Source: FedEx Corporation 2002 annual report, the first year FedEx declared a dividend

FedEx Corporation (FDX 0.76%) has paid dividends consistently for more than a decade. But the delivery logistics landscape is changing, and the road ahead could be rockier than ever for FedEx Corporation. To determine whether FedEx Corporation will raise its dividend in 2016, let's take a look at three important indicators. Here's what you need to know.

1. Past precedent

While the past is not indicative of the future, there's a lot to learn from looking at a corporation's past dividend payouts. In Fedex's case, the company has doled out dividends every year since a $0.10 distribution in 2002 . It's also managed to raise its dividend payout every year except calendar year 2011, when it knocked its annual distribution $0.04 to $0.50.

For the past five years, FedEx Corporation has also outgrown its dividend compared to competitor United Parcel Services, (UPS 1.43%). While UPS has increased its distributions by about 40%, FedEx Corporation has doubled its dividend.

UPS Dividend data by YCharts

However, that starts to make sense when you consider each stock's starting point. United Parcel Services, is a more established company happy to hand cash straight back to investors—its current dividend yield sits at 3.1%. Despite FedEx Corporation's dividend increase, a lower starting point and steeper stock price increase puts its own yield at just 0.7%.

UPS Dividend Yield (TTM) data by YCharts

2. Finding those fundamentals

There's little double that FedEx has a lengthy history of growing its dividend year-to-year. But the delivery logistics industry landscape is changing, and companies may feel that there's better use for their funds. For two quick quantitative checks on FedEx's fundamentals, investors should take a deeper dive into its debt and cash situation.

On the debt front, FedEx Corporation enjoys a 0.57 debt-to-equity ratio and a 0.22 debt-to-assets ratio. That means that FedEx's total debt amounts to around 60% of its equity and 20% of its assets. FedEx has generally been less aggressive with debt than the majority of its competitors (United Parcel Services, has a 0.37 debt-to-assets ratio), meaning investors probably don't need to worry about the corporation paying off debt instead of distributing dividends .

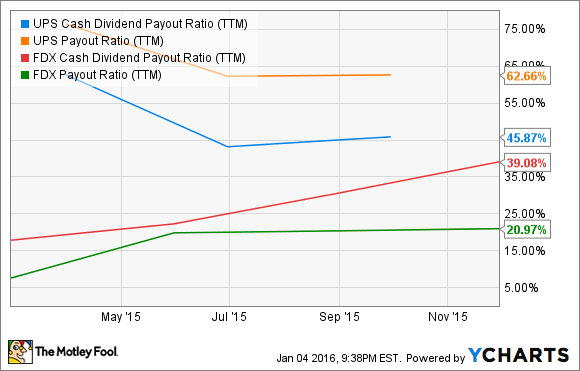

On the earnings and cash front, FedEx Corporation also looks solid. Its 21 % payout ratio (annual dividend payouts divided by annual earnings) and 39 % cash dividend payout ratio (annual dividend payouts divided by free cash flow) show that its dividends aren't tying up its available funds. Similar to the debt situation, United Parcel Services, also spends more of its earnings and cash on distributions, but neither corporation has overextended itself.

UPS Cash Dividend Payout Ratio (TTM) data by YCharts

3. Plans for 2016

While examining past precedent and current fundamentals is important, investors can't forget to focus on FedEx's future plans.

In 2016, both FedEx and United Parcel Services, will need to address new competition from e-commerce companies looking to get into delivery logistics, themselves. With whispers of sharing economy worries , FedEx's and UPS's scale may no longer play a part in their competitive moats.

FedEx also plans to close out its acquisition of Netherlands-based TNT Express by mid-2016 . The purchase will dramatically expand its European market share and put sales on par with UPS , but the company may experience some growing pains as its adjusts to its new geographic girth. FedEx Corporation will also focus on further incorporating recently purchased GENCO, a "reverse logistics" company that specializes in e-commerce package returns , into its existing business model.

The bottom line for investors

2015 was a tough year for FedEx, and 2016 won't necessarily be any different. Past precedent and current fundamentals suggest that the company will most likely raise its dividend, but dividends aren't everything. With a shifting competitive environment and major moves for the year ahead, investors will need to watch FDX closely to be sure this pick is still the most profitable choice for their portfolio.