A fiduciary is someone who’s legally and ethically bound to put the interests of their client or another person above their own. Typically, a fiduciary manages money, assets, or property for a client or beneficiary. If a fiduciary breaches their duty, they can be held legally liable.

What is a fiduciary?

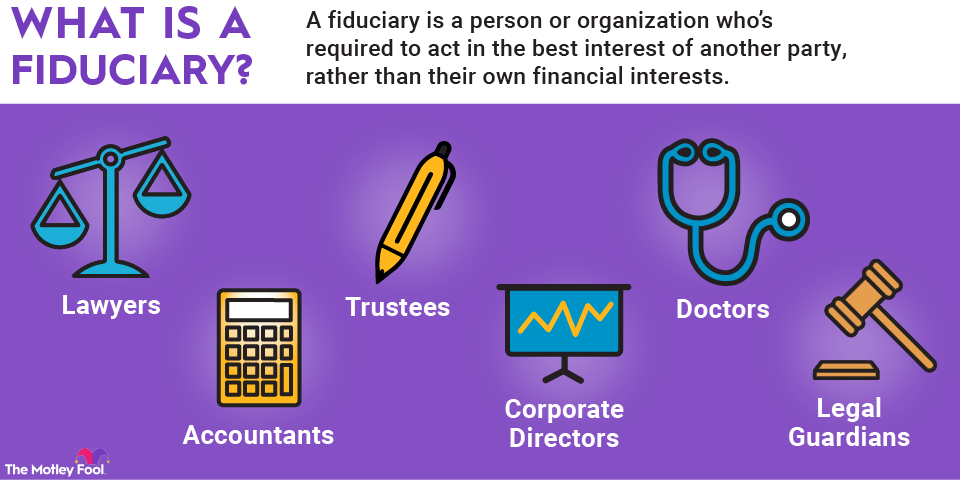

A fiduciary is a person or organization who’s required to act in the best interest of another party, rather than their own financial interests. When you work with a fiduciary, they need to manage your money in a way that meets your needs and goals even if an alternative would be more profitable for them.

For example, suppose a client is working with a fiduciary financial advisor to evaluate two mutual funds. Mutual Fund A is the best fit for the client’s investment goals, but the fiduciary will earn a commission if the client invests in Mutual Fund B.

Steering the client toward Mutual Fund B would be a breach of fiduciary duties because the investment isn’t in the client’s best interest. In this instance, the fiduciary would have also breached a duty by failing to disclose the conflict of interest.

A fiduciary relationship commonly exists when you hire an attorney, a real estate or insurance broker, or one of many types of financial advisors. However, there are some instances when a non-professional may be asked to serve in a fiduciary capacity. This frequently occurs in estate planning. If you agree to be the executor of your parents’ estate or serve as power of attorney for a friend in case they’re unable to manage their affairs, you’ve agreed to serve as a fiduciary.

What does a fiduciary do?

A fiduciary’s responsibilities depend on their role and the nature of the relationship. They may provide advice, negotiate on a client’s behalf, create financial plans, or manage a client’s investments. They may also be responsible for ensuring that a party’s taxes and other debts are paid, particularly if they’re serving as the executor of an estate. A fiduciary is also required to maintain complete and accurate records of transactions.

Generally, a fiduciary has the following duties:

- Duty of care: A fiduciary must make sound decisions based on available information when representing another party. But simply relying on information presented isn’t enough to meet the duty of care in some circumstances. For example, the director of a corporation is required to examine information with a “critical eye” to protect the interests of the corporation and its shareholders. A fiduciary financial advisor may need to seek the expertise of a third party, such as an attorney or certified public accountant (CPA), to meet the duty of care.

- Duty of loyalty: If you’re acting as a fiduciary, you must put the interests of the client or beneficiary ahead of your own. You must also avoid actions that could cause harm to the person or entity you’re representing. A fiduciary who comingles client funds with their own money, misleads a client, or reveals confidential client information is breaching their duty of loyalty.

Fiduciary relationships

In some cases, a fiduciary relationship is established through a contract or a legal document, such as a will or trust. In other circumstances, a fiduciary relationship is implied. For instance, it’s assumed that attorneys and clients or trustees and beneficiaries have a fiduciary relationship.

The following list provides some examples of common fiduciary relationships.

Financial advisors

Some, but not all, financial advisors are fiduciaries. A financial advisor is a generic term that often refers to a broker who isn’t required to act as a fiduciary. The term investment adviser, however, is a legal term that refers to an individual or company who is registered with the U.S. Securities and Exchange Commission and is bound by fiduciary standards. Certified financial planners, or CFPs, are also required to act as fiduciaries.

Attorneys

Attorneys must act as fiduciaries on behalf of their clients. Attorneys must seek the best potential outcomes for their clients whether they’re representing them in criminal or civil matters. A fiduciary breach can occur for a number of reasons, such as if an attorney uses their influence over a client for personal gain.

A non-fiduciary financial advisor has less rigorous obligations. Instead, they’re held to what’s known as the suitability standard, which means that any investment or advice they recommend must be suitable for the investor’s needs. For example, under the suitability standard, a financial advisor can recommend a mutual fund that charges a fee called a sales load that earns them a commission. Ultimately, the fee lowers the client’s returns, but as long as it’s a suitable investment, the recommendation would be allowable even if a lower-cost fund that’s virtually identical is available.

Executors of wills and estates

An executor is a fiduciary who must act in the best interest of the estate. The executor is responsible for ensuring that the estate is distributed according to the deceased person’s wishes while also making sure creditor claims are paid.

Trustees

The role of a trustee varies somewhat based on the type of trust, but a trustee is responsible for overseeing and managing the trust’s assets. The trustee must act on behalf of both the trustor (the person or entity that created the trust) by carrying out their instructions and the beneficiary by acting in their best interest.

Real estate agents

Real estate agents generally have a fiduciary duty to their clients. The duty of disclosure is especially key when an agent represents a client. For example, if the agent is representing a seller, they must disclose all offers, the identity of any potential buyer and their relationship to them, and any information that may affect the selling price. An agent who represents a buyer must tell their client if the seller is willing to accept a lower price, their relationship to the seller, and any facts related to the property value.

Directors of corporations

Corporate directors and officers have a fiduciary duty to both the company itself and its shareholders. Although they’re required to act in the company’s best interest, it’s also expected that directors and officers will take calculated risks, some of which may have negative outcomes.

Retirement plan sponsor

The sponsor of any workplace retirement plan, such as a 401(k) or pension plan, is required to act as a fiduciary under the rules of the Employee Retirement Income Security Act (ERISA). They must comply with plan documents and diversify investments to mitigate the risk of losses.

Related investing topics

The bottom line

In some situations, it’s tricky to determine whether someone is required to act as a fiduciary. So before entering into an agreement with anyone, it’s important to ask about the nature of the relationship. When you’re trusting someone to handle your money or property, you want to be sure they’re acting in your best interests.