There has been one certainty for Caterpillar (CAT 0.04%) and its investors over the last couple of years, and that certainty is that there's complete uncertainty of when its global business will turn around. Sales, revenue, and profit per share are expected to check in at their lowest levels in half a decade when the book is closed on 2015.

Despite a stock price that hasn't returned much value to shareholders, and only moved 5% lower since the beginning of 2013, the company has still proven that it can return value to shareholders via dividends and share buybacks.

Let's take a look at Caterpillar's recent 10% dividend hike, and see how sustainable it is with weaker global operating profits.

Dividend details

Caterpillar's board of directors approved a 10% dividend in the quarterly cash dividend to $0.77 per share of common stock, payable on August 20, 2015, to shareholders on record at the close of business on July 20, 2015. According to a press release:

This 10 percent dividend increase is another example of our commitment to deliver superior returns to stockholders through the ups and downs of the industries we serve. Our strong balance sheet, cash flow and operational performance have put us in a position to reward stockholders with a higher dividend again this year. -- Caterpillar Chairman and CEO Doug Oberhelman

Two quick and easy factors to calculate when looking at a dividend stock are the yield and payout ratio. The dividend yield, which is calculated as the annual dividend per share divided by the share price, shows how much bang you're getting back for your buck -- the higher, the better. Caterpillar's 10% increase puts its dividend yield at about 3.5%, which is above the S&P 500 average of about 2.5%.

Next, the payout ratio is calculated as the annual dividend amount divided by the annual earnings per share. For this exercise, I'll use Caterpillar's new dividend rate of $0.77 for four quarters, a total of $3.08, and its 2015 forecast of $4.70 profit per share, which brings us to a payout ratio of about 65%.

My exercise was more forward-looking, which is a good way to calculate the payout ratio, but it's also worth looking back at Caterpillar's payout ratio history to get a feel for if the company is paying out a higher percentage of its profits than in years past.

CAT Payout Ratio (Annual) data by YCharts.

While Caterpillar paying out 65% of its profits as dividends might seem like a high percentage, and it's certainly a higher percentage than in years past, investors also have to remember that Caterpillar isn't a young company and no longer needs all of its cash to fuel growth.

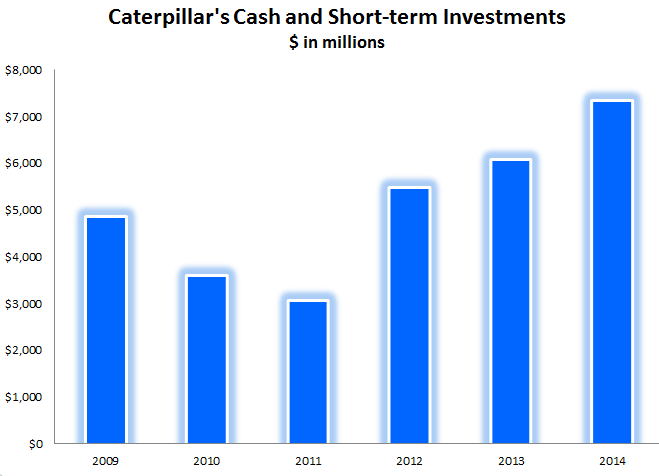

Furthermore, despite weaker revenues and profits, Caterpillar has focused on becoming a more efficient company and has cut costs over the last couple of years. That's helped Caterpillar generate more cash to add to its growing pile of cash and cash equivalents.

Chart by author. Information source: Caterpillar's SEC filings.

Strong track record

Because of its growing cash pile and ability to maintain its balance sheet and fund growth, growing its dividend makes sense, and that's not a new trend for Caterpillar. The company boasts a great track record of increasing its dividend and has paid a cash dividend every year since the company was formed in 1925. Caterpillar has also paid out higher annual dividends to shareholders for 21 consecutive years -- and it has more than doubled since 2006.

Sure, Caterpillar's stock price hasn't returned much value for shareholders over the last couple of years, but its dividend strikes the right balance between value and sustainability, which should give investors enough reason to stick it out and wait for a rebound in its global business.