In a world getting used to global growth rates at far lower levels than in previous decades, large industrial companies can't simply rely on revenue growth in order to increase earnings significantly. Something more is needed. One of those "somethings" is the Industrial Internet of Things (IIoT), and there are three early adopters set to win out. Let's take a closer look at them.

Back to basics

In the past year, General Electric Company (GE +1.62%) CEO Jeffrey Immelt has finally begun to win plaudits for transforming the company, returning it to its industrial roots. A big part of his plans involves the company's expansion of its industrial Internet solutions. In a nutshell, General Electric will increasingly embed Internet-enabled devices into its hardware solutions in order to capture and analyze data on its Predix platform. Why is this so key in a low-growth world?

Simply put, it creates scenarios in which General Electric can grow margin and earnings without much help from the economy.

- Using the industrial Internet will result in internal productivity improvements -- such as reducing production costs on its new LEAP engine -- resulting in margin expansion.

- Adding software and analytics to hardware solutions creates added value for customers, and will help grab market share.

- Analytics capability will support General Electric's services offerings -- how it generates the majority of its industrial profit.

- Predix-based analytics will offer a value-add solution to hardware customers, and also help retain customers -- so General Electric will generate more revenue from existing customers, while the cost of customer acquisition should drop.

In all these points there is a common theme: They all involve cutting costs or maximizing the lifetime value of a customer, and none of them necessarily rely on economic growth. In other words, growing the bottom line (earnings) while the top line (revenue) is only growing moderately.

A natural fit

Most of the investment attention on Danaher Corp. (DHR 1.58%) in 2016 will focus on its integration of Pall Corp. and Danaher's subsequent split into two companies. All of which makes perfect sense in the near term -- but investors shouldn't lose sight of the long-term opportunity from Danaher's IIoT operations.

Back in the summer of 2014, Danaher's then-CEO Larry Culp disclosed that a third of the company's engineering head count was already employed in digital activities -- in other words, embedding software in its solutions. Why does this matter, and why is it such a specific opportunity for Danaher?

The answer lies in understanding the following graphic.

Image source: Danaher presentations.

The businesses shown will comprise the post-split Danaher, and as you can see, they all contain a high degree of recurring revenue. Examples of recurring revenue include consumables and services in diagnostics and life sciences, and across Pall Corp.'s operations.

The opportunity facing Danaher comes from embedding more software in its equipment, thereby spurring increased consumables sales and keeping customers engaged with Danaher's services. Moreover, analyzing data from customer usage of equipment can create valuable opportunities for the company to modify its customer offerings.

