge to produce great cars, but that talent was working within a system that imposed delays and restrictions that turned too many GM products into also-rans.

Shortly after she took over as GM's product leader in 2011, Barra announced a sweeping overhaul of the automaker's product-development process; the improvements have been dramatic.

In a nutshell, GM can bring much-improved cars and trucks to market much more quickly, at lower cost: Barra's changes have saved GM about $1 billion per year.

How good quality leads to higher profits

Obviously, lower product-development costs are a good thing for GM shareholders. But improved quality is also extremely important to the company's bottom line in a way that might not be immediately obvious.

Simply put, new models that are perceived as class leaders are more profitable because they can be sold at premium prices, with fewer profit-margin-crushing incentives. The result: more profit per sale, and more cash for GM.

That's a big part of how GM has pushed its operating profit margin in North America into the 9% range recently, well above what it was making just a few years ago. Now, Barra and her team are working to bring GM's operations around the world up to a similar level of profitability by "early next decade," according to the CEO.

It will take more than strong product quality to make that happen. But it won't happen without great products -- and it's looking more and more like General Motors finally has that base covered.