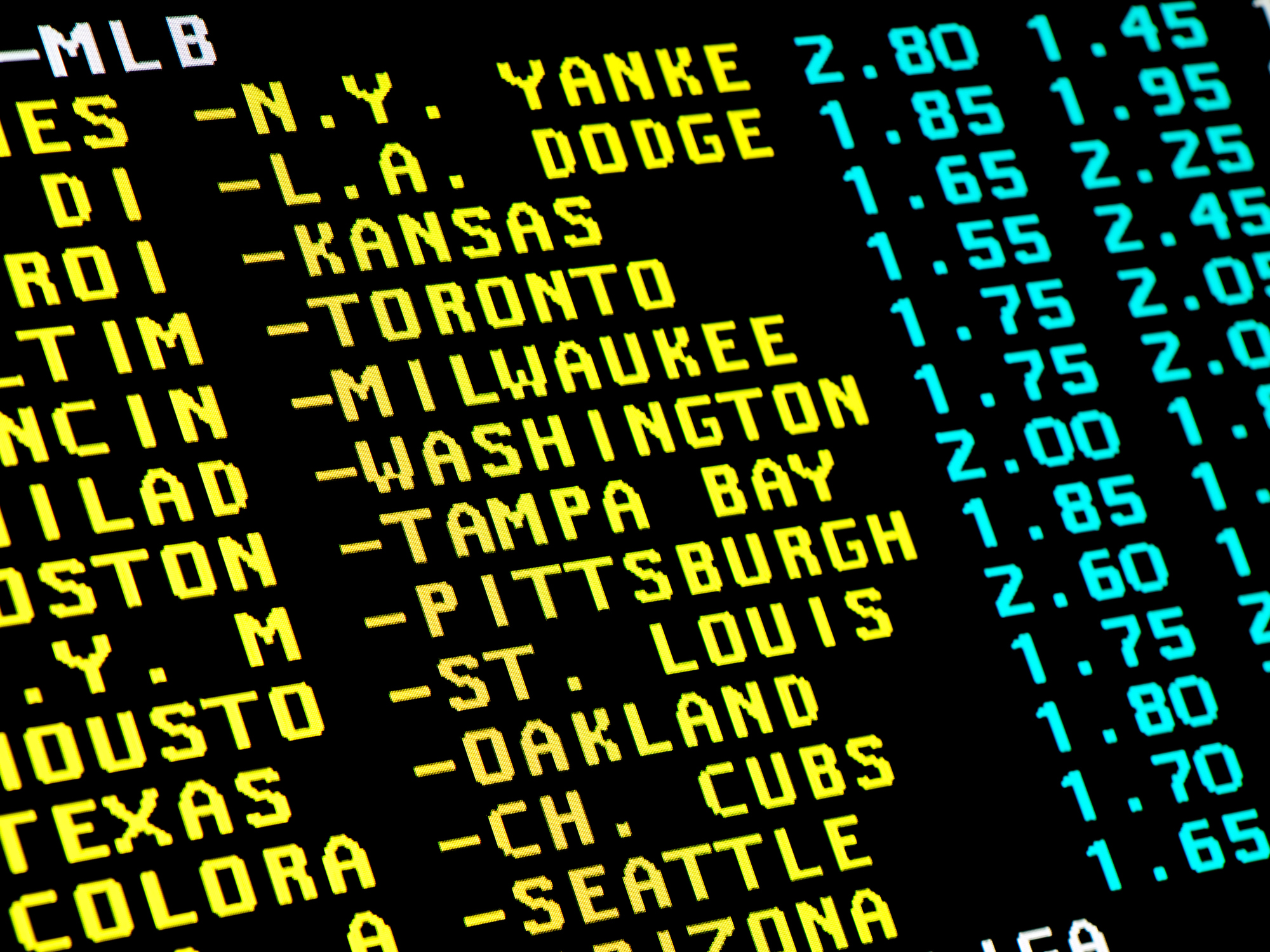

Sports betting has taken off, with sports-focused outfits such as DraftKings competing with casino titans like Caesars and MGM Resorts to attract gamblers.

