Investors are often told that they can safely withdraw 4% of their portfolios upon retirement to help fund their living expenses. While doing so typically requires selling off assets, there are some dividend stocks that currently yield more than 4%. Filling your portfolio with these types of stocks could make it possible for you to live off your dividend income alone, thereby reducing the need to decide which assets to sell -- and when. If that sounds appealing, read on to learn about two quality stocks that can help satisfy your income requirements.

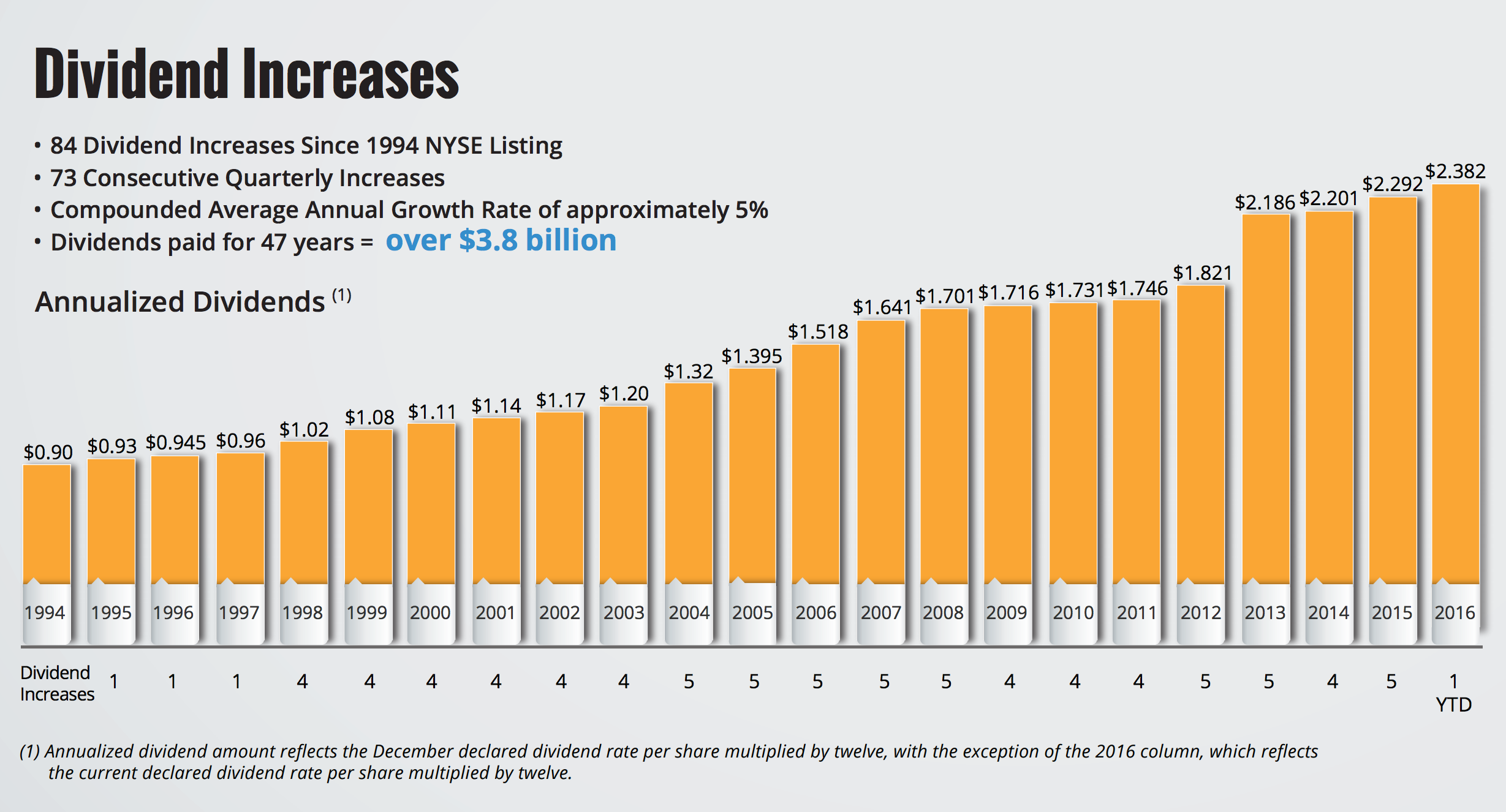

Image source: Realty Income.

