The drop in oil prices have wreaked havoc on the offshore drilling industry. Over the past year, stocks have plunged as conditions deteriorated and contracts for out-of-work rigs dried up. As work slowed, companies have started to stack or retire older rigs that will have a hard time competing in the offshore drilling market. But with oil prices beginning to recover, we could see Seadrill (SDRL +0.00%) emerge from the market's doldrums smelling like a rose.

Retirements change the competitive environment

When an offshore drilling rig comes off contract and there's no work to be found for that rig, a company has a few options. It can keep the rig in service, but not working, incurring the cost to pay salaries and other expenses associated with the rig. It could also cold-stack the rig, essentially lowering cost to a minimum but not getting rid of the rig altogether. Or, the company can retire the rig and scrap it.

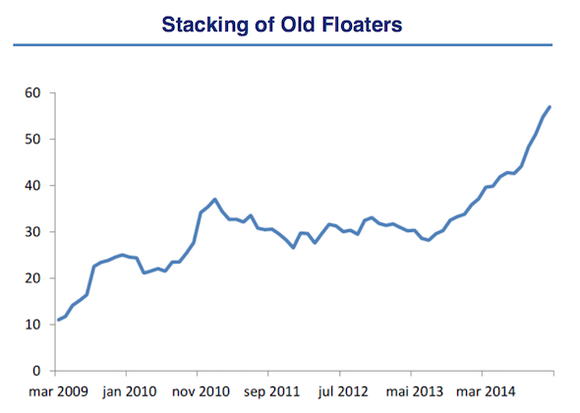

According to Seadrill's recent presentation at the Howard Weil Energy Conference, 34 floater rigs were stacked in 2014, and a total of 54 floaters are stacked. Another 70 rigs will come off contract in the next 12 months that could be stacked or scrapped.

Seadrill's publicly traded competitors are a big part of that cold-stacking and scrapping. Transocean (RIG 1.92%) has announced plans to scrap 16 rigs and has stacked another four recently. Noble (NE +0.00%) announced the retirement of three semisubmersibles when they reported fourth-quarter earnings. Ensco (ESV +0.00%) announced the cold-stacking of seven rigs during their fourth-quarter call.

This cold-stacking and retirement activity is critical for the industry because it reduces the supply of offshore rigs, reducing competition for contracts. If the oil market improves, and demand comes with it, there will be even fewer rigs for Seadrill and others to compete with.

Is the oil market recovering?

For Seadrill, or any other offshore drilling stock, to be a great investment, we still need to see an improvement in the oil market and the rate of offshore drilling contracts. On that front, we're starting to see a sliver of hope.

The U.S. Energy Information Administration has predicted that global production exceeded consumption in Q1 2015 by 1.6 million barrels per day, but that gap will close to 320,000 barrels per day by Q4 2015 and the market will be undersupplied early in 2016. That should lead to higher oil prices, which will in turn increase demand for offshore rigs.

Oil is starting to show some of this optimism, as the three-month chart of Brent Crude and WTI Crude spot prices shows below. You can see that the market has stabilized and even recovered slightly:

Shale drilling in the U.S. is taking the brunt of the pain from lower oil prices and if reduced supply from the U.S. and elsewhere around the world can lead to a recovery of oil to even $70 or $80 per barrel, we should see offshore contracts pick up once again.

If they do, Seadrill will be positioned perfectly to take advantage of the increase in demand and lower supply from competitors. It may have been a rough ride over the past year for investors, but Seadrill is a stock I'm sticking with, and I think it's one of the best ways to play rising oil prices.