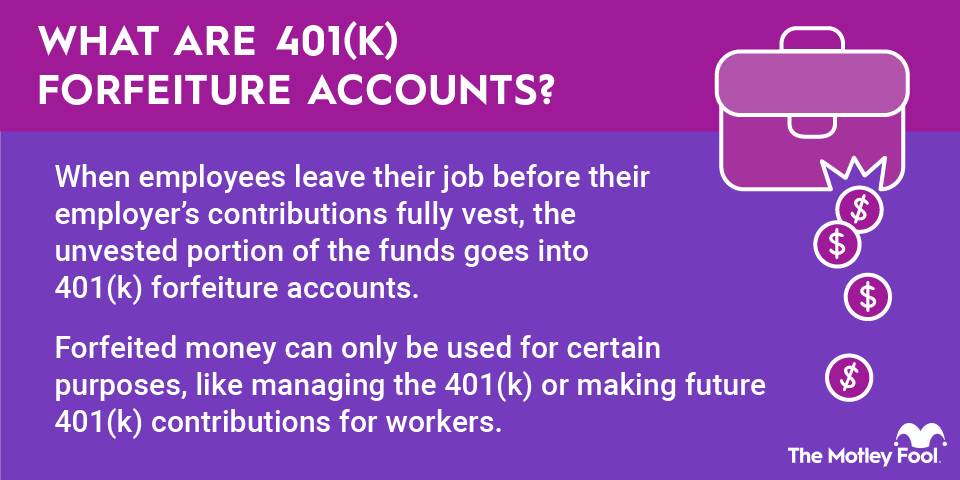

A 401(k) forfeiture is when you lose the unvested portion of your 401(k) balance. Contributions you made are 100% yours, but contributions your employer made are only yours once they're vested. Since a 401(k) forfeiture can be a sizable loss, it's important to know how it works and how to avoid it.

Understanding 401(k) forfeiture

Many employers offer their employees a 401(k) company match. For example, your employer may match your contributions dollar-for-dollar on the first 3% of your salary and then $0.50 for every $1 on the next 3%. If you put money into your 401(k), the balance will include both your contributions and those made by your employer.

Your employer will have a vesting schedule for the contributions it makes. The money isn't completely yours right away. It needs to vest first, meaning you must complete a minimum amount of time with your employer.

If you leave or lose your job, you will forfeit any unvested funds, which go into a 401(k) forfeiture account. Employers can use money in 401(k) forfeiture accounts only for certain types of expenses and within a set time frame.

401(k) vesting schedules

The Internal Revenue Code provides minimum vesting schedules that employers must follow. There are two options: cliff vesting, where you become 100% vested all at once, and graded vesting, where you gradually become vested over time.

Under cliff vesting, employees must become 100% vested after three years of service at most. The minimum vesting schedule for graded vesting is in the table below.

Full Years of Service Completed | Amount Vested |

|---|---|

Less than 2 years | 0% |

2 years | 20% |

3 years | 40% |

4 years | 60% |

5 years | 80% |

6 years | 100% |

Employers can choose a faster vesting schedule but not a slower one. For example, an employer could fully vest contributions immediately or go with graded vesting, where you become 25% vested every year for four years. But an employer couldn't set up a four-year cliff vesting schedule or an eight-year graded vesting schedule, as these would exceed the minimum requirements.

How to avoid 401(k) forfeiture

The only requirement to avoid forfeiting employer 401(k) contributions is to stay at your job long enough to become fully vested. You can learn about your employer's vesting schedule in the documents for your 401(k) plan.

Make sure to review how many years of service it takes to become fully vested and how your employer defines a year of service. Employers may go by calendar year or anniversary year, and a year of service typically requires a minimum number of hours, such as 1,000 hours worked during the year.

Unfortunately, unvested contributions are normally forfeited if you're fired or laid off. But if a company has a turnover rate of 20% or more, that generally qualifies as a partial termination of the 401(k) plan, which requires fully vesting contributions. So, in the event of a mass layoff at your company, you may be fully vested if you're one of the people let go.

Related investing topics

Example of how 401(k) forfeiture works

Let's say you make an $80,000 salary and contribute 4% ($3,200) to your 401(k). Your employer matches that 4%, adding another $3,200 per year. It has a six-year graded vesting schedule, where 20% of its contributions vest per year, starting in year two.

By year four, you would have $25,600 in contributions, with half coming from you and half from your employer. You'd also be 60% vested in your employer contributions.

If you quit your job, you'd keep your $12,800 in contributions and the $7,680 in contributions your employer made, totaling $20,480. The remaining $5,120 in employer contributions would go into the company's 401(k) forfeiture account. To keep the entire amount, you would need to complete at least six years of service.