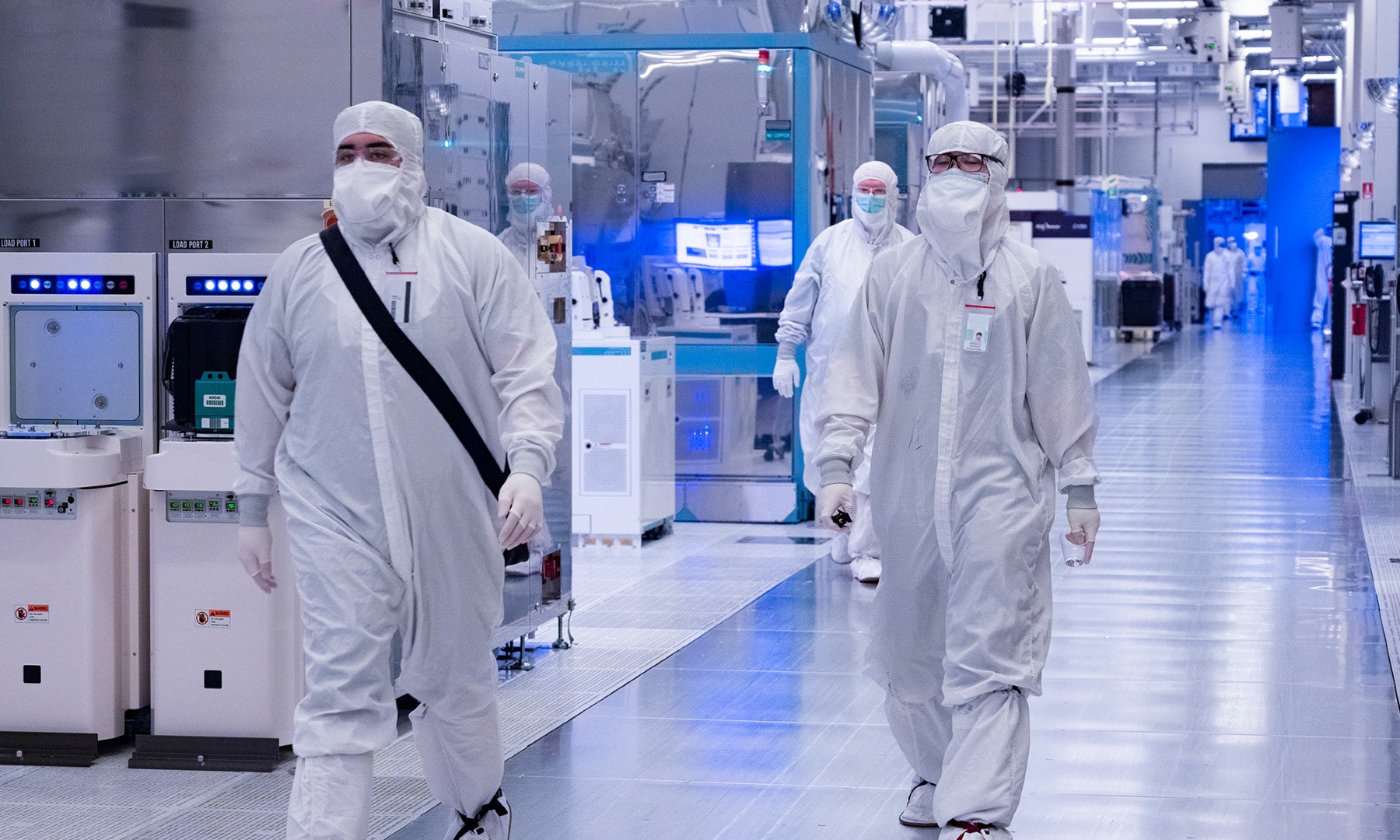

Image source: Intel.

Chip giant Intel (INTC +2.25%) is, yet again, changing its reporting structure. However, unlike the last one -- in which Intel merged its money-losing mobile group with its highly profitable but declining PC group -- this one promises to increase visibility into the performance of the company's operations.

Old versus new

Intel's prior reporting segments were as follows:

- Client Computing Group

- Data Center Group

- Internet of Things Group

- Software and services group

- All other

This structure gave a good look into Intel's businesses, but as you'll see in a moment, the new structure is much better. Starting with the April 19 earnings release, Intel says it plans to report results for the following segments:

- Client Computing Group

- Data Center Group

- Internet of Things Group

- Non-Volatile Memory Solutions Group

- Intel Security Group

- Programmable Solutions Group

- All other

- New Technology Group

The big hitters for Intel's business -- Client Computing Group and Data Center Group -- remain unchanged. There are a number of notable changes here, though.

Some significant changes

Firstly, Intel will finally start breaking out the revenue/profitability of its NAND flash memory efforts. Given that the company is investing significantly to equip one of its own factories to build both 3D NAND flash memory as well as 3D XPoint non-volatile memory. It also seems to be allocating significant research and development talent to developing new non-volatile memory technologies.

In light of these investments and the non-trivial revenue that the company generates from such products, it only makes sense to give more insight into the financial performance of this business.

Intel has also done away with the Software and Services Group, which had long been thought of as a "catchall" for software technologies and products that served to benefit other operating segments. In its place, Intel is now disclosing financials for what it calls the Intel Security Group -- essentially McAfee.

The Programmable Solutions Group is essentially the Altera FPGA business that Intel acquired last year.

The "All other" category that was there previously remains. This includes the company's "New Technology" group as well as other miscellaneous items that don't neatly map to a major operating segment.

Good news here, as well as an interesting tidbit

Though I was disappointed with the last set of reporting changes -- I liked having the mobile business broken out separately -- this set of changes is welcome and should give investors a very clear picture of the company's business.

What I found interesting, though, is that Intel still isn't breaking out its Custom Foundry business as its own operating segment, instead seemingly lumping it in with the catchall "All other" group. This signals to me that the company doesn't expect revenues from this venture to be material anytime soon.

Indeed, these reporting structure changes -- especially given that the company needs to restate historical results in order to give investors a clear way to compare future results with those from prior years -- likely require a lot of work.

If Intel Custom Foundry does ever make it off the ground and starts bringing in revenue that's, say, in excess of $1 billion per year, then I would expect another revision to the chip maker's reporting structure.