As the transportation sector goes, so goes the economy. At least that's the conventional investing wisdom. However, the recovery since the financial crisis has been uneven and inconsistent, so merely looking at the headline numbers when a transportation logistics company such as J.B. Hunt Transport Services (JBHT +3.05%) reports earnings isn't enough. That said, let's look at its earnings and what they say about the transportation sector and U.S. economy at large.

Reasons to be fearful

There are three key themes to look out for in the transportation sector:

- Growth in truck tonnage slowed in late 2015, raising fears for the direction of the economy.

- Other transportation companies, such as United Parcel Service (UPS +1.82%), have spoken of a relative shift in demand growth from business-facing customers and commodity-related companies toward consumer-facing.

- UPS also reported a drop in less-than-truckload tonnage in its third quarter.

- The impact of falling oil on revenue fuel surcharges is a negative, while lower oil prices should reduce fuel costs.

DATA SOURCE: U.S. BUREAU OF TRANSPORTATION STATISTICS

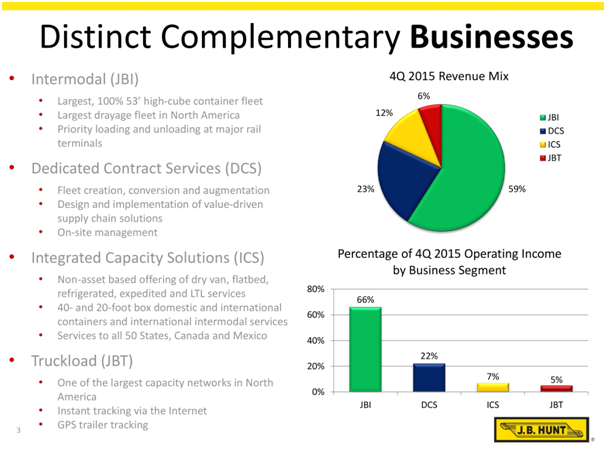

I'll deal in turn with how the three themes played out, but first it's useful to break down how J.B. Hunt earns money.

SOURCE: J.B. HUNT PRESENTATIONS.

End demand?

The company's fourth-quarter revenue and earnings were pretty much in line with analyst estimates, so it doesn't look as if the economy tailed off more than expected. Moreover, the evidence from the intermodal segment results is that growth in other areas of the economy is helping offset weakness in the industrial sector. Although intermodal revenue increased only 1% (and segment operating income fell 1%) in the fourth quarter, the underlying end-demand picture is better.

For example, intermodal total volume increased 6% in the quarter, with revenue per load excluding fuel surcharges increasing 5% compared with the same period last year -- a key point, because J.B. Hunt increased its average intermodal tractors by 8.3% in the fourth quarter compared to last year. In other words, the intermodal revenue increase wasn't just due to an increase in tractors.

Intermodal operating profit fell largely because of "increases in rail purchased transportation costs, equipment ownership costs, and driver recruiting and retention costs," according to the earnings release. While this is problematic for J.B. Hunt, it doesn't speak to weakness in end demand.

Asset utilization

The big fear with trucking companies relates to falling asset utilization values. Indeed, J.B. Hunt's asset utilization fell in both its relevant activities -- namely, the Dedicated Contract Services and Truck segments.

| Segment | Asset Utilization Q4 2014 | Asset Utilization Q4 2015 | % Change |

|---|---|---|---|

| Dedicated Contract Services | $4,184 | $4,048 | (3.3%) |

| Truck | $4,086 | $3,663 | (10.4%) |

DATA SOURCE: J.B. HUNT PRESENTATIONS. ASSET UTILIZATION IS MEASURED IN REVENUE PER TRUCK PER WEEK.

Frankly, these are worrying trends, but investors should note a couple of points:

- Excluding the effects of a lower fuel surcharge, J.B. Hunt's asset utilization increased 2.5% compared with a year ago.

- While Truck asset utilization fell, it contributed only 6% to the fourth quarter anyway.

Clearly, fuel price changes played a part in making J.B. Hunt's operating numbers look worse than they might have been, so let's focus on it a bit.

Oil impacts

The impact of lower fuel surcharges has reduced revenue per package growth at UPS, and J.B. Hunt has similarly been affected. Here's what the impact of oil looks like:

| Metric |

Q4 2014 (in Thousands) |

Q5 2015 (in Thousands) |

Change (in Thousands) |

% Change |

|---|---|---|---|---|

|

Operating revenue, excluding fuel surcharges |

$1,344,891 |

$1,472,291 |

$127,400 |

9.5% |

|

Fuel surcharges |

$264,620 |

$148,724 | ($115,896) | (43.8%) |

|

Operating revenue |

$1,609,511 |

$1,621,015 |

$11,504 |

0.7% |

|

Fuel and fuel taxes |

$101,467 |

$69,575 | ($31,892) | (31.4%) |

|

Operating income |

$182,905 |

$192,893 |

$9,988 |

5.5% |

DATA SOURCE: J.B. HUNT PRESENTATIONS.

The data clearly shows that the reduction in fuel costs of some $32 million wasn't enough to offset the $116 million reduction from lower fuel surcharges.

However, excluding fuel surcharges, operating revenue increased 9.5%. Given that J.B. Hunt plans a similar level of capital expenditure for 2016 ($570 million, compared with $556 million in 2015), this creates confidence that the implied growth investments will produce the 9% to 12% revenue increase the company forecasts. Naturally, my commentary is assuming that oil prices don't deteriorate further.

Looking back, looking ahead

While growth in the industrial and commodity sectors slowed in the second half of 2016, it appears that other parts of the economy have grown enough to offset significant deterioration in at least some U.S.-focused transportation companies.

Moreover, the impact of fuel surcharges on transportation and package delivery companies such as UPS is often underestimated. If oil prices are flat compared with last year, then companies in the sector will start to see underlying revenue growth showing up in their headline numbers, and the market usually rewards such things. Despite the gloom in the markets, the U.S. transportation sector isn't dead yet.