For nearly a decade, one company has dominated the business of sending satellites into space in the U.S. Now, that company may be for sale.

Today, Russia's RD-180 rocket engine powers the liftoff of America's biggest space rockets. But perhaps not for much longer. Image source: Wikimedia Commons.

Created in 2005 as a joint venture between aerospace giants Boeing (BA 1.50%) and Lockheed Martin (LMT +1.16%), the United Launch Alliance has grown into a $492 million-a-year behemoth. According to Bloomberg, ULA ranks among NASA's top 10 contractors, winning $298 million in NASA contracts in 2013 alone.

And now, one of ULA's key suppliers wants to buy it.

The deal

As reported this week by The Wall Street Journal, rocket maker Aerojet Rocketdyne (AJRD +0.00%) has put in a bid to buy ULA from Boeing and Lockheed Martin. The bid, reportedly set at $2 billion, will be made in cash. If it succeeds, it will unite America's premier rocket-launch company with the country's premier manufacturer of the engines that power those rockets.

It would also, incidentally, be very bad news for one space-tech upstart.

What it means for Boeing and Lockheed Martin

The $492 million that Boeing and Lockheed took in last year sounds like a lot of money. There are, however, a couple of caveats that may make you rethink the ULA success story. For one thing, much of that money comes from ULA's monopoly over launching America's biggest and most secretive government and spy satellites. Yet ULA has struggled to make sales in the commercial space launch market, which it sees as its greatest prospect for growing sales.

In contrast, ULA European rival Arianespace was last clocked doing $1.4 billion in annual business by financial data aggregator S&P Capital IQ -- nearly three times' ULA's annual revenue stream. And at the same time as Arianespace outmaneuvers ULA abroad, local rival SpaceX is rushing to steal sales from ULA here at home.

Elon Musk's space-launch upstart has already underpriced ULA's rockets and is in the process of outperforming them technically. In what could well be a deathblow to ULA's monopoly over government launches, SpaceX also recently won certification to compete with the space giant on U.S. Air Force and "Category 2" NASA launches.

So, goodbye, ULA space launch monopoly.

What it means for Aerojet Rocketdyne

All of these developments argue in favor of Boeing and Lockheed Martin making a calculated exit, stage left, from the space launch market -- before business gets any worse. But what could possibly explain Aerojet Rocketdyne's desire to pay $2 billion for ULA?

$2 billion is, after all, more than four times ULA's annual revenues -- revenues that seem destined to shrink as SpaceX horns in on the space business. And to put that in perspective, Lockheed Martin stock sells for just 1.4 times sales, while Boeing and Aerojet Rocketdyne shares both sell for less than 1.0 times sales.

I've got a theory -- and you may not like it.

Scale model of the new BE-4 engine. Image source: Blue Origin video still.

Rocket-blocking Jeff Bezos

Last year, as you may have heard, United Launch Alliance announced a project to replace the Russian RD-180 engines currently used to power its Atlas V rockets with a new, cheaper, fuel-efficient engine-to-be-named-later. At last report, the BE-4 engine built by Amazon.com CEO Jeff Bezos' Blue Origin was the odds-on favorite to win this rocket contract. But just in case the BE-4 didn't perform to spec, ULA was keeping its options open and considering Aerojet Rocketdyne's AR-1 engine as a backup option.

A merger between Aerojet Rocketdyne and ULA, however, would obviously shift the calculus on the latter's decision to favor Blue Origin's engine. Regardless of capability, price, or performance, a merged AR/ULA would almost certainly choose to install AR-1 engines on its rockets instead.

And with billions of dollars of engine contracts on the line over the coming decades, that makes for a very strong argument in favor of Aerojet Rocketdyne buying ULA today.

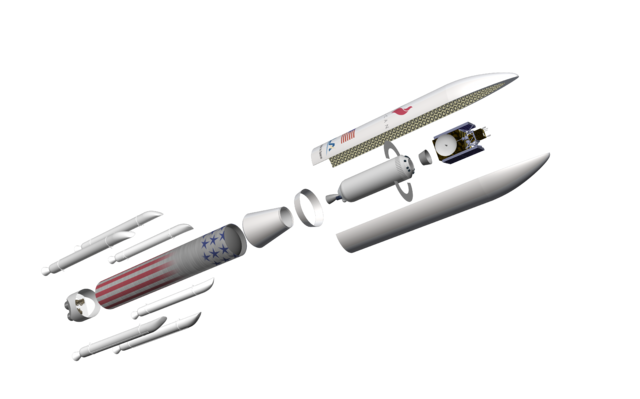

ULA's new Vulcan rocket. Soon to be brought to you by... Aerojet Rocketdyne? Image source: United Launch Alliance.