Source: American Advisors Group via Flickr.

Everyone wants the "dream" retirement, and if you save and invest enough, you have a great shot at achieving financial independence. However, as more and more of us can expect to live past 80, there's an increasing likelihood that you or your spouse will need long-term care at some point in your life. The scariest data? Less than one-third of those over 50 are saving for long-term care.

According to the U.S. Department of Health and Human Services, 70% of people over 65 will need long-term care at some point. And by 2020, 20% of America's population will fall in age group -- we're talking about 50 million people who will likely need long-term care. There's a good chance you'll be one of them.

I spoke with life insurance industry expert and CEO of AccuQuote, Byron Udell, about this, and he had some insight. Let's take a closer look at this issue, because it's worth understanding the potential consequences and knowing what you can do to prepare yourself and protect your legacy.

Common misconceptions about long-term care

Given the odds that you'll need long-term care at some point, it's important that you don't share any of the common misconceptions about long-term care. Here are three myths you should be aware of:

- "I can access care from Medicaid." The reality is, as Udell put it, "For those who have no money, they don't need any sort of 'policy,' as Medicaid will pay for it for the indigent. But you truly have to be broke."

- "My home is protected." According to the Department of Health and Human Services, most states have home equity limits, and they will go after your estate to collect on long-term care expenses.

- "I'll just pay for it with my retirement savings." If you've done well and built up a substantial nest egg, maybe that's the case. However, the median non-home equity net wealth for homeowners over 50 was $117,000 in 2010, and long-term care can cost far more than that. From Udell:

Long-term care is currently $200 to $300 per day or more (in larger urban markets) and it's going up at 5% yearly. Do the math on that, and understand that if you don't need care for another 25 years, the daily rate could be $600 to $800 per day or more. That could easily wipe out your entire legacy. It's definitely worth planning for.

Do the math based on today's costs, and the typical saver could wipe out half their savings in about a year.

What you can do to prepare for it

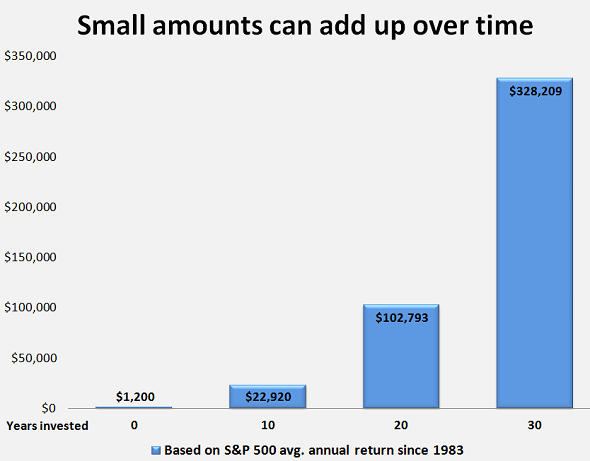

As a starting point, building up your nest egg makes sense. If you have a decade or more before retirement, even a small amount of money can grow quite large. The table below shows how $100 per month invested over the past 30 years would grow, based on the real-world return of the S&P 500 since 1983.

Even a lower rate of return -- say, 8% annualized (about 50% lower than the actual average since 1983) would turn $100 per month into $159,000. Long-term investing is a great way to build a safety net.

However, many people closer to retirement should consider an insurance alternative. Udell had this to say on the subject:

I chose to fund the liability using a rider on one of my life insurance policies, that allows me to access the DEATH BENEFIT for long term care if I ever need it. Nice thing about this way of doing it is: 1) my premiums are guaranteed for life (unlike traditional LTC policies that can and do go up any time the carrier pleases); 2) there is no elimination or "waiting" period (typically 90 days of rendered care before any benefits can be paid); and lastly, 3) if it turns out that I die suddenly one day, never having needed any care, my kids will get the money... my premiums will not have gone to waste.

In short, a hybrid approach to long-term care, using your life insurance policy to cover care might be an alternative for you.

Looking ahead

The best thing any of us can do is start planning and building as large of a financial cushion as we can, as early as we can. For those of us who haven't been able to do so, there are alternatives out there. Talk to an insurance professional and visit the HHS long-term care website to start learning about your options. Don't put it off any longer.