However, adding in dividends changes the equation dramatically. Investors who reinvested their dividends back into the same S&P 500 index fund would have more than $6.4 million at the end of 2024.

Given that much higher return potential, investors should consider automatically reinvesting all their dividends unless:

- They need the money to cover expenses.

- They specifically plan to use the money to make other investments, such as allocating the payments from income stocks to buy growth stocks.

- They don't want to increase their allocation to a particular company or fund.

Dividend reinvestment tax

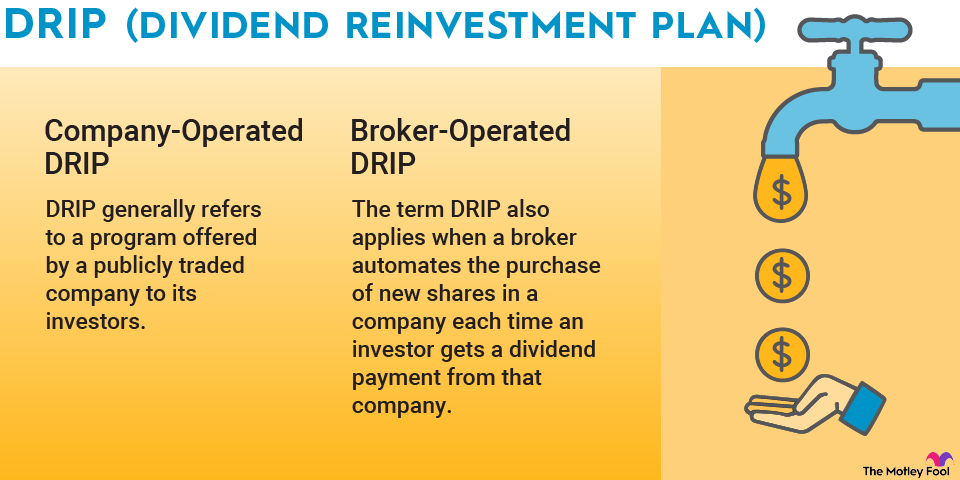

Are reinvested dividends taxable? Sometimes. Cash dividends are usually taxable even if investors reinvest that money automatically through their brokerage account or via the company's DRIP.

However, tax rates can vary significantly depending on the type of dividend paid (qualified or non-qualified) and an investor's taxable income. The tax rate on qualified dividends is 0%, 15%, or 20%, depending on an investor's taxable income and filing status. Meanwhile, the tax rate of non-qualified dividends is the same as the investor's regular income bracket, which ranges from 10% to 37%.

In addition to qualified dividends earned by investors in the lowest income bracket, another type of payout that isn't taxable includes those paid in stock by companies that don't give investors a choice between cash and stock. In such cases, investors usually don't need to pay taxes on the stock dividend until they sell.