Like most utilities in the U.S., Duke Energy Corporation (DUK -0.85%) has seen a once-stable business become far more fluid. Customer load growth has slowed, energy prices have fallen, and consumers are now starting to generate their own electricity.

Suddenly, investors need to be aware of the risks at Duke Energy and I think there are three that are bigger than most.

Coal-related cost

Duke Energy has done a good job of transitioning its fleet from coal to natural gas and renewable energy, but there are still risks from legacy assets. There are 3,955 MW in coal plants that have been identified for possible retirement, which could just be the beginning of the coal challenge.

There are five lawsuits relating to Duke Energy's coal ash ponds leaking into groundwater. There's no way to know if these lawsuits will be costly long term, but if they are, it could be a reason the stock falls. Coal seems to be the fuel source of never-ending surprises and that's not a good thing for a utility.

Electricity growth is slowing

Utilities grow revenue and earnings by growing assets to serve a growing customer base. To grow assets, utilities need to growing demand from their customers, but that's not happening in Duke Energy's territories.

Over the past 12 months, retail load growth was just 0.3%, including a 0.2% drop in demand from residential customers. There's no sign that the dynamic will improve in the near future, either. North Carolina was second behind only California in solar energy installations in the third quarter, and when residential and commercial customers go solar, they reduce electric demand from the utility.

This isn't a challenge unique to Duke Energy and it's one of the reasons the company is investing in owning renewable energy assets that have long-term contracts. But slow demand growth is a challenge for the company, and if it continues, it could cause a challenge keeping the stock at its current valuation.

Value

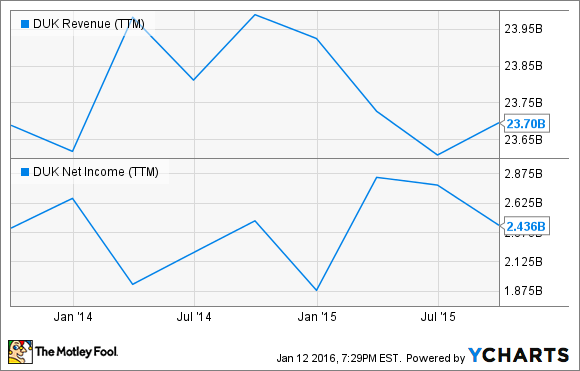

Underlying the unknown about coal risks and demand growth is the fact that Duke Energy's stock trades at 20.5 times trailing earnings. That's a lofty valuation for a company that's had no growth since 2013.

DUK Revenue (TTM) data by YCharts.

For decades, a higher valuation was justified for utilities because they were more stable than most stocks given their monopoly status. Plus, there was always a small amount of growth in electricity demand.

That slow and steady growth is now under pressure because of new energy options like rooftop solar, and it makes utilities a less stable investment than they've been for decades. I think it's likely that investors put a lower premium on utilities over the next few years and that may be the biggest risk Duke Energy's share price faces.