Source: LinkedIn

With its shares down sharply from its all-time high, you might be wondering what's wrong with once-favored growth stock LinkedIn (LNKD +0.00%).

Nothing -- but that's not what Wall Street would have you think.

Stung by a series of downgrades, the mood surrounding the world's leading professional social network is arguably as negative as it ever has been. Thankfully, this recent wave of pessimism grossly underestimates the attractive long-term opportunity apparent in its shares today.

Barclays becomes bearish

Last Tuesday, shares of LinkedIn sank on a downgrade from the research arm of British banking giant Barclays. The firm cut its rating on LinkedIn stock from overweight, the equivalent of a buy, to equal weight, essentially a hold rating. Barclays cited LinkedIn's first-quarter guidance, which fell meaningfully short of the consensus Wall Street estimates.

For context, LinkedIn said its expects to earn $0.55 per share this year. An average of analysts' estimates called for the firm to reach an EPS of $0.74. This wide disparity helped spark an acute selloff in LinkedIn's shares that have cut its price to less than half of its level 12 months ago.

Barclays is by no means the first company to lose faith in LinkedIn's growth proposition. It joins Morgan Stanley, which downgraded LinkedIn stock from overweight to equal weight in late March. As you might guess, Morgan Stanley's rationale for its downgrade largely mirrors Barclay's. And while growth might be slowing for LinkedIn, as is usually the case as companies expand, the recent wave of downgrades puts investors at risk of overlooking an attractive long-term opportunity trading at an increasingly reasonable valuation.

Against the grain

True, the aforementioned downgrades correctly note, even emphasize, that growth at LinkedIn in the year ahead will likely prove slower than many had hoped. At the same time though, it strikes me as an incomplete analysis to totally overlook the firm's dramatically reduced valuation. These downgrades only tell part of the story, which I believe leaves an interesting opportunity on the table for investors with long-term vision.

Keep in mind, backward-looking valuation tools don't provide a lot in the way of insight since LinkedIn isn't profitable at present. That's widely expected to change in 2016. Here's how LinkedIn's current valuation relates to its 2016 and 2017 consensus expectations.

| Metric |

2016 |

2017 |

|---|---|---|

|

LinkedIn Stock Price |

$115.40 |

$115.40 |

|

LinkedIn Estimated EPS |

$3.20 |

$4.16 |

|

Forward P/E |

36.1 |

27.7 |

Data Source: Yahoo! Finance; April 1.

That's far from cheap. However, when benchmarked against estimates of LinkedIn's long-term growth rate, its pricing isn't necessarily as outlandish as it might seem. For context, LinkedIn's estimated annual average growth rate over the next five years is expected to be 27%.

To be clear, analysts' estimates aren't the Gospel creed, and any investor worth his or her salt takes them with a grain of, well, salt. However, even if not precisely correct, the massive long-term growth rate from the preceding paragraph speaks to the fact that LinkedIn indeed enjoys sizable long-term business opportunity.

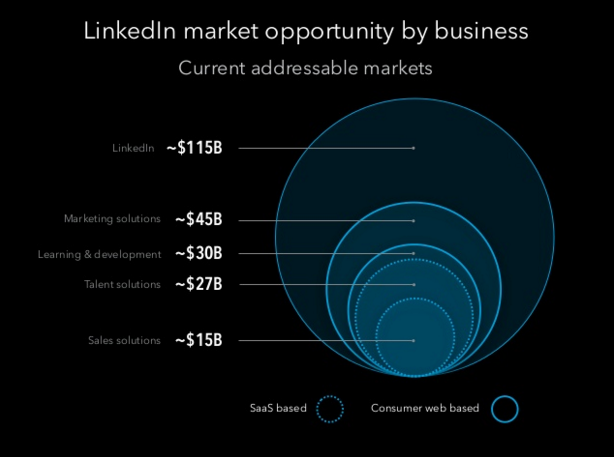

Source: LinkedIn

The market for online professional services is set to explode, and LinkedIn has positioned itself ideally as the go-to resource within this space. All told, the firm's executive team estimates that the overall market potential for LinkedIn sits at $115 billion total. Compare that to the $2.9 billion the firm brought in in fiscal 2015, and hopefully we can all agree that LinkedIn has ample growth opportunities well into the future.

The key to succeeding here, in my eyes, is an investor's time horizon. If you want LinkedIn's growth in the next year or two to justify its admittedly premium multiple today, you've come to the wrong place. Even as its growth moderates, LinkedIn clearly remains a growth stock, one whose progress, given, say a decade's time, could more than compensate for the levels at which its currently trades. So while certain research firms continue to downgrade LinkedIn's shares, contrarian investors with long-term time horizons would do well to further examine the world's largest professional social network.