The biggest day of the year for Social Security's more than 70 million beneficiaries is right around the corner.

With an overwhelming majority of retirees reliant on their Social Security income, in some capacity, to make ends meet, knowing how much they'll receive on a monthly basis in the new year takes on heightened importance. This is where the annual unveiling of the cost-of-living adjustment (COLA) comes into play.

Image source: Getty Images.

What is Social Security's COLA, and when will it be announced?

The COLA you've probably been hearing about frequently in recent weeks is the Social Security Administration's (SSA's) tool designed to counteract the effects of inflation on the program's more than 70 million recipients.

For example, if the collective cost for a broad-reaching basket of goods and services regularly purchased by seniors increases by 4% from one year to the next, Social Security benefits would also need to climb by 4%. Otherwise, recipients would see some of their buying power stripped away. The cost-of-living adjustment is the raise passed along to beneficiaries on a near-annual basis that attempts to account for the inflationary pressures they're facing.

For the last half-century, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) has served as Social Security's measure of inflation -- and, thus, COLA determinant. The CPI-W has more than 200 different spending categories, with each having its own unique percentage weighting. These weightings are what allow the monthly reported CPI-W to be whittled down to a single figure, which makes for simple year-over-year comparisons to determine whether prices have been rising (inflation) or falling (deflation).

But even though the CPI-W is reported monthly by the U.S. Bureau of Labor Statistics (BLS), only readings from the third quarter (July, August, and September) factor into Social Security's COLA calculation.

The BLS reports prior-month inflation data between to 10th and 15th calendar day. Assuming the government shutdown doesn't delay the release of CPI-W data, on Oct. 15, at 08:30 a.m. ET, the BLS will release the September inflation report, which is the final puzzle piece needed to calculate the 2026 COLA. Beneficiaries can expect the SSA's news release announcing the 2026 cost-of-living adjustment to publish by no later than 8:35 a.m. ET.

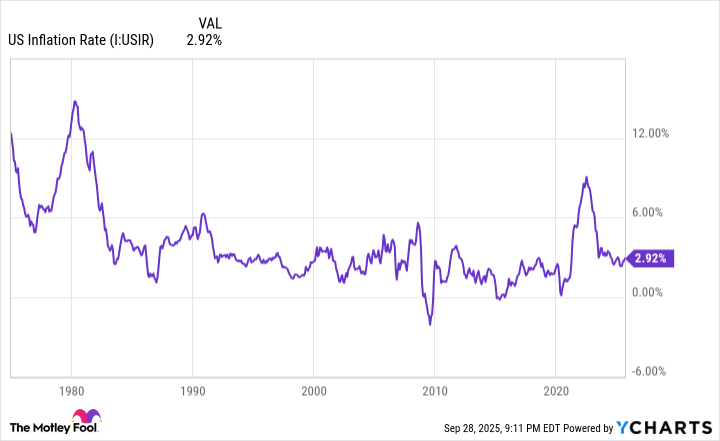

The prevailing rate of inflation and Social Security COLAs have notably increased in recent years. U.S. Inflation Rate data by YCharts.

Social Security's 2026 COLA should be historic -- but don't uncork the champagne just yet

With this much-anticipated announcement rapidly approaching, beneficiaries can start pondering how much their Social Security check will increase due to the effects of inflation in the upcoming year.

In each of the last four years, retired workers, workers with disabilities, and survivors of deceased workers enjoyed some of the most robust cost-of-living adjustments in decades. A never-before-seen spike in U.S. money supply during the COVID-19 pandemic sent the prevailing rate of inflation soaring at its fastest clip in four decades. This resulted in COLAs of 5.9% in 2022, 8.7% in 2023 (the highest on a percentage basis in 41 years), 3.2% in 2024, and 2.5% in 2025.

Following the release of the August inflation report in mid-September, two independent estimates for Social Security's 2026 COLA were updated. Nonpartisan senior advocacy group The Senior Citizens League (TSCL) held firm on its prior forecast that calls for a 2.7% payout bump next year. Meanwhile, Social Security and Medicare policy analyst Mary Johnson inched her previous cost-of-living adjustment forecast up by a tenth of a percent to 2.8%.

If either of these projections hits the mark, it would represent the fifth consecutive year of COLAs meeting or surpassing 2.5%. The last time that happened was a 10-year stretch from 1988 through 1997. That's what makes next year's COLA such a historic event.

Depending on which independent estimate you prefer, the average retired-worker beneficiary can expect their monthly Social Security check to climb by $54 to $56. As for the average worker with disabilities and survivor beneficiary, their monthly payout would respectively rise by $43 to $44 in 2026.

While a historical moment might sound like cause for celebration, beneficiaries would be wise to keep the champagne on ice.

Image source: Getty Images.

Most beneficiaries won't enjoy the full impact of their 2026 cost-of-living adjustment

Even though a 2.7% or 2.8% COLA would come in above the average raise of 2.3% since 2010, a couple of factors are working against Social Security beneficiaries -- specifically, retired workers.

The first issue pertains to Social Security retirees who are also enrolled in traditional Medicare. It's commonplace for dual enrollees to have their Medicare Part B premium automatically deducted from their Social Security payout each month, Part B being the segment of Medicare responsible for outpatient services.

In 2024, Medicare's Part B premium rose by 5.9%. But according to the estimate published in the Medicare Trustees Report in mid-June, the Part B premium is expected to jump by 11.5% to $206.20 per month in the new year. Dual enrollees will see some or all of their 2026 COLA gobbled up by this double-digit percentage increase in Medicare Part B.

However, it's not just dual enrollees who could see the purchasing power of their Social Security income take a hit in 2026.

In July 2024, TSCL published an analysis that compared cumulative COLAs from 2010 to 2024 to the actual inflation seniors faced on products and services they regularly purchase. TSCL found the buying power of a Social Security dollar had declined by 20% since 2010.

The inability of Social Security payments to keep up with the prevailing rate of inflation has to do with inherent flaws built into the CPI-W. It's an index that's tracking the cost pressures that "urban wage earners and clerical workers" are dealing with. This isn't much help when 87% of Social Security beneficiaries are aged 62 and above.

Compared to the average worker, retirees spend a disproportionately higher percentage of their monthly budget on shelter and medical care services. But the CPI-W doesn't take this added importance into account in its COLA calculation. What's more, the trailing-12-month inflation rate for shelter and medical care services has consistently been higher than the COLAs passed along to beneficiaries.

Although the big day for Social Security beneficiaries is almost here, there may not be much to celebrate.