The Hail Mary pass has to be on the Mount Rushmore of sports moments. The stakes, the two tense moments between pass and the potential game-winning catch bridged by calm when the ball is in the air like the eye of the storm, and the realization that a receiver coming down with it for a touchdown is pretty much a 50/50 chance -- they all make for some real heart-stopping moments.

There are a lot of investments out there that sure feel like a Hail Mary pass. Whether it's the tense scramble of a company to position itself in a dynamic market or the feeling that the investment is pretty much a binary outcome. Either way, they sure are fun to follow. So we asked three of our energy contributors which three companies feel like a Hail Mary investment today. Here's what they had to say:

Matt DiLallo: The entire offshore drilling industry is beginning to look like a Hail Mary investment. Even before oil prices collapsed, the sector was under pressure as escalating costs were really eating into the return potential of oil companies. Now, with shale drilling cost improving so dramatically, we're starting to see a fundamental shift by energy companies back on shore. This is potentially setting up a very troubling future for offshore drilling contractors like Seadrill (SDRL).

Seadrill is starting to recognize that the growth it once saw in the offshore drilling sector might not materialize as quickly as expected. That's one reason why the company recently took advantage of the opportunity to cancel the order for a drilling rig that was nearly complete and already signed to a five-year contract with a customer. While we don't know all the details behind that decision, it would appear that the company is hoping to convince its customer to lease one of its other rigs in exchange for a much lower rate. It likely felt that scenario was a better one than having to finish paying for another rig if it could get out of the deal.

Having said that, the industry knows that it needs the oil supplies found offshore in order to meet future demand. While it doesn't need as much of that supply right now thanks to shale, it simply can't abandon offshore drilling altogether. Among the many reasons for this is because we're one major supply disruption in the Middle East away from being in a lot of trouble because OPEC's spare oil capacity is the lowest it has been in years. Given that OPEC is pumping out as much oil as it can these days, it suggests that oil prices could eventually roll over to the point that offshore drilling is a compelling option, especially if oil demand continues to accelerate.

Source: U.S. Energy Information Administration.

The problem is that no one knows when oil prices will improve, which is why buying a struggling offshore driller like Seadrill has the same binary outcome of a Hail Mary pass. The company has a lot of debt and its short-term prospects are worrisome. However, if oil prices, and therefore the offshore drilling market, improve this stock could score big.

Jason Hall: The energy companies in the most trouble -- or at least closest to being in trouble -- are the ones that took on huge amounts of debt to fund fast growth in recent years.

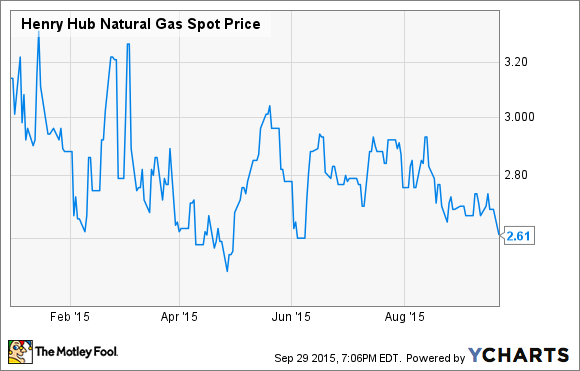

Its most recent earnings report makes Chesapeake Energy (CHKA.Q) look like it's one of the companies on the precipice. After all, the company reported an average sales price $1.01per mcf for natural gas last quarter, which is less than half the average wholesale price of around $2.70 over the same period:

Henry Hub Natural Gas Spot Price data by YCharts.

And that $1.01 price was after the benefit of the company's historically solid hedging program. In short, its contract with Williams Companies for natural gas gathering in some key plays was killing its ability to make money. Luckily, Williams Companies recently agreed to rework the deal, and so far this year Chesapeake has reported that its production costs have continued to drop.

But its $11.5 billion in debt are like ankle weights on a wide receiver, and flexibility is more important for oil and gas producers today than at any time since the recession hit. The good news in that regard? Chesapeake has more than $2 billion in cash on hand, and an undrawn $4 billion credit facility that should allow management plenty of options if oil and gas prices get worse, or just don't improve anytime soon.

Chesapeake could be a huge winner in a few years (I've put my money where my mouth is on that), but it could just as easily be a money-loser.

Tyler Crowe: The idea of a Hail Mary investment makes me think of the quarterback. Typically, he scrambles out of the pocket to buy as much time to let the play develop before chucking it down field. I can't think of a company that embodies this image more than SolarCity (SCTY.DL).

Today, the regulatory environment is pretty favorable for residential solar, but there is no telling how much longer it can last. The 30% federal tax credit for solar panels is expected to expire at the end of 2016, and many of the favorable net metering laws in place today are under review. So the company is growing its customer base as fast as it can under these favorable conditions. So far, it's worked out pretty well as its total megawatts installed has grown at an compounded annual rate of 95%.

Source: SolarCity investor presentation.

Also, as a means of setting itself up with the best chance of success in the future, SolarCity has branched out from just a financier and installer of panels in order to pursue ways of lowering costs as well as adding other options such as demand response software and energy storage to increase the value proposition to its customers.

Source: SolarCity investor presentation.

Today, these pursuits make for pretty tense moments for SolarCity's investors. The rate of expansion and the costs associated with it pretty much guarantee that the company isn't going to turn a profit for a while. However, these are all moves to boost SolarCity's competitiveness in the solar industry that are intended to pay off down the road as the market for solar matures and as the larger customer base starts throwing cash back at the company in the form of power bill payments.

So, yeah, SolarCity feels an awful lot like that quarterback. It's a company still in its infancy that is scrambling quickly to put itself in the best position possible while the market develops. Investing in the company will be pretty tense during this time, but if it can position itself in the right place, it should be in a great position to win further downfield.