Image source: Sprint.

SoftBank (NASDAQOTH: SFTBF) CEO Masayoshi Son said on an earnings call recently that Sprint (S +0.00%) will need to cut "thousands" of jobs and cut at least $2 billion in annual costs. This wasn't a complete shock, considering that several reports came out a few weeks ago noting that Sprint would likely lose some jobs.

"I think $2 billion is a minimum target, and we should go even deeper. We need to do this, including reduction of personnel," Son said on the call.

Sprint is arguably stronger now than it was when SoftBank purchased a majority stake in the company back in 2013, but even given its mostly positive third-quarter results, the company still has a lot of work ahead of it to catch up to its closest competitor, T-Mobile (TMUS +0.60%).

Sprint's most recent quarter

Here's what Sprint's calendar third quarter 2015 looked like:

- 1.1 million net additions, up about 80% year over year

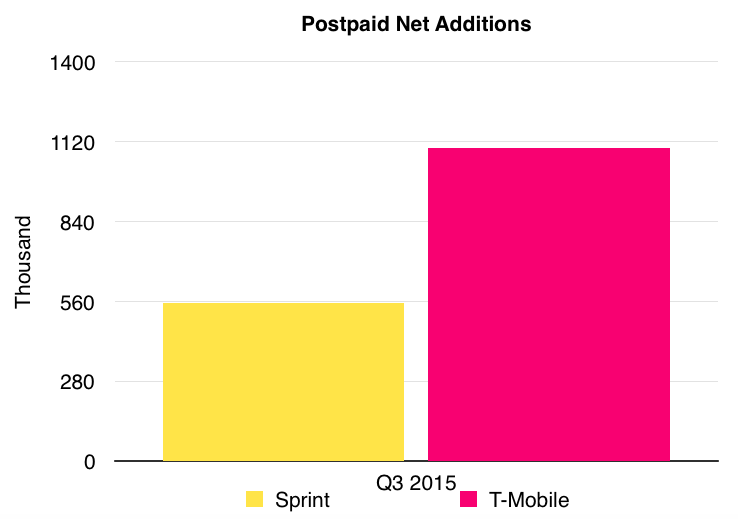

- 553,000 postpaid net additions in the quarter compared to a net loss of 272,000 in the year-ago quarter.

- 237,000 net postpaid phone additions, compared to net losses of 500,000 in the prior year quarter.

- Average postpaid revenue per user (ARPU) fell to $54.02, down from $60.58 from a year ago.

- All-time low churn rate of 1.54%

- The company posted a loss of $585 million, a loss of $0.15 per share

This was the first quarter in two years that Sprint posted positive postpaid net additions, and the first time in three years the company posted positive postpaid phone net additions for six consecutive months. So why does Sprint need to make cuts if it's on the path to recovery? Because the carrier blew through $100 million in the quarter and still can't keep up with the competition.

Take a look at Sprint's net additions compared to T-Mobile's.

Data source: Sprint and T-Mobile.

Data source: Sprint and T-Mobile.

In the second quarter, T-Mobile overtook Sprint as the nation's third-largest wireless carrier by subscriber numbers. So even as Sprint started making some gains in net additions and phone additions in Q3, it's not nearly enough to catch up with T-Mobile's current lead.

Cutting back to get ahead

Of course, no one wants to see Sprint cut any jobs, but the carrier will have to do so to help reach the $2 billion to $2.5 billion in annual spending cuts. Son also mentioned that other cutbacks will come, like ditching free snacks for employees (which is expected to save $600,000), and having workers empty their own trash cans. Clearly, Sprint still has a long road ahead.

But the carrier will need to see several quarters of strong customer additions to make the turnaround a reality. While Sprint has made some big moves recently, like its inexpensive iPhone Forever plan, it doesn't come close to the blitz of publicity and customer growth that's propelled T-Mobile to the No. 3 spot.

I don't see Sprint taking that lead back form T-Mobile anytime soon, especially considering that the carrier already burned through $100 million in the third quarter and made only modest gains. Sprint will have to settle with a slow and steady turnaround -- and at this point any positive gains should be praised.