Since 2018, sportsbooks have generated $47 billion in gross revenue from nearly $555 billion in bets across the 38 states, plus the District of Columbia, where sports betting is legal.

DraftKings, Inc., is the largest company with a sportsbook by market capitalization. The company is a relative newcomer, founded in 2012 as a fantasy sports platform. It has swayed investors with major media partnerships and by quickly launching sportsbooks in legal states after the Supreme Court allowed states to legalize sports wagering in 2018.

Read on for a full report into the biggest sports betting companies.

Key findings

- Flutter Entertainment, the owner of FanDuel, is the largest online sportsbook operator in the U.S. with a market capitalization of $39.2 billion as of Dec. 22, 2025.

- Sportsbooks have earned $47 billion in gross revenue on nearly $555 billion worth of sports wagers since 2018.

- Most online sportsbooks are owned by companies that have other gambling and hospitality operations.

Biggest sports betting companies

Sports Betting Company | Market Cap (as of Dec. 22, 2025) |

|---|---|

Flutter Entertainment (LSE:FLTR; OTC:PDYPF; OTC:PDYP.Y) | $39.2 billion (converted from British Pounds) |

MGM Resorts (NYSE:MGM) | $10.3 billion |

DraftKings (NASDAQ:DKNG) | $17.4 billion |

Caesars Entertainment (NASDAQ:CZR) | $5.1 billion |

Wynn Resorts (NASDAQ:WYNN) | $13.3 billion |

Bet365 | $4.6 billion (converted from British Pounds). (Revenue is for the financial year ending March 31, 2024). |

Penn National Gaming (NASDAQ:PENN) | $2.1 billion |

Rush Street Interactive (NYSE:RSI) | $4.5 billion |

PointsBet (OTC:PBTHF) | $399 million (converted from Australian dollars) |

Caesars Entertainment

Caesars Entertainment, Inc., (CZR +6.42%) manages resorts and casinos branded under Caesars, Harrah's, Horseshoe, and Eldorado. Caesars Entertainment also offers digital gaming, including online sports betting, which it offers in 33 North American jurisdictions.

The company generated roughly $1.3 billion in net revenue from sports betting for the trailing 12 months in the third quarter of 2025 and an adjusted EBITDA of $171 million.

Caesars Digital segment, which includes its online sportsbook and iGaming, posted its first quarter of positive adjusted EBITDA in the second quarter of 2023.

Wynn Resorts

Wynn Resorts, Ltd., (WYNN +4.52%) is a holding company that operates multiple segments in the casino space, including Wynn Interactive, which the online sportsbook WynnBet falls under.

While Wynn Resorts posted operating revenue of $1.8 billion in the third quarter of 2025, Wynn Interactive, which includes its online sportsbook, seems to be a minimal part of the business picture at this point.

In 2023, WynnBet closed in eight of the states it operated in. Then in 2024, it sold its New York sports betting license to Penn Entertainment. It currently appears to have a mobile presence in Nevada and in-person betting at its casino hotel in Boston.

Bet365

Bet365 is a private British online gambling company founded in 2000. The company has sportsbooks in 14 states, Canada, and across Europe and Asia.

While Bet365 is private, it does post some financial information. In the fiscal year ending March 31, 2024, it earned $4.6 billion in revenue, a 9% increase year over year. Sports betting revenue increased 11% during that period.

Penn Entertainment

Penn Entertainment, Inc., (PENN +4.20%) owns and operates casinos across the U.S., plus an online sportsbook. It aimed to shake up the sports betting scene with its acquisition of sports media company Barstool Sports, only to shed ownership of it three years later and reraise with a $2 billion deal with ESPN, rebranding its app as ESPN Bet.

However, in November 2025, Penn and ESPN terminated the agreement, with Penn migrating to theScore platform and ESPN signing a new agreement with DraftKings.

About the Author

Jack Caporal has no position in any of the stocks mentioned. The Motley Fool recommends the following options: long January 2025 $25 calls on Penn Entertainment and short January 2025 $30 calls on Penn Entertainment. The Motley Fool has a disclosure policy.