Right timing, right markets

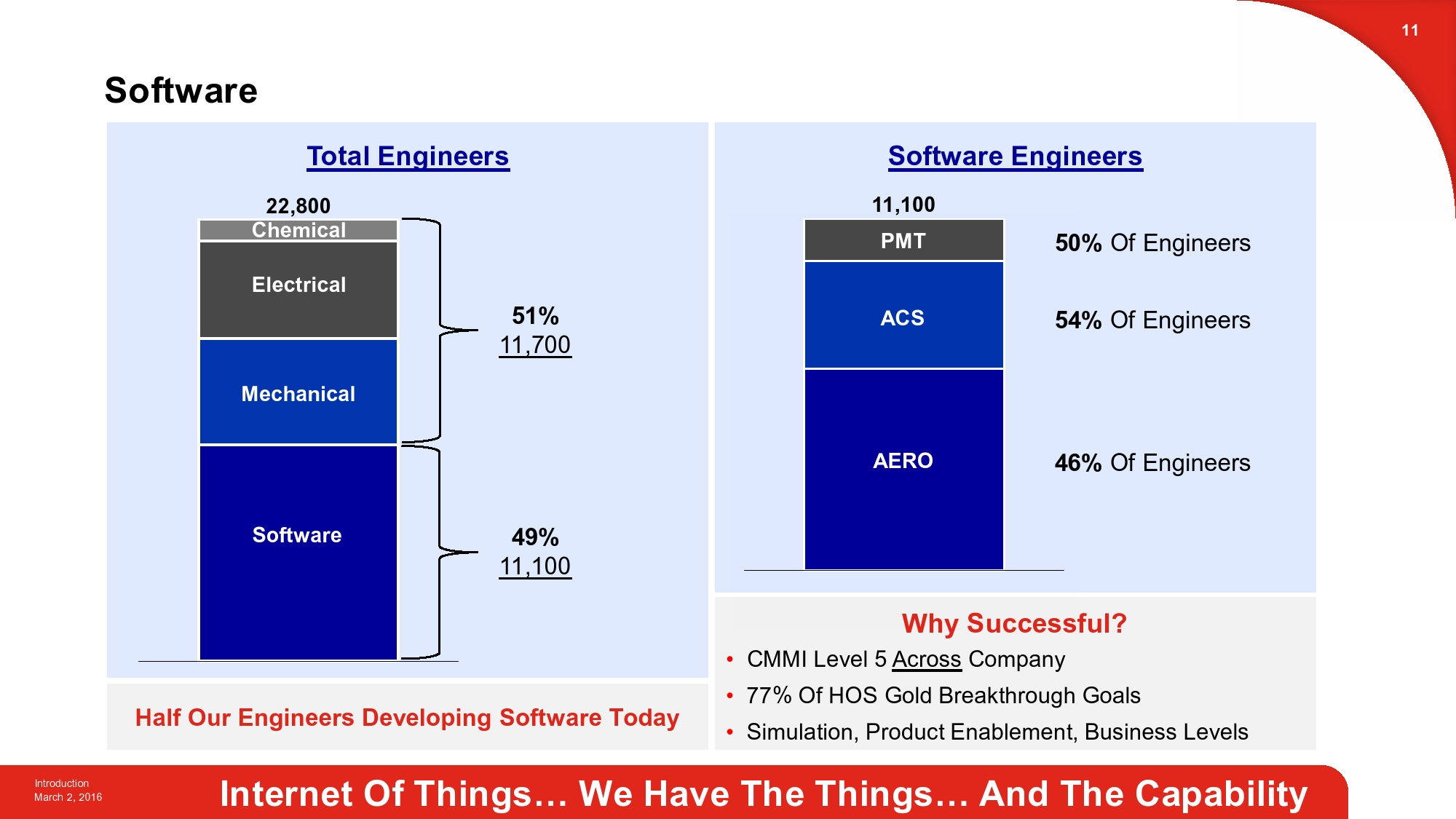

As you can see below, Honeywell International (HON +2.03%) is taking IIoT very seriously -- in fact, nearly half of its engineering force is currently employed developing software.

Image souce: Honeywell International presentation.

As with General Electric, Honeywell's aerospace and building solutions (automation and control solutions, or ACS segment) are a natural fit for IIoT, because airplanes and buildings are in constant need of monitoring and servicing -- generating long-term revenue growth for Honeywell.

In fact, Honeywell expects that by 2020, around 60% of its aerospace sales will be from products with software embedded, and a further 6% from stand-alone software. The ratios for ACS are expected to be 74% and 7%, respecitvely.

Moreover, the performance, materials, and technologies (PMT) segment -- not activities easily associated with IIoT -- is also expected to derive 22% of its sales from software-embedded products, and a further 9% from stand-alone software. Opportunities in PMT include using IIOT to optimize sales of catalysts and absorbents to the refining and processing industries, and sales of refrigerants to supermarkets.

Large companies to win out

All three of these companies are leaders in their fields and have large installed bases into which they can embed IIoT solutions. In other words, they already have strong advantages over the competition.

In addition, it takes significant resources to build a platform such as General Electric's Predix, and hiring scores of software engineers isn't an activity that smaller rivals can easily afford. All told, IIoT is likely to favor the large and early-stage adopters, and all three companies are set to be winners in the coming decade.