There's a chance that by saving a ton in your retirement account, you're inadvertently costing yourself money.

Before you read any further, do a quick check:

- Take your salary.

- Find the percentage of your salary you contribute to your 401(k).

- Multiply them.

Is the number less than $18,000? Then you're good -- for now.

Some high savers, anxious to tuck away pre-tax dollars into their 401(k) accounts, hit the IRS's annual deferral limit prior to receiving the entirety of their employer's match, leaving "free money" on the table.

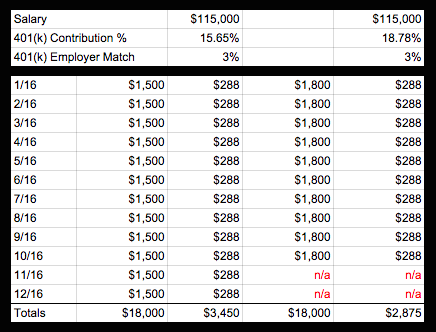

As an example, let's take an employee who makes $115,000 and works at a company that matches 50% up to 6% of contributions. If that employee contributes 6% or more, they should receive $3,450 in their retirement account from their employer in matching.

But if they set their deferral percentage higher than 15.652%, they might miss out on a portion of the match they are entitled to. How?

Here's a look at the contributions over the course of the year at two different rates. In both situations, the employee personally contributes $18,000, but at a deferral percentage of 18.78%, they cost themselves more than $500 in employer matching.

That's why running the numbers on your contribution schedule is important, particularly if you get a raise, adjust your deferral percentage, or switch jobs (maybe getting a pay bump in the process) and are planning on using the same contribution percentage you had previously used.

If you do hit the IRS cap early, some employers will still honor the entirety of the match through a "true-up" provision. The true-up looks at what an employee should have received based on their contributions, and if it's less that what they actually received, the company adds difference to their retirement account. If you find yourself in this situation, talk to the payroll and benefits folks at work and see if it is an option.

As a preventative measure, if you're within striking distance of the IRS's annual pre-tax deferral limit, most retirement plans allow you to denominate your per paycheck contributions in actual dollars rather than as a percentage of your income.

Switching over to this method would keep your deferrals at a set value, so you wouldn't have to remember to revisit your 401(k) strategy each time you get a raise. However, if you elect to use this approach and want to continue to max out your allowable pre-tax retirement contributions, you want to check in at the end of each year to be sure your set dollar contributions reach the new deferral limits set by the IRS.