One comment from Disney (DIS 1.10%) CEO Bob Iger earlier this month helped send the company's shares into a tailspin, dragging a handful of other media stocks down along with it.

Iger told analysts in the Aug. 4 earnings conference call that Disney executives are "realists about the business," and that the cord-cutting trend, particularly among younger people, "has and will continue to put pressure on the multi-channel ecosystem, which has seen a decline in overall households..."

It was an important comment, for sure, since many saw it as the first public acknowledgement that Disney is starting to feel the effects of cord cutters in its media networks division, which includes its single most important property, ESPN. Iger said ESPN has "experienced some modest sub losses."

But it's not one that should have come as a surprise, and it's certainly not one that should have come as such a shock as to drag down Disney's share price by as much as 14% over a few days.

Consider:

- Statistics showing a slow but real move away from cable bundles has been out there for some time.

- Iger has mentioned the possibility of creating a stand-alone sports product for cord cutters, even if that product may be at least five years in the future.

- Disney has reportedly ordered significant cost cutting at the sports network -- somewhere in the neighborhood of $350 million over two years.

That should have been more than enough evidence that the phenomenon is real, and that it's something Disney is already moving to deal with.

But the market reaction shows that it's something investors had either been willfully ignoring, or perhaps even wishing away.

Where do investors go from here?

Now that we have confirmation that cord cutting is a real problem that Disney and other TV content providers will have to reckon with over the coming years, is Disney still a company investors should want to buy and hold?

To answer that question, we need to examine two things: the impact of cord cutting on the overall business, and the strength of Disney's business outside of its media properties.

Although Netflix and other web-based streaming services have made cord cutting a more palatable option for TV watchers, the drift away from the TV bundle hasn't been swift. In 2014, the major cable providers lost a total of nearly 1.2 million subscribers, or a little more than 2% of their collective TV customer base. But AT&T's U-verse, Verizon's FiOS, and DirecTV all posted gains in subscribers last year, offsetting all but about 125,000 of those cord cutters who left their traditional cable companies.

That doesn't exactly paint a picture of TV watchers streaming for the fire exits.

Other research, however, paints a grimmer picture for Disney than those numbers would indicate. The Wall Street Journal used Nielsen data to report last month that ESPN's viewership in the U.S. had fallen by 7.2% since 2011, and cited unnamed sources as saying that figure included a loss of more than 3 million subscribers in just over a year's time.

Disney executives have disputed reports of larger subscriber losses, although they have not disclosed detailed numbers. That said, what we're likely to see is a glacial move: slow, steady, lasting.

Between the cost cutting Disney already reportedly has underway at ESPN and the development of stand-alone options, the company should have time to alleviate major problems in that important part of its business.

Disney's much more than ESPN

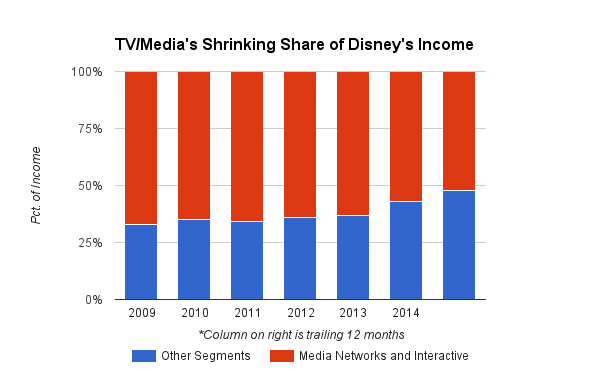

What's perhaps better news for investors is that the rest of Disney's diversified entertainment business is firing on all cylinders. Movies, theme parks, and consumer products are all making up a larger share of the company's income today than they were five or six years ago. Media networks -- including ESPN -- meanwhile, continue to make up a smaller piece of that pie.

It's true that the other segments are prone to much lumpier revenue and income than Disney's media networks are. Studio entertainment, the lumpiest of segments, saw negative growth in 2013, but growth of 134% last fiscal year.

Still, the broader trend in Disney's financials is clear. Where media networks, including ESPN, made up more than two-thirds of the company's income in 2009, it comprised a progressively smaller share in each of the past four fiscal years, and made up just 52% of the company's income over the trailing 12 months.

Data source: Disney's annual and quarterly reports.

Considering that companywide income has just about doubled since 2009 – and that Disney has yet to truly start capitalizing on the Star Wars properties it purchased along with Lucasfilm in 2012 -- those trends bode well for the future of the business.

Cord cutting is a genuine threat to Disney – and probably the single largest threat the company faces at this time. But as long as the trend remains slow to develop, it shouldn't be a reason to cut ties with Disney's stock.