Under normal circumstances, this would be the most-anticipated week of the year for the more than 70 million traditional beneficiaries currently receiving a monthly Social Security payout.

The U.S. Bureau of Labor Statistics (BLS) had been scheduled to release the September inflation report on Oct. 15 at 08:30 a.m., ET, which is the final puzzle piece needed for the Social Security Administration (SSA) to announce the 2026 cost-of-living adjustment (COLA). But due to factors beyond the SSA's and BLS's control, which I'll touch on in a moment, this highly awaited reveal has been delayed.

If you're a retired worker, worker with a long-term disability, or a survivor of a deceased worker who's currently receiving monthly Social Security income, here's the rundown of everything you need to know about this delay, the new inflation report release date, and what to expect when the 2026 COLA is announced.

Image source: Getty Images.

Why the delay?

Social Security's "COLA" is the tool the SSA leans on in an attempt to keep program beneficiaries from losing buying power. Hypothetically, if the cost for a broad swath of goods and services regularly purchased by program recipients rose by 4% from one year to the next, benefits would need to rise by the same percentage to ensure the same amount of goods and services can be purchased the following year. The cost-of-living adjustment is effectively a "raise" in monthly benefits designed to mirror the effects of inflation.

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) has been Social Security's cost-tracking tool since 1975. Though the CPI-W reported as a single figure on a monthly basis, which makes for easy year-over-year comparisons to determine if prices are, collectively, rising (inflation) or falling (deflation), only readings from the third quarter (July, August, and September) factor into the COLA calculation.

On Oct. 1, a federal government shutdown began due to the inability of elected officials in Congress (specifically the Senate) to pass federal funding legislation. While a government shutdown doesn't impact the ability of the SSA to dole out monthly benefits, it does halt/delay the reporting of most economic data, including the monthly inflation report from the BLS.

The government shutdown is directly responsible for this temporary delay in the 2026 COLA announcement.

There's a new release date for the September inflation report

The good news is that even if the federal government shutdown persists, the BLS has laid out a new reporting date for the September inflation data.

According to information obtained by CNBC, the BLS is bringing back some of its workers to compile the necessary pricing data to report the Consumer Price Index for All Urban Consumers (CPI-U) and the CPI-W on Friday, Oct. 24, at 08:30am, ET -- nine days after this data was originally to be released.

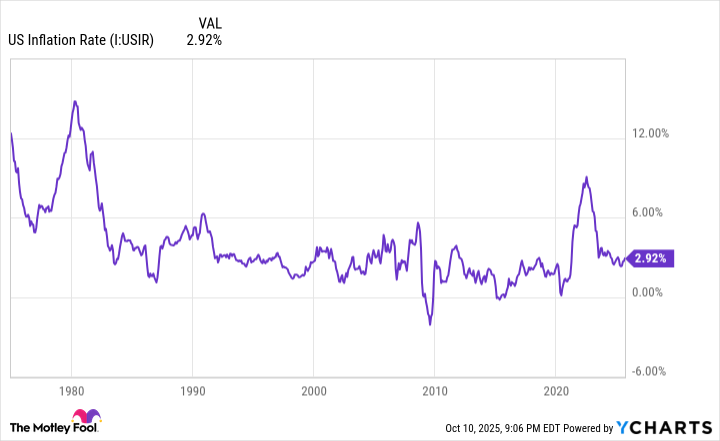

An uptick in the prevailing inflation rate lifted Social Security COLAs in recent years. US Inflation Rate data by YCharts.

The SSA may not reveal the 2026 COLA immediately -- but you can calculate it yourself (with ease)

Normally, the SSA publishes its Social Security Fact Sheet mere minutes after the release of the BLS September inflation report. This two-page online document lays out the COLA for the upcoming year, as well as a laundry list of other changes, such as the maximum taxable earnings cap, maximum monthly payout at full retirement age, and withholding thresholds tied to the retirement earnings test, to name a few.

