It was just the opening salvo in PotashCorp's (NYSE: POT) attempt to jump-start its business again amid weak fertilizer pricing, but its $8.7 billion, 41 euro per share acquisition offer for Morton Salt's German owner K+S was quickly rejected for being too low and for setting up the company to be broken.

Seeds of doubt

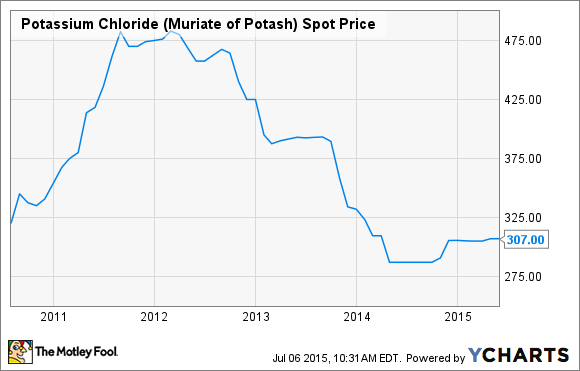

Potash pricing remains weak some two years after the industry was thrown into turmoil following Russian potash producer Uralkali ending its distribution agreement with joint venture partner Belaruskali. The two had teamed up to control roughly 43% of global potash exports through the Belarusian Potash Corp. cartel, but Uralkali made a push for more market share and backed out of the agreement.

The split caused the price of potash to plunge from nearly $400 per tonne to $305 last year, and though there were hopes the industry would be able to wrangle higher prices this year, Belaruskali quickly signed a deal with China for just $315 a tonne to ensure its market position and Uralkali quickly fell in line afterwards with its own similar deal.

That left Canpotex -- the marketing organization for PotashCorp, Mosaic, and Agrium -- with little room to negotiate and it was also forced to sign agreements with China that were bid at "current competitive levels."

Today, potash pricing on the spot market is going for just $307 per tonne.

Potassium Chloride (Muriate of Potash) Spot Price data by YCharts

Yet the bid for K+S by PotashCorp is an attempt to bolster its business in advance of new production coming online. There hasn't been any new production from a major potash mine in the last 40 years, but over the next few years the industry is expecting several new projects to go live.

A plethora of potash production

BHP Billiton (NYSE: BHP) is shifting its focus from iron ore and coal to copper and potash, resources that have a greater consumer focus compared to the minerals that were key during the boom years of China's infrastructure expansion.

In particular, the massive Jansen mine in Saskatchewan, home to half the world's potash deposits, would become its "fifth pillar." BHP holds exploration rights to more than 14,500 square kilometers in Canada's Saskatchewan potash basin, and though it's still in the feasibility stage, Jansen is expected to have mine output of around 8 million tonnes a year for the estimated 70-year life of the mine. It anticipates full-scale operations will begin as soon as 2020.

Similarly, K+S said last month it is on track to start production at its $4.1 billion Legacy mine in Saskatchewan that it acquired in 2010. It's looking to start production by the end of next year and to 2 million tonnes annually by 2017. K+S thinks it can reach full production capacity of 2.9 million tonnes by 2023.

However, so much new capacity and production amid an already weak market flush with supply could be a problem for major players like PotashCorp. By acquiring K+S, the potash leader would gain a strong foothold in the European market while giving it a major asset in its own backyard. PotashCorp also denies it has any intention of closing any K+S mines if the deal goes through, and the salt business would be an attractive diversification.

High costs of production

K+S is one of the highest cost producers of potash, about $230 per metric ton, according to The Wall Street Journal, while PotashCorp produces its potash for just $95 per metric ton.

Analysts view an offer between 45-55 euro to be reasonable (though K+S says 60 euros would be more fair) so it would not be surprising to see PotashCorp come back and take another swing at a deal with a sweetened bid.

If successful, PotashCorp would control 30% of the global potash supply making a formidable rival in negotiations. That spells trouble for Uralkali and Belaruskali, though Mosaic and Agrium could benefit if PotashCorp's position inside Canpotex remains unchanged. This could also be the turning point PotashCorp investors have been waiting for.