Image source: SunPower.

Wall Street doesn't have much to cheer about right now from solar leader SunPower (SPWR +0.00%). On Thursday night, it reported that first-quarter revenue fell 36.3% to $440.9 million and net loss was $9.6 million, or $0.07 per share.

Even on a non-generally accepted accounting principles basis, which adjusts for timing of revenue for large projects, revenue was just $430.6 million and earnings landed at $0.13 per share. But that doesn't tell the full story of SunPower, something long-term investors need to keep in mind.

Setting up for the future

A quarterly loss is never great, but SunPower is making moves that will set it up for future growth and value creation.

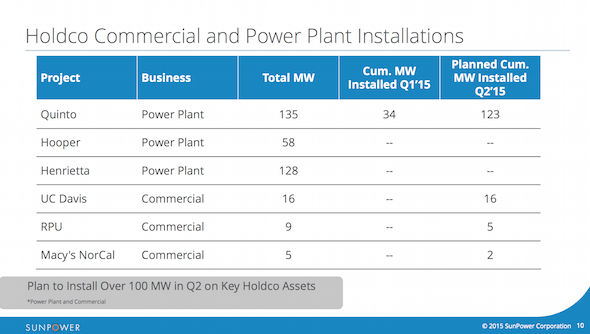

First, the company is building projects on the balance sheet in anticipation of a yieldco launch with First Solar (FSLR +5.42%). In the first quarter, that mostly meant building residential and commercial installations; and as you can see below, in the second quarter it will mean building even larger projects on the balance sheet.

Image source: SunPower.

This implication is the company is accepting lower revenue, margins, and profits now in return for greater value creation in the future (this could be even more stark in the second quarter). What's key is that SunPower is at or near profitability now while it's stashing these projects away for the future. If we believe management, owning these projects will lead to even greater value creation than selling them would have.

The next thing SunPower is investing in is future value creation capabilities. Partnerships with EnerNOC (ENOC +0.00%), Tendril, and joint ventures in China could result in higher operating costs today, but the intention is to build higher-margin growth businesses for the long term. Particularly in the commercial space, SunPower is investing a lot today, at a fairly low margin, in an effort to ultimately win big.

SunPower's third big investment is in capacity expansion. The 350-megawatt Fab 4 solar-cell plant is under construction and will begin manufacturing salable product late this year. In the meantime the costs associated with ramping up the facility go straight to the income statement. Pain now -- gain later.

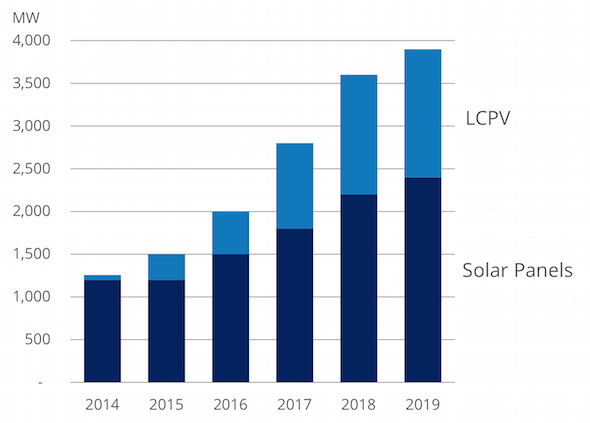

SunPower's growth plans don't really hit an inflection point until 2016. Image source: SunPower.

More of the same for the next year

SunPower's end game is to be in the best possible position four or five years from now when the industry is less volatile and more mature, which is why it is investing in complementary technologies and capacity expansion. But those investments take time and, as you can see from the planned capacity chart on the right, the growth plans don't really start to have a meaningful impact until 2016.

In the meantime, SunPower will compete in the solar market, stash projects on the balance sheet, and incrementally improve its technology. For the next year or two that's about all we can expect from an earnings standpoint. It's from 2016 to 2019 that we'll see real growth on all levels for SunPower.

I think SunPower is well positioned for the future of solar, but investors must have realistic expectations for the company. It won't be a high-growth stock in the near term like some competitors. The focus on a stable technology-based foundation should lead to greater long-term value, but the downside is that growth will be slow until capacity expansions are complete and customers are demanding more value-added services.

SunPower won't win the headline game, but slowly it's building a long-term winner in solar. That's why I'm still betting on SunPower.