While the SSA will announce the 2026 COLA on Oct. 24, it's not clear if it'll be reported as expeditiously as it usually does.

The good news is you'll be able to easily calculate your 2026 "raise" using data we already have (which is outlined below) and a single figure from the upcoming September inflation report.

To calculate Social Security's 2026 COLA, the average CPI-W reading from the third quarter (Q3) of the current year is compared to the average Q3 CPI-W reading from 2024. If the current-year average is higher, inflation has occurred and beneficiaries will see their benefits climb. The year-over-year percentage difference, rounded to the nearest tenth of a percent, equals next year's COLA.

In 2024, the July, August, and September CPI-W readings were 308.501, 308.640, and 309.046, respectively, which averages out to 308.729.

Meanwhile, the July and August CPI-W readings from the current year are 316.349 and 317.306, respectively. Once the CPI-W is reported for September, you'd add it, 316.349, and 317.306, and divide by 3 to get the 2025 Q3 average CPI-W reading. Subtract the average Q3 2024 CPI-W reading (308.729) from the average Q3 2025 CPI-W reading, then divide this remaining number into the average Q3 2024 CPI-W reading (308.729), multiply by 100, and round to the nearest tenth of a percent. That'll be the 2026 cost-of-living adjustment -- and you won't have to wait to hear about it from the SSA.

Social Security's 2026 cost-of-living adjustment will be historic

Based solely on independent estimates, Social Security raises for the upcoming year are expected to do something that hasn't been witnessed since 1997.

According to nonpartisan senior advocacy group The Senior Citizens League (TSCL), payouts are forecast to climb by 2.7% in 2026. Meanwhile, independent Social Security and Medicare policy analyst Mary Johnson foresees benefits rising by 2.8% in the new year.

While a 2.7% or 2.8% benefit increase may not sound historic, it would mark the first time this century, and 29 years in total, since program recipients enjoyed five consecutive years with COLAs meeting or surpassing 2.5%. The last time this happened was 1988 through 1997, when COLAs clocked in between 2.6% and 5.4% each year.

If the assumption is made that TSCL or Johnson are correct with their forecasts, the average retired-worker beneficiary would see their payout climb $54 to $56 per month next year. As for the average worker with disabilities and survivor beneficiary, their monthly Social Security income would each rise $43 to $44, respectively.

Image source: Getty Images.

The wait is unlikely to be worth the reward

Despite the expected historic nature of the 2026 COLA, which is being lifted in part by President Donald Trump's tariff and trade policy, the delay in its announcement is unlikely to be worth the reward for most retirees.

For starters, COLAs haven't been doing a particularly good job of keeping up with the actual inflation seniors are contending with. This is a reflection of the inherent flaws built into the CPI-W.

This is an index that tracks the cost pressures faced by "urban wage earners and clerical workers," who in most cases are working-age Americans not currently receiving a Social Security benefit. In comparison, 87% of Social Security recipients were age 62 and above, as of December 2024. Retirees and urban wage earners-clerical workers have very different inflationary concerns.

Retirees tend to spend a higher percentage of their monthly budget on shelter and medical care services, compared to the average worker. Not only is the added importance of these two spending categories not being factored into the CPI-W, but the trailing-12-month inflation rate for these two spending categories has been consistently higher than the COLAs passed along to beneficiaries.

Long story short, the purchasing power of Social Security income for retirees will likely decline in 2026.

Were this not enough, Social Security beneficiaries enrolled in traditional Medicare will see some or all of their COLA get gobbled up by a projected double-digit percentage increase in next year's Part B premium.

Part B is the portion of Medicare responsible for outpatient services, and its premium is commonly deducted from the monthly payout of Social Security beneficiaries. With the 2025 Medicare Trustees Report estimating an 11.5% increase in the Part B premium to $206.20/month in 2026, it's likely that dual enrollees will get the short end of the stick, yet again.