Stock exchanges are places where people buy and sell shares of stock. Companies agree to have their shares listed for trade on the stock exchanges they choose, and members of each exchange are allowed to trade the stocks listed there.

What are stock exchanges?

A stock exchange functions in some ways like a farmers’ market. There, farmers pay the market to have space to sell their goods. Buyers come to the market because they know they'll be able to buy from many farmers selling a lot of different farm goods. Both farmers and buyers benefit from the market.

The farmers’ market itself doesn't actually participate in the buying and selling of farm goods; its role is simply to provide the space so that farmers and buyers have a place to meet and trade. Similarly, stock exchanges bring together the companies and current shareholders who want to sell stock, and the investors who want to buy stock from them.

Why are stock exchanges useful?

Stock exchanges help individual investors put money to work in the stock market. Typically, brokerage companies that investors use to buy and sell stocks either are members of major stock exchanges or have agreements with exchange members, giving them the ability to buy and sell shares.

Without stock exchanges, interested investors would have to either go directly to the companies whose stock they wanted to buy or find other individuals who owned shares and were willing to sell them. Instead stock exchanges bring together buyers and sellers -- usually without the two parties ever even knowing each other’s identity. Stock exchanges make trading easier, providing what's known as liquidity: a greater ability to buy or sell stock.

Stock exchanges also help companies raise money so that they can grow their businesses. When a company first decides to list its shares on a stock exchange and sell stock to the public in an initial public offering, it typically uses the capital it receives from interested investors to expand its operations, do research and development, raise customer awareness through marketing, or pay for other things critical to long-term growth.

Investors can use stock exchanges to help distinguish healthy, reputable companies from more questionable ones. Stock exchanges have requirements for companies to list their shares. The most prominent stock exchanges set strict listing requirements that are tough for most companies to hit, including minimum figures for outstanding shares, market capitalization, and company income. Investors know that a stock listed on an exchange has met those requirements, and if a stock isn't on the exchange, that’s an indication that an investor ought to find out why.

Companies that list their stocks on stock exchanges also must give investors a lot of information about their businesses. The U.S. Securities and Exchange Commission requires listed companies to make these disclosures, including quarterly and annual financial reports. These reports, along with other important news items disclosed as they occur, help investors know more about the companies in which they want to invest.

How do stock exchanges work?

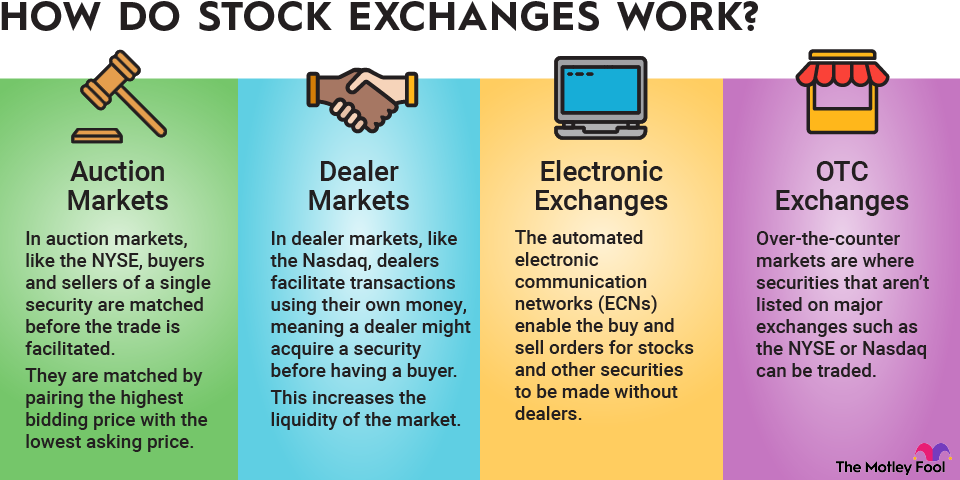

There are two modes of operation that most stock exchanges generally use. Some exchanges have traders physically located on an exchange floor, whose job it is to work directly with each other to buy and sell listed stocks. Historically, this was the primary way most exchanges worked.

More recently, electronic trading has become the most common method for exchange operation. Rather than physical trading floors with traders talking to each other directly, computerized platforms can connect buyers with sellers. Today, many exchanges that used to rely solely on a physical trading floor have incorporated electronic trading capabilities into their operations, using both methods together.

Related investing topics

Important international stock exchanges

In addition to the NYSE and Nasdaq exchanges in the U.S., there's a network of stock exchanges across the globe. They include the Tokyo Stock Exchange in Japan, the Shanghai Stock Exchange in China, the U.K.'s London Stock Exchange, and the Euronext exchange, which serves the European Union.

Companies often choose to list primarily in the country in which they're located, so international stock exchanges can give investors access to companies around the world. However, some companies choose to list their shares on more than one exchange. This practice, known as dual listing, allows investors across the globe direct access to the stock of those companies. In some cases, it also makes it possible to buy and sell their shares around the clock.

Put stock exchanges to good use

You might never visit a stock exchange, but if you buy and sell stocks, exchanges play a vital role in letting you invest. Without these exchanges, it'd be far more difficult to find someone willing to take the other side of your stock trade.