Alefia Health (ALEAF +0.00%) has fixed a date for its next quarterly earnings release.

The company announced that it will reveal its third quarter of fiscal 2019 results before market open on Tuesday, Nov. 12. On that day starting at 8:30 a.m. EDT, Aleafia will host a conference call to discuss its performance during the quarter, which ended on Sept. 30. CEO Geoffrey Benic and CFO Benjamin Ferdinand will lead the call.

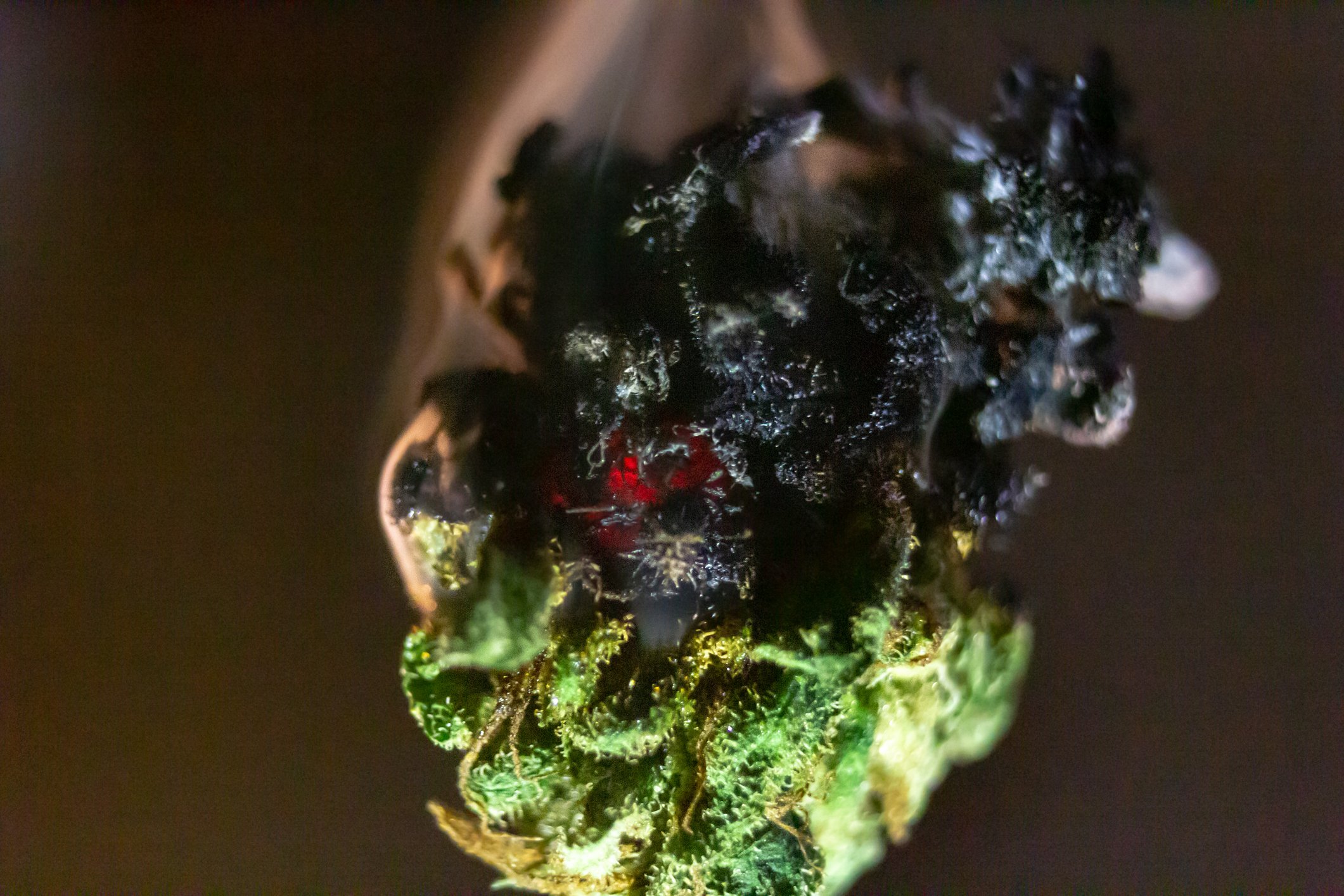

Image source: Getty Images.

This will be a high-stakes quarter for the company. In late September, Aleafia proffered guidance for the quarter, which it is forecasting to be the first net profit in its history. This would represent not only a high-water mark for the company but a rarity among marijuana stocks as a class. Burdened by negative external (supply challenges, to name but one) and internal factors (for instance poor management), cannabis companies frequently and commonly book quarterly net losses.

The positive news was somewhat tempered by the fact that Aleafia did not put a number or even a range on that anticipated net profit. It also didn't offer any number(s) for revenue. It did assert that Q3 "will mark our second consecutive quarter featuring both substantial expense reductions and increased revenues as we continue to drive toward sustainable, compliant growth that will deliver real benefits to our stakeholders."

In that brief guidance note, Aleafia also said it is effectively shifting its business model. "We have, until now been executing on major capital projects which are now either finished or weeks away from completion," the company wrote. "With a strong cash position, we are extremely well positioned to build on the growth experienced this quarter [Q3] on a much greater scale."

Aleafia said its balance sheet is strong, bolstered by roughly $51 million in cash.

Although not as acquisitive as some of its larger rivals, the company has made a number of asset purchases. The one with arguably the most potential is its late 2018 acquisition of, and subsequent merger with, vertically integrated cannabis company Emblem Health in an all-stock deal. That once-independent business is now a fully owned subsidiary of Aleafia.

Emblem was in the news recently, as a supply deal it signed as a stand-alone company with Aphria (APHA +0.00%) was terminated by Aleafia earlier this month. In its press release on the matter, Aleafia wrote bluntly of Aphria's "failure to meet its supply obligations" under a contract in which Aphria was to supply up to 175,000 kilos worth of cannabis product to Emblem across a five-year period.