The REIT

Realty Income (O +0.88%) is particularly well suited as an income investment thanks to its nifty monthly dividend payout schedule. In fact, the real estate investment trust notes on its website that the company was founded in 1969 for the express purpose of providing "investors with monthly dividends that increase over time." And since its inception, Realty Income has paid 546 consecutive monthly dividends, including 73 consecutive quarterly dividend increases.

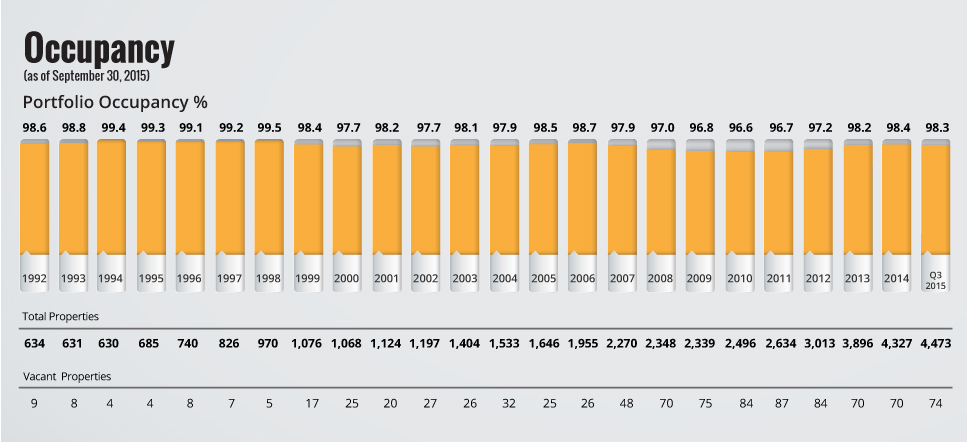

Source: Realty Income.

Those dividends are supported by stable and steadily rising cash flow from Realty Income's commercial real estate assets. The REIT leases the majority of its properties on a net basis, so tenants are responsible for expenses such as maintenance, taxes, and insurance. The leases are long-term -- typically spanning 10 to 20 years -- and include annual rent increases of up to 2% per year, thereby providing investors an element of inflation protection.

Maybe most importantly, Realty Income focuses on acquiring properties leased to retailers that are insulated from the threat of e-commerce, such as those with a service, non-discretionary, and/or low price point component to their business. Think gyms, pharmacies, and dollar stores. These types of tenants also help to make Realty Income somewhat recession-proof -- a benefit reflected in the REIT's multi-decade streak of greater than 96% occupancy.

Source: Realty Income

All told, Realty Income is a quality business and a relatively low-risk way to earn an annual dividend yield of more than 4%, paid out in convenient monthly intervals.

Image source: Verizon.

The telecom king

In addition to REITs, the telecom sector is another area where investors often turn for low-risk, income-producing stocks. That's because the industry tends to lend itself to subscription-based revenue streams and stable cash flows -- two areas where telecom titan Verizon (VZ +1.61%) excels.

The utility-like nature of Verizon's massive wireless business and FiOS fiber optic TV and Internet services generates predictable revenue and substantial free cash flow. That, in turn, allows Verizon to reinvest in its already best-in-class network, while still rewarding shareholders with a 4.5% dividend yield. In that way, Verizon is able to continuously strengthen its major competitive advantage -- a reputation for superior call quality and reliability -- in a sustainable manner.

That's something that can't be said for less financially sound competitors such as No. 3 U.S. wireless carrier T-Mobile US (TMUS +1.60%), which will probably have to raise prices in the near future to earn adequate returns on its infrastructure investments and promotional spending -- a move that could curb its customer growth. And No. 4 U.S carrier Sprint (S +0.00%) is in an even worse predicament, as it's being forced to slash jobs and cut costs as it struggles under the weight of its heavy debt burden.

Verizon's reputation for having a superior network also helps to explain why its wireless customer counts have continued to move higher in recent quarters, even as T-Mobile and Sprint waged price wars in an attempt to lure customers. That's a trend that could accelerate in the years ahead, if Sprint and T-Mobile are forced to raise prices as expected. And should that occur, Verizon's shareholders would probably enjoy significant share price appreciation in addition to the telecom giant's steadily rising dividend stream.