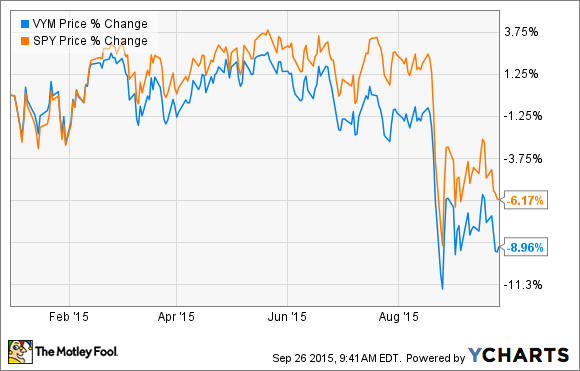

The fear of an increase in interest rates has caused many investors to flee from stocks, and dividend stocks have been hit especially hard. The Vanguard High Dividend Yield ETF, which holds a collection of dividend stocks with yields higher than the overall market, has under-performed the S&P 500 by almost three percentage points year-to-date.

Whenever that happens, we Fools start to lick our chops and go bargain hunting for great dividend-paying stocks that offer huge yields thanks to declines in their share prices.

We asked our team of Motley Fool contributors to highlight high-yielding dividend stocks that they think deserve spots on your radar. Read below to see if you agree.

Brian Feroldi: While real estate investment trusts, or REITs, have been hurt by fears of an interest rate hike, small-cap STAG Industrial (STAG +0.62%) has been hit especially hard. Shares of the single-tenant focused REIT are down more than 25% since the start of the year, and this monthly dividend payer now yields more than 7.5%.

A sell-off in the stock would certainly be warranted if the company was struggling financially or had no growth prospects, but that's not the case at all for STAG. Since its IPO in 2011 this company's portfolio has grown more than 269%, its dividend is up 33%, and its total return is almost at 100%, far ahead of a similar investment in the S&P 500.

So what gives? While STAG has certainly been growing fast, I think investors are shying away from the company because its per-share metrics haven't kept up with its asset growth recently -- the company is investing heavily in its people and processes right now to allow it to scale operations in the future. I think the odds are good that those investments will pay off down the road, and once the company is at scale we could see core FFO per share (the REIT equivalent of earnings per-share) pick up nicely.While we wait for that to happen, I'm perfectly content to bank the company's huge dividend payment.

STAG offers investors the rare combination of high-growth and a high-yield right now, and I think it's a great time to consider joining me as a shareholder in this fast-growing REIT.

Jason Hall: Retail Opportunity Investment Corp. (ROIC +0.00%) remains one of my favorite dividend stocks, as a solid growth-focused real estate investment trust -- or REIT -- with a strong asset base and growing dividend.

CEO Stuart Tanz -- a seasoned veteran with a strong track record of performance -- is focusing the company on acquiring high-value retail properties, particularly ones with grocery or pharmacy anchor tenants already in place.

It may seem like a minor detail, but grocery and pharmacy anchor tenants offer a key benefit versus other "big box" anchor stores: consistent high traffic, and much lower risk of disruption from online retail, especially compared to consumer electronics and department stores.

In short, high-value properties with valuable anchor tenants are more likely to be attractive to other retailers, helping minimize vacant units and maximize rents. For shareholders, this has been a key driver behind a steady stream of dividend increases:

Yes, there is some concern over dilution, and total debt is now approaching $900 million, but so far Tanz and team have used that debt and the proceeds from stock offerings to benefit shareholders. Over the past three years, earnings per share have more than doubled, even with significant shareholder dilution over the same time frame.

With a great operator at the helm, it's likely that ROIC will continue on the same path of dividend and earnings growth for years to come.

Selena Maranjian: One promising high-dividend stock to consider is HCP (HCP +0.58%), a healthcare-focused real estate investment trust (REIT) that recently yielded 5.9%. Dividends are a key attraction of REITs, as they're required to pay out at least 90% of their earnings in the form of dividends. HCP owns senior housing, medical offices, life science buildings, nursing homes, and hospitals, which it buys, develops, leases, manages, and sometimes sells. The company has pointed out that this gives it "multiple avenues to achieve growth." Its properties are geographically diversified, too, reducing the risk of a particular region going through tough times and hurting the company's performance.

HCP's dividend history features 30 years of uninterrupted dividends and annual dividend increases. Its stock-price appreciation has rewarded investors well over the years, too, averaging an annual gain of about 10% over the past decade. One risk it faces is rising interest rates, which can put pressure on its profit margins. Those margins are quite high, though, with gross margins recently around 80% or above and net margins in the double digits. That reflects a solid, high-performing outfit.

In its last quarter, HCP's revenue grew by nearly 15% year over year, with occupancy rates for its medical office and life sciences properties hitting 92% and 98%, respectively. Its funds from operations (FFO), a key measure of income for REITs, advanced 5%, while the company spent $1.4 billion on investments. Management boosted its projections for the year, too.

Given America's large and growing population of seniors who will need more and more healthcare services and senior housing, HCP is well positioned to keep growing and to keep rewarding its shareholders.

Sean Williams: If there's one beat-up industry that offers substantial yield that I believe income investors should be eyeing, it's mortgage real estate investment trusts, or mREITs. Specifically, I'd encourage income seekers to take a closer look at American Capital Agency (AGNC 3.80%).

American Capital Agency's stock price has been on the defensive for a few years now. The problem with mREITs is that they thrive in falling interest rate environments and tend to see their net interest margins shrink in rising rate environments. Even though lending rates aren't rising at the moment, the fear that a rate rise is right around the corner has held these stocks back and tightened their profitability, even with the use of leverage. In the coming quarters, it wouldn't be out of the question to see the value of American Capital Agency's mortgage-backed securities portfolio (or even its book value) fall.

However, Wall Street and investors may also have overshot on their pessimism for the industry. With the Federal Reserve pushing off a rate hike in its September meeting for a later date, it looks like the governing body of monetary policy is going to take things nice and easy when it comes to rate hikes in the coming years, which should be music to the ears of mREIT holders. A slow but steady approach to rising rates should also lend to a healthy housing market.

With American Capital Agency we get a company valued at around 80% of its book value that's reduced its leverage on a quarter-over-quarter basis to give itself a bit more flexibility in a volatile interest rate environment. Furthermore, we get a monthly dividend of $0.20 per share, which works out to a current yield of 12%. Even if American Capital Agency reins in its dividend a bit in lieu of interest rate volatility, I suspect its yield could remain triple or quadruple the average yield of the broader S&P 500.

Eric Volkman: My pick is a stellar performer in the financial sector, New York Community Bancorp (NYCB 2.40%).

It's a regional bank that focuses on mortgage lending in one of the best market segments on the planet -- multi-family housing in New York City. People are always going to want to live in The Big Apple, so this permanently robust -- not to mention virtually recession-proof -- demand results in a loan book with sky-high quality. So much so that the company's charge-off rate (loans removed from the books as a percentage of total lending) is tiny compared to even the best peer mortgage banks on the market.

On the back of this, New York Community Bancorp has been strongly and consistently profitable for many years, even during the dark days of last decade's financial crisis. The bank pays out much of that profit in its dividend, which at a current yield of 5.5% pulverizes the 2.2% average of the S&P 500 index.