| Tuesday's Markets | |

|---|---|

| S&P 500 6,843 (+0.10%) |

|

| Nasdaq 22,578 (+0.14%) |

|

| Dow 49,533 (+0.07%) |

|

| Bitcoin $67,769 (-1.12%) |

|

| Tuesday's Markets | |

|---|---|

| S&P 500 6,843 (+0.10%) |

|

| Nasdaq 22,578 (+0.14%) |

|

| Dow 49,533 (+0.07%) |

|

| Bitcoin $67,769 (-1.12%) |

|

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Wake up to the latest market news, company insights, and a bit of Foolish fun -- all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 a.m. ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

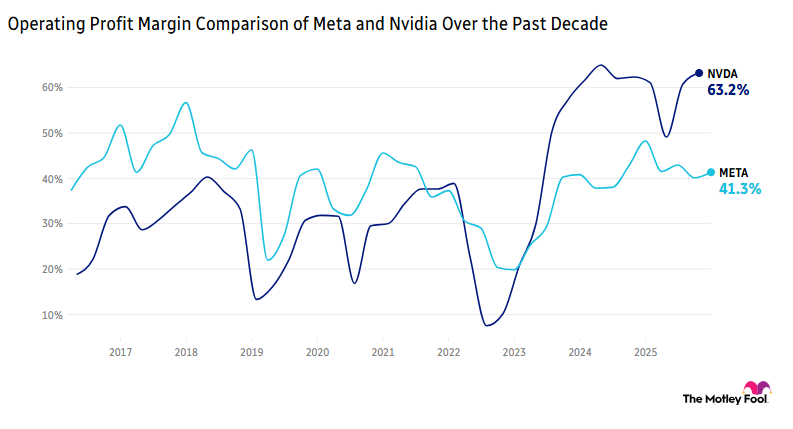

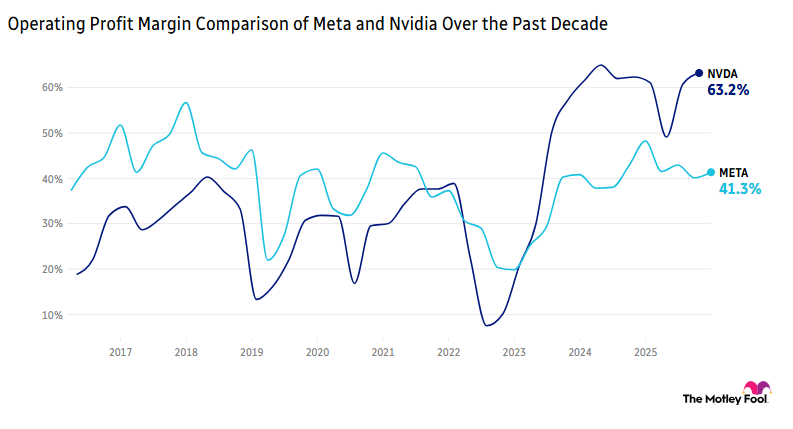

Nvidia (NASDAQ:NVDA) and Meta Platforms (NASDAQ:META) announced a new deal yesterday for Meta to use millions of Nvidia's Blackwell and other chips, plus networking technology, in its data centers and for powering artificial intelligence (AI) offerings. Neither company has revealed the new deal's value, and both saw their share prices edge up slightly in pre-market trading.

Berkshire Hathaway (NYSE:BRKB) sold 75% of its holding in Amazon (NASDAQ:AMZN) in Q4, the company's latest filing reveals, and continued trimming its Apple (NASDAQ:AAPL) stake -- though Apple is still its biggest holding. In Warren Buffett's final quarter as CEO, Berkshire made a new investment in The New York Times (NYSE:NYT) and upped its stake in Chevron (NYSE:CVX).

Garmin's primary business used to be in-car navigation products, though now it has become a diversified designer, manufacturer, and distributor of GPS-enabled products around the world, including marine electronics, avionics, and more.

What other company has "diversified hard" (with a vengeance) and may look like a market beater over the next three to five years from now? And if nothing springs to mind, try asking an AI assistant!

Debate with friends and family, or become a member to hear what your fellow Fools are saying!