Deere & Company (DE +4.09%) is a great business with good long-term prospects, but it's facing a significant amount of risk in its near-term prospects. Given that its upside potential is reliant on crop prices rising, it makes more sense to buy an ETF in a crop like corn or wheat than carry the near-term risk in Deere stock. Here's why.

Introducing Deere's financial services segment

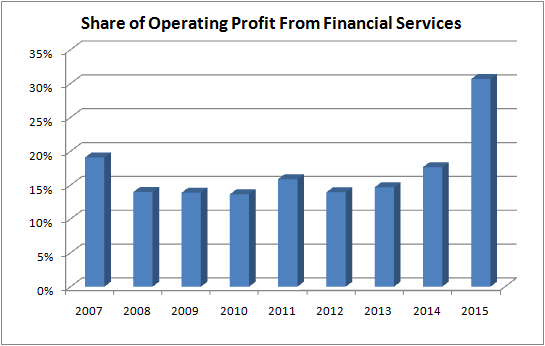

Deere makes tractors and combine harvesters, but did you know that more than 40% of its operating profit in the fourth quarter came from its financial services? It's clearly not a one-off thing, either, because Deere's management is forecasting that $550 million of its projected $1.4 billion in net income in 2016 will come from its financial services.

Moreover, the high share of income from financial services isn't just about equipment sales falling. The previous trough in overall earnings occurred in 2009 (when equipment sales were also falling), and as you can see below, the share of Deere's operating profit from financial services was much lower back then.

DATA SOURCE: DEERE & COMPANY SEC FILINGS.

Simply put, Deere has become increasingly reliant on its financial services segment, and specifically on leasing out equipment. To be clear, Deere's management is on record stating that its financial company "has not been encouraging customers to utilize leases in general, or short-term leases specifically, through pricing or residual values." Rather, it's an option that has become more attractive to customers.

There are three major risks in this:

- Rising interest rates and/or Deere's ability to obtain financing

- Quality of financing receivables could decline, leading to an increase in credit loss provisions

- A huge increase in leasing activity could lead to a glut of used equipment on the market

- Leasing options could be artificially stimulating a market that could correct sharply

I will let the first point lie, because if you can accurately predict interest rate movements, then there is no need to waste time on equities! Nonetheless, it's an exposure that Deere has, given the reliance on its financial services.

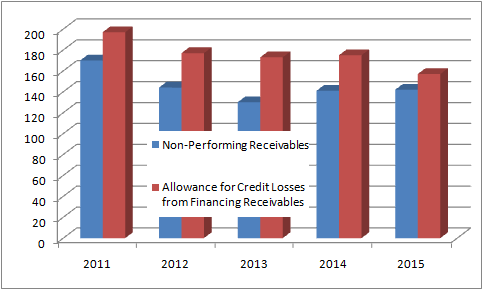

Financing receivables

As you can see below, Deere has done a pretty good job of managing nonperforming loans, and its allowance for credit losses actually fell to $157 million at the end of 2015 compared to $175 million at the end of 2014 -- although foreign currency movements helped improve matters by $23 million.

DATA SOURCE: DEERE & COMPANY SEC FILINGS. ALL DATA IN MILLIONS OF U.S. DOLLARS.

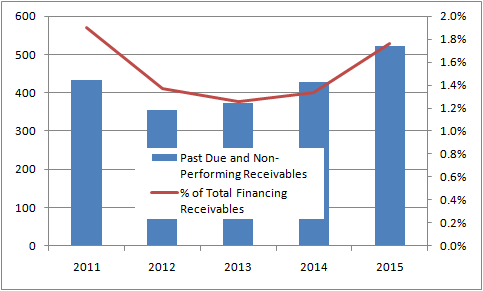

However, the pressure is building. Adding its nonperforming receivables to the total of its past-due receivables (generally whereby payments have not been made after 30 days or more) it's clear that there is a strong increase. If conditions in its end markets don't improve, then Deere may have to increase credit loss provisions.

DATA SOURCE: DEERE & COMPANY SEC FILINGS. IN MILLIONS OF U.S. DOLLARS. PAST DUE = AFTER 30 DAYS OR MORE.

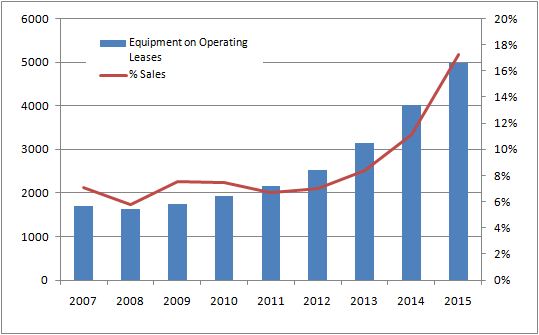

Leasing activity

Deere has been significantly increasing leasing activity. As noted above, Deere may not necessarily be encouraging it, but it's happening all the same, and Deere has been supporting it. A combination of low interest rates, declining farmer income, and an uncertain economic environment have come together to create conditions for its growth.

The chart below shows that the growth in equipment on operating leases has significantly increased in recent years -- note that it wasn't a significant factor back in the last trough in 2009.

DATA SOURCE: DEERE & COMPANY SEC FILINGS. IN MILLIONS OF U.S. DOLLARS.

Used-equipment prices

In truth, Deere is moving into uncharted territory, and it's hard to know how used-equipment prices will be affected when some of the equipment comes on the market, let alone how new-equipment prices might be affected. Consequently, this isn't just a Deere issue; investors in other agricultural machinery companies like AGCO Corporation (AGCO +3.17%) and CNH Industrial (CNHI +3.58%) could also be affected.

So far, pricing in the industry has held up well, with AGCO and CNH recently releasing results warmly received by the market; Deere also has an assumption of a 2% price increase baked into its first-quarter and full-year guidance. The question is: How long will it last?

Two bottom lines, and a caveat

All told, Deere's financial services segment has a lot of near-term risk facing it, but investors shouldn't lose sight of the fact that if crop prices increase -- perhaps due to unfavorable growing conditions caused by, say, a La Nina following on from this year's strong El Nino -- then nearly all Deere's metrics are likely to turn around positively.

Still, that doesn't build a case for buying the stock. The company is still a great long-term business, but if you are buying in the expectation of a pickup in crop prices, then simply investing in a corn or wheat ETF like Teucrium Corn Fund or Teucrium Wheat Fund makes more sense than carrying the near-term risk in Deere's financial services segment.