If you own a share of stock in a company, it means that you own an economic interest in the underlying business. But there's more to the story than that. Here's a rundown of what a share of stock is, and what investors should know about how shares of stock work.

What is it?

What is a share of stock in a company?

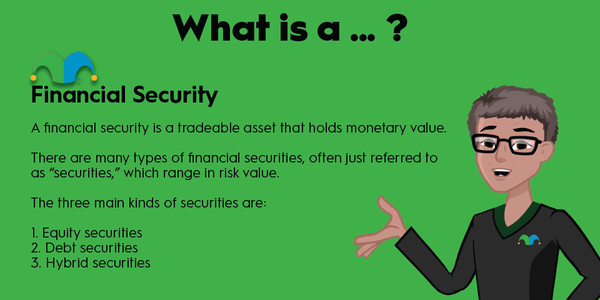

You'll often hear the words "shares" and "stocks" used interchangeably, but there is a difference. The term stock is used to express equity ownership in a business. A stock represents a piece of ownership in a corporation.

On the other hand, a share of stock is a unit of ownership in the business. The number of shares determines how big of a piece of ownership in a business you have. If a company has 100,000 outstanding shares of stock and you own 1,000, you have a 1% equity ownership stake in the company's business.

If a company chooses to pay a dividend, it will be divided proportionally based on the total number of shares that exist. If stock owners have voting rights in corporate affairs, the voting rights given to shareholders are typically dependent on the number of shares you own.

Taking the terminology a step further, a shareholder is an individual who owns shares of stock in a company. This term is often (correctly) used interchangeably with stockholder.

The value of a share of stock depends on several factors, such as the sales, growth, or profitability (or lack thereof) of the underlying business, as well as overall market factors such as the health of the economy, interest rate conditions, and more.

Public vs. Private

Public versus private companies

While the general idea is the same in regard to equity in a business, there are some stocks that trade on the public stock markets and some that don't.

Publicly traded stocks are the most visible. These are companies like Microsoft (MSFT 1.82%) and Coca-Cola (KO 0.0%) whose shares can be bought on major stock exchanges by anyone with a funded U.S. brokerage account. But it's important to understand that privately owned companies have shares of stock as well -- they are just not available for purchase by everyday investors. The process a private company uses to become a publicly traded company, and therefore allow its shares to be owned by everyday investors, is known as an initial public offering, or IPO.

Types

Different types of stock

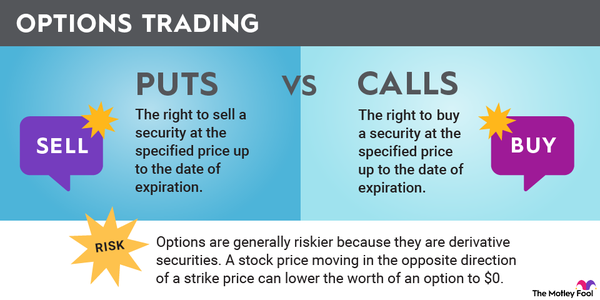

Technically speaking, there are two different types of shares of stock that you could buy -- common stock and preferred stock.

- Common stock: Common stock is what most people think of when they hear the word "stock." Common stock represents an equity ownership interest in a business, as discussed earlier. It's also worth mentioning that there can be different classes of common stock, even among the same company. For example, Alphabet (GOOGL 10.22%)(GOOG 9.96%) has two different classes of publicly traded stock. The difference? One has voting rights when it comes to electing board members and other shareholder votes, and the other doesn't.

- Preferred stock: Preferred stocks work quite differently -- they are more like fixed-income instruments, with a predetermined dividend amount and par value. Unlike with a common stock, preferred stocks don't represent a proportional share of a company's earnings -- no matter what a company earns, preferred shareholders get the same dividend and the intrinsic (par) value of the shares remains the same. Preferred shareholders don't have voting rights, while common shareholders generally do. Preferred dividends are generally superior to common dividends in terms of priority -- if a company is struggling financially, preferred stockholders must get paid before any common shareholders are. Preferred shareholders are higher in priority when it comes to claims on a company's assets in bankruptcy situations.

Related investing topics

Fractional Shares

Do you have to buy a whole share of stock?

Shares of stock are the smallest units of ownership in a company, but they aren't necessarily the smallest units that individual investors can own. In recent years, many brokerages have started to offer fractional shares to their clients, which can especially come in handy with high-priced stocks like Amazon.com (AMZN 3.43%). Without getting too technical, the key point to know is that the brokerage is still buying whole shares, but is essentially selling bits and pieces to its clients. In other words, if three investors wanted to buy 0.1, 0.4, and 0.5 shares of Amazon, respectively, the brokerage would buy one share and allocate it among the investors' accounts, dividing dividends and economic rights proportionally.

The takeaway is that if your brokerage offers fractional share investing, you don't necessarily need to buy a whole share of a stock to get an equity interest in the company.