Social Security is the backbone of many Americans' retirement plans. A growing percentage of non-retirees expect the government program to provide a major source of income in retirement. Thirty-seven percent said as much in an annual Gallup poll this year, up from 25% to 28% of respondents saying the same in the mid-2000s.

The realty is that many more actually rely on Social Security than expected with over 60% of retirees citing it as a major source of income this year.

Unfortunately, for the millions of retired and soon-to-be-retired Americans, the program finds itself on shaky footing. The Board of Trustees estimated the program could deplete its trust fund by 2033. New legislation passed by Congress earlier this year actually accelerated that timeline. Social Security's chief actuary now says the country is just seven years away from depleting the trust fund in late 2032. At that point, Social Security is required under current law to reduce payments for all beneficiaries.

And one hidden cost could make things even worse for retirees.

Image source: Getty Images.

The big drain on Social Security

Social Security stands apart from most other government programs in that its main source of funding comes from a special tax assessed on wages. It also collects any income taxes assessed on monthly benefits. Any tax income that it doesn't pay out in benefits goes into a trust fund. The trustees invest the excess cash in safe government bonds, earning a small amount of interest on the balance.

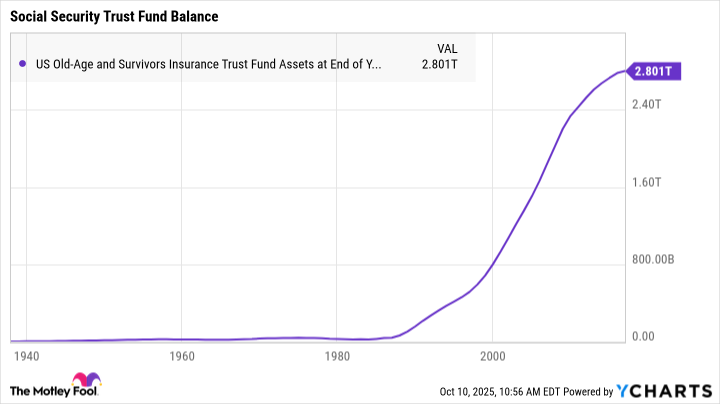

For a long time, Social Security collected much more in revenue than it paid out in benefits. A growing working population (baby boomers) and rising real wages (economic expansion) led to a huge influx of cash into the trust fund. By the end of 2017, the Old-Age and Survivors Insurance Trust Fund held over $2.8 trillion in assets.

Data by YCharts.

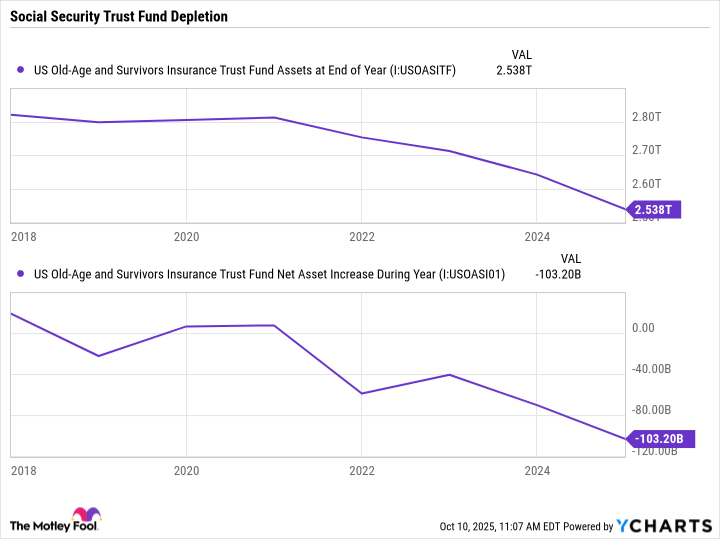

But baby boomers are now retirement age and younger generations aren't having as many kids. What's more, the average lifespan continues to improve nearly every year, and retirees are collecting benefits for longer.

Those shifts combined with other smaller factors like a growing wage gap and a decrease in working-age immigration, and Social Security has paid out more than it brought in during each of the last four years. The fund's assets sat at $2.5 trillion at the end of 2024, and the trustees expect 2025 to end with just $2.3 trillion in the trust.

Data by YCharts.

The balance will dwindle down to $0 by late 2032. That's accelerated by the passage of new tax legislation this year, which will decrease the amount of income tax revenue collected on Social Security benefits.

Once the trust fund is depleted, Social Security is only allowed to pay out as much in benefits as it collects in revenue. The Board of Trustees estimated it'll have to cut benefits by 23% in its most recent report.

But there's an additional hidden cost that makes those potential cuts sting even more.

The growing expense coming out of your benefit payments

About 69 million Americans are enrolled in Medicare, the government-sponsored health insurance program. For most of those also receiving Social Security payments, their Medicare Part B premiums are deducted directly from their monthly benefits. Many don't even realize the expense comes out of their monthly payment, with just 57% of respondents correctly stating Medicare premiums are deducted from Social Security checks in a recent Nationwide Financial Survey.

Unfortunately, Medicare is set to increase the monthly premium it charges over the next few years. Next year's standard premium is set to go up to $206.50 per month, up 11.6% from last year. By 2034, the Medicare Trustees estimate the standard premium could climb to $347.50. Here's how that breaks down by year.

| Year | Part B Premium Estimate |

|---|---|

| 2026 | $206.50 |

| 2027 | $218.60 |

| 2028 | $231.30 |

| 2029 | $247.40 |

| 2030 | $264.70 |

| 2031 | $281.60 |

| 2032 | $300.80 |

| 2033 | $325.90 |

| 2034 | $347.50 |

Data source: Centers for Medicare & Medicaid Services.

That's an average increase of 7.3% per year. It's very unlikely Social Security beneficiaries see annual cost-of-living adjustments (COLAs) coming close to that level over the next nine years. And with the potential benefit cuts coming in 2032, it'll hurt seniors even more.

The growing insurance premiums are partially a result of the same demographic shifts negatively impacting Social Security. There's a growing senior population, and they're living longer. On top of that, healthcare costs continue to rise far faster than overall inflation. As a result, Medicare is seeing higher utilization rates and experiencing higher costs, which leads to higher premiums.

When combined with the potential for benefit cuts early next decade, the rising cost of Medicare could become a huge burden on many senior households. Unless Congress acts to change Social Security, improve its health, and ensure its longevity, many will see their budgets severely reduced over the next seven years.