Intuitive Surgical (ISRG 0.99%) stock started the year with a bang. A first quarter earnings report showing strong growth of procedures performed, and robotic surgical systems shipped were encouraging to say the least, and the stock has risen more than 15% already this year.

Unfortunately, anxiety-ridden investors like me can't get over one big problem with this stock: Its robotic surgical systems are the source of practically all the company's revenue. A better mousetrap from competitors, or any unforeseen mishap for the da Vinci surgical system in the years ahead could result in long-term losses.

Image source: Getty Images.

Jittery investors might want to want to ignore the robotic surgery pure play in favor of Johnson & Johnson (JNJ +0.47%), Roche (RHHBY +0.30%), and Medtronic (MDT +0.26%). Let's look closer at these three large and diverse healthcare companies, and see if they're right for you.

1. Johnson & Johnson: The epitome of long-term safety

Johnson & Johnson practically invented the consumer healthcare goods industry in the 19th century, and it's still going strong. It's brands have taken hits that would have felled lesser companies, but the J&J has increased its dividend for 54 consecutive years.

The company owes its decades of growth to steady diversification from consumer healthcare goods into medical devices, and biopharmaceuticals on the cutting edge of technology. In fact, J&J could become one of Intuitive's competitors in the robotic surgery space.

A joint venture recently formed with Alphabet's life sciences division, Verb Surgical, is miles behind Intuitive in the surgical robotics space. That said, the global leader in machine learning and data analytics, and J&J generated a combined $31.9 billion in free-cash-flow last year. Verb has the resources to become "what's happening" in the years ahead, it's just a matter of execution.

While J&J's surgical robotics future is uncertain, its pharmaceutical segment is producing results in the present. For example, sales of blood cancer therapy, Imbruvica, more than doubled to an annualized run rate of over $1 billion in the first quarter.

I think sales of Imbruvica are just beginning to take off, and could top $5 billion annually. In March the therapy won approval for first-line treatment of the most common form of leukemia, giving newly diagnosed patients an alternative to chemotherapy.

2. Roche: Drugs and diagnostics

This Swiss drug and diagnostics giant was making strides in personalized medicine before the trend had a name. It was 1998 when Herceptin for treatment of patients with tumors showing HER2-overexpression on its diagnostic test first won FDA approval.

Roche has continued advancing the combination of diagnostics and cancer therapies. This year's meeting of the American Society of Clinical Oncology will include results from over 200 studies involving 19 of its drugs!

The company's also made strides beyond cancer into neuroscience with a revolutionary multiple sclerosis treatment, Ocrevus. If approved, I believe it could become the best-selling drug in the space, eventually adding more than $5 billion annually to the company's top-line.

3. Medtronic: The med-tech juggernaut

Medtronic was already big, but following the acquisition of Covidien, it's become a giant in the med-tech space. On this field, economies-of-scale provide an advantage that should keep this company growing for generations to come.

During the three months ended this January, sales of $6.9 billion were 61% higher than the same period in 2015, which ended just ahead of the merger. Profits haven't risen nearly as much, but as acquisition related charges work their way out, they'll follow.

Consider this:

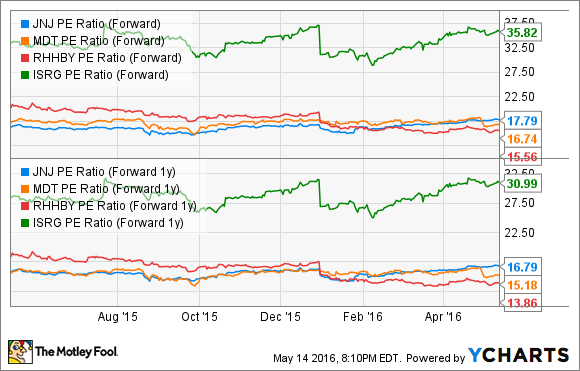

Perhaps the two most important distinctions between these three companies, and Intuitive Surgical is that these three return profits to shareholders, and they're relatively cheap at the moment.

Not only do they return profits, but the amount they return keeps growing. Medtronic has increased its dividend for 38 consecutive years, and last June hiked it by 25% per share. Roche's annual dividend is subject to currency fluctuations, but keeps rising in Swiss Francs. Any way you slice it, it's cash in your pocket, or brokerage account.

Intuitive keeps shoveling all its profits into its growing operations. They are growing, quickly, but its relatively high forward price-to-earnings ratio means any hint of trouble with its da Vinci system in the next several years could leave you sitting on net losses.

These three alternative stocks, can't offer you Intuitive's growth potential, but given their relatively low forward valuations, steady cash flows from diverse revenue streams, and increasing dividends, your chances of losses over the next several years, are slim. Over the long term, your chances of beating the broad market are also pretty good, which makes them much better stocks for us nervous types.