When you think of growth companies, Honeywell (HON +2.03%) probably isn't on the top of your list. The industrial company has seen revenue stagnate over the last few years, and it can't seem to find any new growth markets out of its core controls and aircraft business.

But little revenue growth doesn't mean Honeywell hasn't been able to dramatically improve its bottom line recently. As you can see below, net income is up 164% in the past decade, and with more margin expansion programs in place, we could see further earnings growth in 2016. Does that mean a higher dividend will follow?

HON Revenue (TTM) data by YCharts.

Bottom-line growth is the best hope

In 2016, management is expecting sales to grow 4%-6% to $39.9 billion-$40.9 billion. That's decent growth, but consider that sales were $40.3 billion in 2014, so the company is essentially running in place on the top line. Even the growth this year comes with some caveats, because the company spent $5.5 billion to acquire companies over the last year.

The real growth will once again be on margins. Segment margins are expected to grow from 18.8% in 2015 to between 18.9% and 19.3% in 2016. That will help drive an 8% to 13% increase in free cash flow to $4.6 billion-$4.8 billion.

Margin expansion has been Honeywell's one tool to grow the bottom line over the past five years. But that lever can only be pulled so far, and I'm not sure how much longer the same will work for investors. For the dividend, that's fine -- but long term, the company needs more avenues for growth.

Can Honeywell pay a higher dividend?

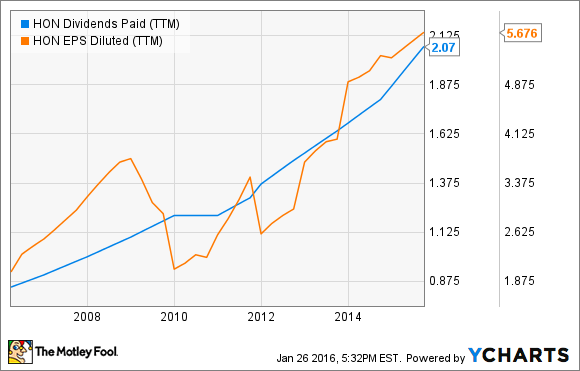

If you look at the chart below, you can see that Honeywell has plenty of room to grow its dividend in 2016, and that it will probably do so. Even a dividend payout ratio of 50% of earnings wouldn't be out of line, so there's plenty of room for dividend growth.

HON Dividends Paid (TTM) data by YCharts.

The problem with paying too much in a dividend is that Honeywell is spending billions on acquisitions to fuel what little growth it has. It's spent $5.5 billion since July, and there could be billions more in acquisitions this year.

Honeywell's dividend is likely heading higher, but that doesn't mean the stock is a great buy for investors. Sales are stagnant, the easy margin expansion opportunities have been exploited, and now management has to count on M&A for growth. That's not a great path for a large industrial company to be on, and I would be wary of Honeywell in 2016.