Image source: United Parcel Service.

United Parcel Service (UPS +4.35%) is a stalwart stock: It has steady growth and a rock-solid dividend. But diving deeper into the details reveals that its past hasn't been without hiccups, and future investments might be riskier than ever before. Here's your five-minute guide to United Parcel Service stock.

Minute 1: The competition

It's not easy to build a global logistics shipping company, and United Parcel Service's competition hasn't changed much over the years. First and foremost, UPS faces competition from government postal services. Often, UPS serves as a higher-cost complement to these services, but government competitors can be difficult to understand -- with public sector backing, any sort of regulatory subsidy, tax break, or cheap money could give government counterparts an unfair advantage.

In the corporate world, FedEx Corporation (FDX +2.67%) is UPS' primary competitor. In the past, FedEx has always played second fiddle to United Parcel Service, but a near-completed European acquisition of Netherlands-based TNT Express promises to finally pull FedEx's revenue up to UPS' levels. That means UPS may no longer enjoy larger economies of scale than FedEx.

Minute 2: Sales, income, and all-important margins

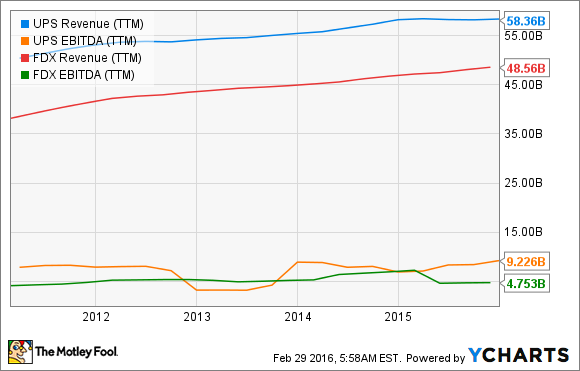

Over the past five years, sales at United Parcel Service and FedEx have both inched up at relatively the same rate. However, UPS' EBITDA (earnings before interest, taxes, depreciation, and amortization) has been a bit more volatile, jumping above and below FedEx's own figure.

UPS Revenue (TTM) data by YCharts.

In the shipping business, it's not just how much you can ship -- it's how much you can profit from each shipment. Here, too, UPS' operating margin has seen its fair share of ups and downs over the past half-decade, but it currently sits at 13%.

UPS Operating Margin (TTM) data by YCharts.

Minute 3: Stock price

If you invested $100 each in United Parcel Service stock, FedEx stock, and the S&P 500 index five years ago, your UPS investment today would be sorely lagging behind.

This is, however, to be expected. Despite the fact that UPS has managed to exceed analysts' earnings expectations for the past four quarters (compared to just two earnings beats for FedEx over the same time period), it's a more stable company with less growth potential. While investors have been eyeing FedEx's aggressive $5 billion acquisition (that's around two years' worth of FedEx profit) to see whether there's great growth, UPS has been chugging along. Currently, UPS' trailing-12-month P/E ratio sits at a reasonable 18.2, nearly half FedEx's 35.2. But for investors considering UPS, there's another reason to get in on this stock besides price appreciation...

Minute 4: Dividends

UPS Dividend data by YCharts.

Since 2000, United Parcel Service investors have enjoyed steadily growing dividend distributions. UPS' "dividend staircase" is something investors (myself included) have come to expect, and its consistent growth has kept UPS' dividend yield hovering around a respectable 3% over the past five years -- more than four times FedEx's current yield. UPS' payout ratio (the amount of earnings it distributes as dividends) has also hovered around 50% for the majority of its existence, meaning that UPS isn't stretching itself too thin. FedEx has kept its own payout ratio at an even more affordable 20%.

UPS Dividend Yield (TTM) data by YCharts.

Minute 5: What to watch

In the years to come, investors should keep a close eye on the indicators above to understand how United Parcel Service is faring. While some UPS stats like sales and dividends have grown steadily through the years, others (such as profit, operating margin, and stock price) have been less predictable.

As FedEx expands, UPS stock could become more volatile than before. As a shareholder myself, I'm not selling anytime soon. On the contrary, I'm excited to see how this tried-and-true company reinvents itself in a changing industry. But I won't follow this stock blindly, either, and a five-minute test is about the simplest way to stay on top of this stock.