Image Source: Potash Corp of Saskatchewan corporate website

Mosaic Co. (NYSE: MOS) doesn't actually produce food, but its crop nutrients play a vital part in helping farmers complete this vital task. Although there are some headwinds today, most notably falling commodity prices, the long-term agriculture story remains unchanged -- which provides\ three reasons Mosaic stock could rise.

A tough stretch

After an over 40% price drop from its highs, Mosaic looks like just another beaten-up commodity play. In some ways it is, with the price of its two main products, phosphate and potash, falling over the last year. For example, the company's gross margin in its phosphate division fell seven percentage points year over year in the fourth quarter to 12%. Gross margin in the potash group declined 16 percentage points to 27%.

That's not good news, but it's in line with peers such as PotashCorp (NYSE: POT), which saw its gross margin collapse nearly 50% year over year in the fourth quarter. The big reason for the weakness at each company is falling prices and reduced demand. But there's something interesting about the fertilizer industry that's a bit different from the rest of the commodity market.

Indeed, the first reason Mosaic stock could rise is very simple: We need to eat. You could argue that we need electricity (coal, natural gas), shelter (iron ore, lumber), and any number of other commodities. But at the end of the day, we really don't have to have those nearly as much as we have to have food. You can live for a long time without electricity, but you won't last long without food. And the crop nutrients Mosaic sells have an underlying demand that simply won't go away.

Demand is still close to record highs. Source: Mosaic

More mouths to feed

The second reason to think investors will push Mosaic's stock higher is that the world's population is growing. For example, the United Nations estimates that there are around 7.3 billion people in the world today, but by 2030 that number should reach around 8.5 billion. In 2050 it's expected to reach 9.7 billion and hit 11.2 billion in the year 2100. That last one is a long way off, but the trend is pretty clear -- more and more mouths to feed. That means more and more food has to be produced.

But there's a second trend that exacerbates the population growth issue. Much of the developing world is moving up the socioeconomic ladder. As that happens, a lot of changes take place, and one important one is that people eat more meat. It takes more grain to produce meat than it does to simply feed a human corn or wheat. That figure can be as high as 7 kilograms of grain to produce a 1 kilogram gain in the weight of a cow. It varies by animal, and, frankly, farmers can skimp out and sell skinny cows, too. But the direction is what's important -- more people eating more meat means the world will need even more grain.

But wait, there's more... While both of these consumption trends are going on, farmland is becoming increasingly scarce. Over short periods of time the numbers may not seem large, but over long periods it starts to add up. For example, according to the World Bank, arable land per capita in the United States fell from 0.49 to 0.48 between 2012 and 2013. But it was around 0.75 in the 1980s. So there's less land to support increasing demand. The fertilizers that Mosaic sells increase crop yields; which allows farmers to produce more on less land. So this trend is bad overall, but good for Mosaic.

Commodity prices

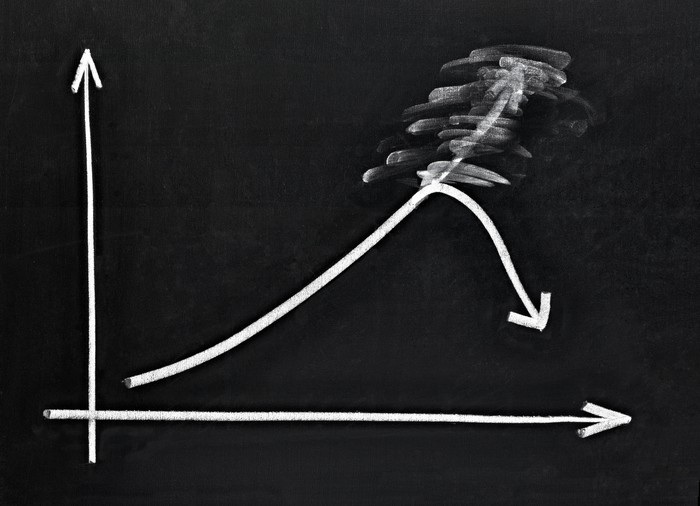

So we quite literally have to eat, and we're going to need more grain globally in the years ahead. Those are two long-term reasons Mosaic stock could rise. But that doesn't help with the near-term issue of supply and demand. Phosphate and potash are both commodities, and they are subject to supply and demand just like every other commodity. Right now there's more supply than needed, and prices are, predictably, weak.

Everyone is cutting back to shore up prices. Source: Mosaic.

However, the industry, just as predictably, is adjusting. For example, between 2014 and 2018, Mosaic is set to permanently shut 600,000 tonnes of potash supply. The company estimates the industry as a whole will shut around 5 million tonnes. The industry is also cutting back on production, with curtailments of some 1.8 million tonnes. Lo and behold, the invisible hand at work. Potash, for example, has trimmed its potash capacity by roughly 1.8 million tonnes through a combination of mine closures and suspensions as it, too, works to match supply and demand.

In other words, the industry will eventually adjust to the current market dynamics and prices will stabilize. When that happens, Mosaic shares will probably start to head higher again. And those adjustments are already under way. This is the dynamic that will have the most obvious near-term impact on how investors value the stock.

The long and short of it

The Mosaic story is really twofold. In the long term, there's always a demand for food, and, in fact, population trends predict there will be an increasing demand for food. That will help support Mosaic's long-term growth prospects. Near term, commodity prices are the biggest driver of investor perception. But Mosaic doesn't live in a vacuum any more than its competitors, such as Potash. They are all working right now to solve the supply/demand equation so that the prices for phosphate and potash stabilize and move higher. These, then, are three reasons Mosaic's stock could move higher, over the near term and the long term. And it's why contrarian types might like to take a look Mosaic today while investors are still so down on the stock.