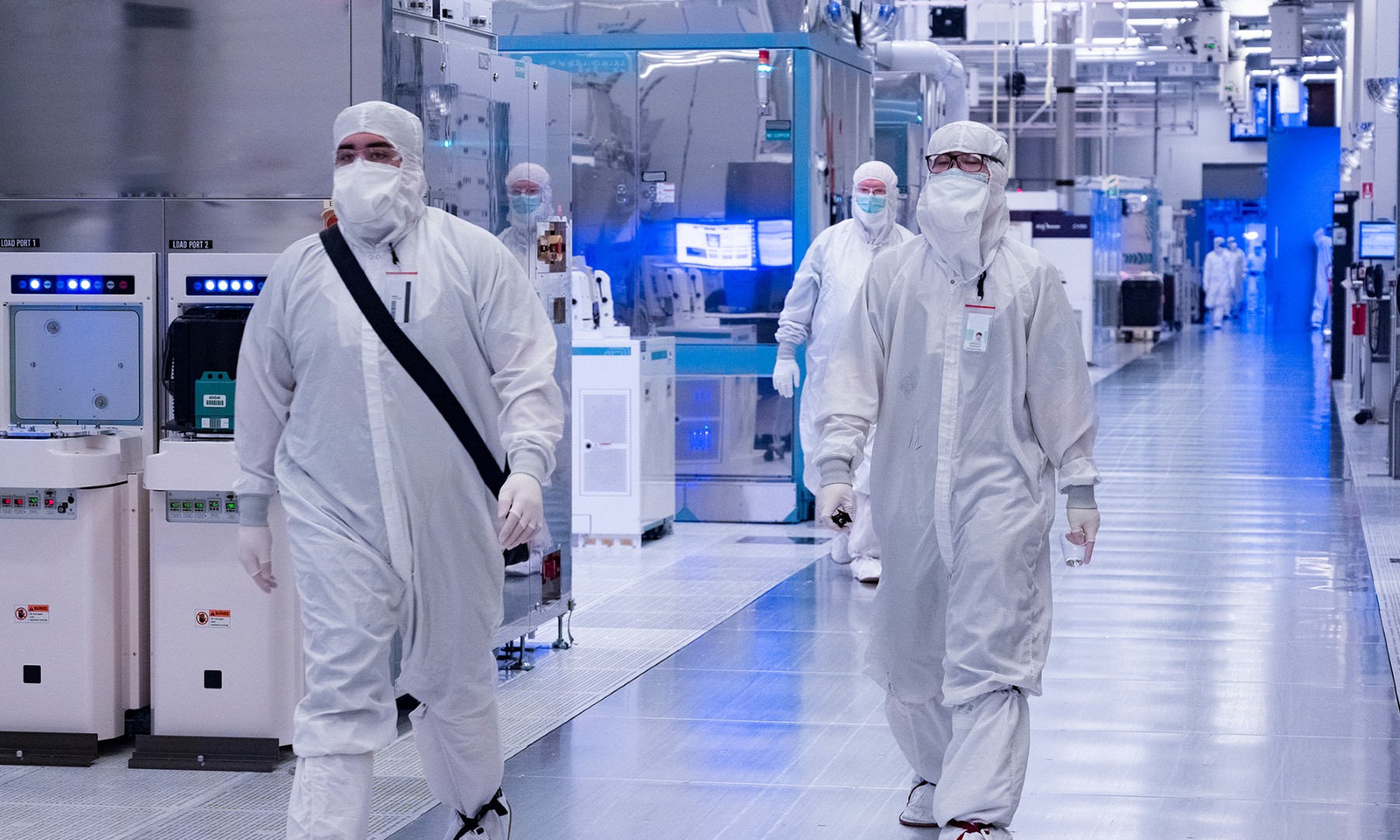

Aicha Evans. Image source: Intel.

Not too long ago, news broke that Intel's (INTC 4.50%) mobile chip chief, Aicha Evans, had handed in her resignation to the chip giant. There had been some speculation that she was effectively "asked to leave," though in a column published here on Fool.com shortly after the news broke, I suggested that the executive, instead, might be leaving out of frustration.

After reading an article published in Bloomberg, it would seem that the latter explanation is more likely. Let's take a closer look.

What Bloomberg had to say

Per Bloomberg, after Ms. Evans handed in her resignation, current Intel CEO Brian Krzanich was apparently "scrambling to get Evans to change her mind."

It's not clear whether Krzanich's efforts were successful. That said, the fact that Intel didn't include Ms. Evans' departure alongside the announcement that the Internet of Things and Client Computing Group heads, Doug Davis and Kirk Skaugen, respectively, were out may mean that she's not left yet.

Why should Evans bother to stick around?

To be blunt, Intel's efforts in the market for smartphone processors have been nothing short of a disaster. Though it is rumored to win a minority share of the stand-alone modems inside the upcoming Apple (AAPL +2.74%) iPhone 7 series of smartphones, the company's efforts to attack the broader smartphone market with integrated applications processors with modems have largely been fruitless.

The company just doesn't release products at a regular clip, and when its highly delayed products finally make it to market, it's too late for them.

I don't blame Ms. Evans for the mess that the company's mobile efforts currently are. Virtually all of Intel's mobile failings can be attributed to prior management.

The issues, however, aren't even totally attributable to the wireless division (i.e., modems) within the chip giant. Intel's struggles in manufacturing technology, as well as issues with the company's system-on-chip designs, also led to key mobility products being pushed out and/or simply not being competitive.

Mobile system-on-chip products incorporate many significant intellectual properties (IPs) and in order to be competitive, a company needs to field products with leadership IPs across the board. Intel, for whatever reason, has been unable to produce such worthwhile products.

In this Fool's mind, the organization itself is simply ill-suited for the fast-paced, hypercompetitive market for mobile system-on-chip products.

Though Intel has made a number of key hires in a bid to address these issues (Murthy Renduchintala and Amir Faintuch from Qualcomm (QCOM 0.47%) are the two highest profile ones that come to mind), it will likely be a while before the impact of their efforts will be felt.

And, by then, it may simply be too late.

In light of all of this, it's not hard to imagine why an executive of Evans' caliber wouldn't want to stick around. Intel's best shot at keeping her, if she is even willing to entertain the notion of staying, would probably be to hand her a substantial amount of money.

We'll find out soon enough whether Evans can ultimately be persuaded to stay.