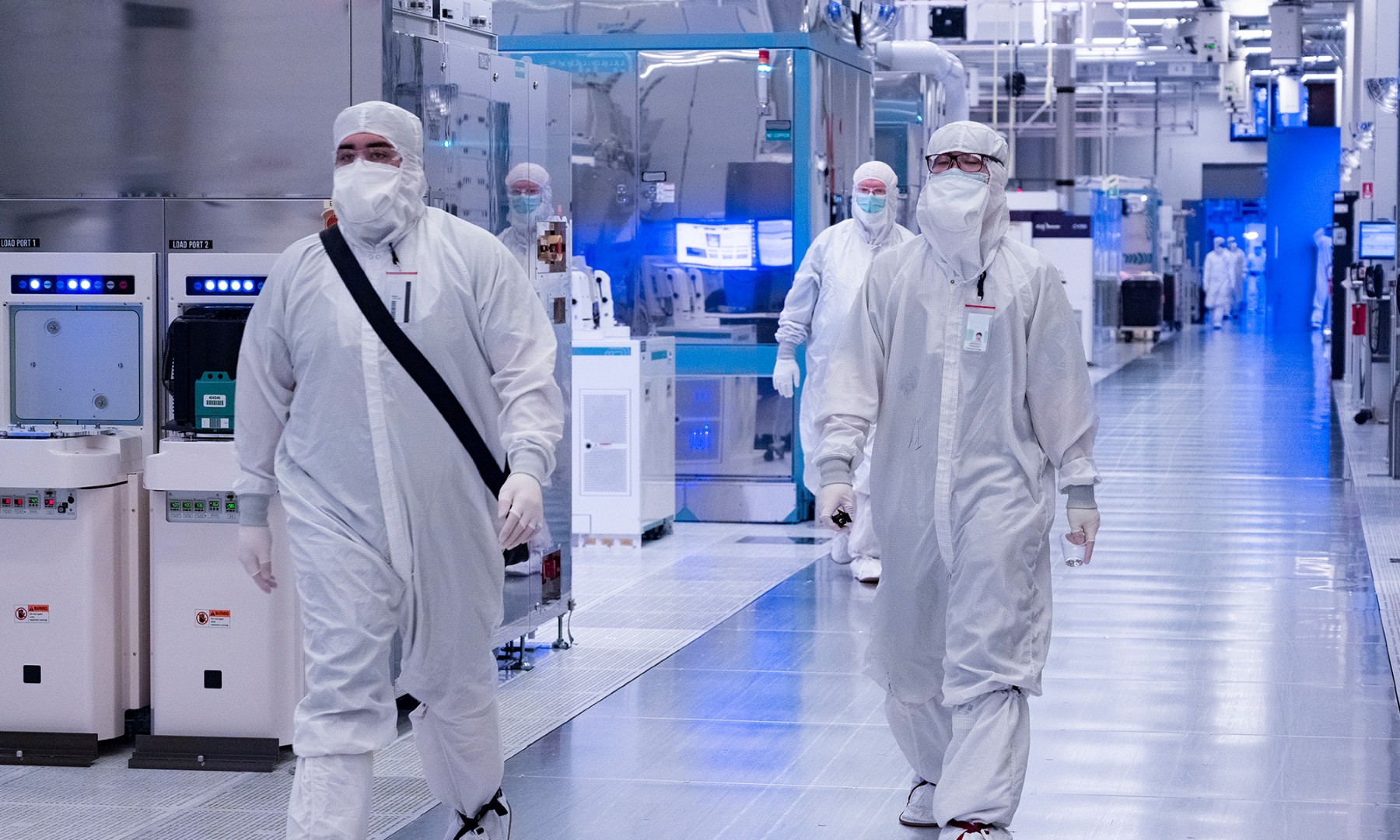

An enterprise-focused solid state drive from Intel. Image source: Intel.

There has been a lot of hype around Intel (INTC +6.59%) potentially becoming a major player in the market for memory chips. The chip giant has historically had exposure to the memory business via a NAND flash joint venture with memory specialist Micron (MU +4.40%), known as IM Flash Technologies.

Last year, though, Intel announced plans to start making significant capital investments in an Intel-owned factory that will be used to manufacture both NAND flash and 3D XPoint (a new type of non-volatile memory). In 2016, that investment is expected to total $1.5 billion.

In a move that increased transparency to investors, Intel now breaks out the financial results of its non-volatile memory group. Interestingly, it looks as though this business deteriorated in the most recent quarter, posting a revenue decline of 6% year over year and swinging to an operating loss of $95 million.

Let's take a closer look at what drove these results.

Strong unit growth, but pricing pressures more than offset

According to prepared remarks from Intel CFO Stacy Smith, the operating loss was due to a number of factors: "challenging pricing, increased 3D XPoint spending, and start-up costs as [Intel ramps] 3D NAND in [its] China factory."

What Intel's CEO has to say

Although the business unit's results in the first quarter were not particularly good (either in terms of revenue or profit), Intel management is actually forecasting growth in this business for 2016.

When questioned by an analyst regarding what Intel sees as driving the "acceleration from the [first quarter] decline," CEO Brian Krzanich replied: "The memory segment, the NAND [flash] segment especially tends to go on these cycles where there's overcapacity in the industry and aggressive pricing, and then it shifts back to more normal pricing, and then tight pricing, which is always very positive." .

Krzanich also went on to say that he believes that Intel has done a very good job of structuring the business in such a way that the company can "ride through" the ebbs and flows of NAND flash pricing "with a high degree of confidence."

Furthermore, Krzanich argues that the company's upcoming 3D NAND technology will give Intel a "real cost advantage" (critical in what is really a commodity market) that will "allow [Intel] to be even more profitable in even these kinds of environments."

Some perspective on Intel's non-volatile memory business

According to the company's recent financial results, its non-volatile memory business did $2.146 billion in revenue and generated $255 million in operating income during 2014. In 2015, revenue grew to $2.597 billion, but operating income actually compressed to just $239 million.

It is likely that even if Intel is able to deliver on its guidance of revenue growth in this segment again in 2016, operating profit will be substantially lower (particularly given the $95 million operating loss in the first quarter).

In order for this business to be worth investing in over the long haul, it is going to need to have a pathway to much-improved profitability. To achieve it, Intel (and its JV partner, Micron) will need to boost their competitive positioning in the marketplace and consistently field best-in-class technologies.

If Intel can pull this off over the long term, it should be able to gain substantial share and grow revenue significantly. However, achieving that technological leadership will be far from easy, and the company may wind up needing to grow its R&D investments substantially over a number of years before it finally sees a payoff.