General Mills' (GIS 2.39%) stock price has been on a tear lately, reaching an all-time high of $65.49 in April. This outstanding performance can be attributed in part to the company's shift to natural and organic foods, a move that was further solidified by its purchase of Annie's in 2014 for $820 million. The company is beginning to invest heavily in organic, but is this a bet that will pay off?

Can organics power General Mills' growth?

Since 2000, General Mills has built up a robust portfolio of natural and organic brands with sales of nearly $700 million in 2015. That equates to only 3.8% of total 2015 sales, but management said that they are not done yet: the company will more than double its organic acreage in the coming years, and by 2020 it should reach reach $1 billion in organic and natural sales.

Success in organic would be a much needed shot in the arm for the maker of Lucky Charms, as its sales growth has slowed down over the past decade. Over a 10-year period, revenues have grown by 4.6%; over the last five, they have grown by 3.6%; and over the last three, a mere 1.9%. The strong dollar is partly to blame for this deceleration, as it has created a drag on revenues in the last two years. But even outside of this headwind it seems clear that General Mills' growth is moderating. Enter salvation in the form of gluten-free pasta and a rabbit named Bernie.

I want my glutten-free pasta

General Mills' purchase of Annie's in 2014 brought to the fold a slew of organic products, from Macaroni and Cheese to Bunny Grahams. This move "significantly expanded [General Mills'] scale and participation in the attractive U.S. natural and organic food category," states the company's 2014 annual report. Management estimated that the purchase added one percentage point of growth in 2015. This isn't earth shattering, but management hopes that Annie's sales coupled with its other organic products will lead to growth in the mid-single digits.

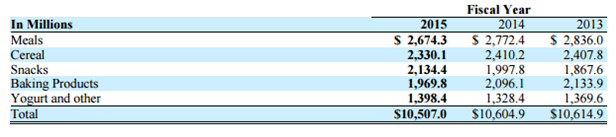

We can see some easing of the brake pedal in recent revenues reported by General Mills. Annie's falls under the company's meals and snacks divisions, and although meals dropped by 3.5% from 2014 to 2015, snacks increased by 6.8%.

General Mills' three-year U.S. 2015 net sales by operating unit

Source: General Mills 2015 10-K.

Lucky the prognosticator

So, will its bet on organic pay off for General Mills? In general, sales of organic foods have increased by 3,400% over the last 24 years and represented 5% of the total food market in 2014. This category is expected to grow at an annual rate of 16% until 2020. If General Mills can catch this wave, it will do well. Natural and organic will represent approximately 10% of the company's U.S. sales in the next five years and will lead to growth in the mid-single digits. Given that growth is trending down right now, this would be a welcome turn of events.

Will consumers continue to purchase organic in droves? Is it a long-term consumer trend of growth or a fad that will hit a ceiling in the near future? Nobody knows for sure. As the cards lie right now, however, it looks like General Mills has made a rational shift to organic, a move that could deliver much needed growth for the food giant in the future.