Valeant Pharmaceuticals CEO J. Michael Pearson. Image source: Valeant Pharmaceuticals International.

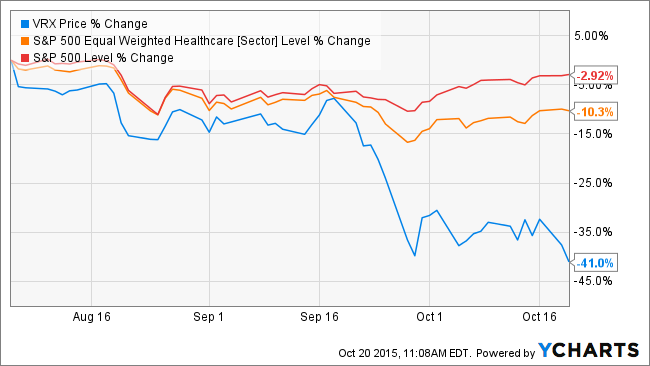

U.S. stocks are roughly unchanged in early afternoon trading on Tuesday, with the Dow Jones Industrial Average (DJINDICES: ^DJI) and the S&P 500 (SNPINDEX: ^GSPC) down 0.04% and 0.15%, respectively, at 1 p.m. EDT. Despite announcing better-than-expected results yesterday, shares of Valeant Pharmaceuticals International Inc are adding to their recent underperformance, declining another 7.39%.

A downdraft has hit the healthcare sector over the past two and a half months, but for Valeant, it's turned into a terrifying maelstrom. Including today's loss, the stock has fallen more than 40% from the all-time high it achieved on Aug. 5. Is this an opportunity for value-driven investors to don their contrarian hats?

During this period, controversial increases in drug prices have attracted enormous negative attention from the media, politicians and regulators. Valeant is sitting in the eye of storm: Last week, the company announced that it had received subpoenas from attorneys general in Boston and New York concerning a number of issues, including its pricing.

This is a cruel reversal of fortune for a stock that, until recently, appeared unstoppable. The market gave its enthusiastic approval to the acquire-and-rationalize strategy of CEO J. Michael Pearson, a 23-year veteran of McKinsey, the strategy consultancy.

The following returns graph starts on Feb. 8, 2008, the date of the announcement of Mr. Pearson's appointment as CEO and Chairman of Valeant:

Even after the recent fall, the stock has had a fabulous run, leaving the index trailing far behind it.

At 9.6 times next year's estimated earnings per share, Valeant shares are trading at a 55% discount to the median multiple for a global peer group of 14 companies compiled by Bloomberg. On that basis, the shares certainly look cheap.

Furthermore, Mr. Pearson told analysts and investors on Valeant's earnings conference call yesterday that it would divest the unit that is at the heart of the controversy over sharp price increases. The unit, which goes by Neuroscience and Other, represents approximately 16% of consolidated revenues, but that figure is expected to shrink to roughly 10% next year.

A divestiture of the unit raises the prospect that the discount between Valeant's valuation and that of its peer group could narrow. At this stage, however, it's not clear that the move would be enough to reassure investors. Beyond the reliance on stiff price increases to generate growth, there are other questions regarding the sustainability of Valeant's acquisition-driven model.

For one, the company uses heavy dollops of debt to finance its takeovers. At $30 billion, net debt is four-and-a-half times equity; earnings before interest, taxes and depreciation and amortization (EBITDA) are less than three times the interest expense. Valeant's cost of debt isn't likely to decrease over the next five years -- to the contrary, in fact.

While interest expense is high relative to earnings, the company's effective tax rate is exceptionally low; investors might reasonably ask how much longer that will last.

For an exhaustive review of the topics that would merit further due diligence when looking at Valeant, investors can start here. Conversely, high-profile activist investor Bill Ackman of Pershing Square Capital Management laid out the bull thesis for Valeant last May in this presentation.

Valeant looks like it might make an interesting speculation, provided one can get comfortable with the questions raised above. However, this columnist believes they are enough to bar Valeant from consideration as an investment.