A defined benefit plan is an employer-sponsored retirement plan that provides you with a guaranteed payout in retirement if you're an employee. It's an alternative to a defined contribution plan, which gives you more control over account contributions as an employee but also requires you to take on more risk. With a defined contribution plan, you're not guaranteed a specific benefit in retirement; your account's value depends on how much you contribute and how your investments perform.

Defined benefit plans have fallen out of favor because they are more costly for employers. However, you can still find them with public agencies, government jobs, and some for-profit companies. Here's a closer look at how this type of qualified retirement plan works and how it stacks up against the more common defined contribution retirement plans.

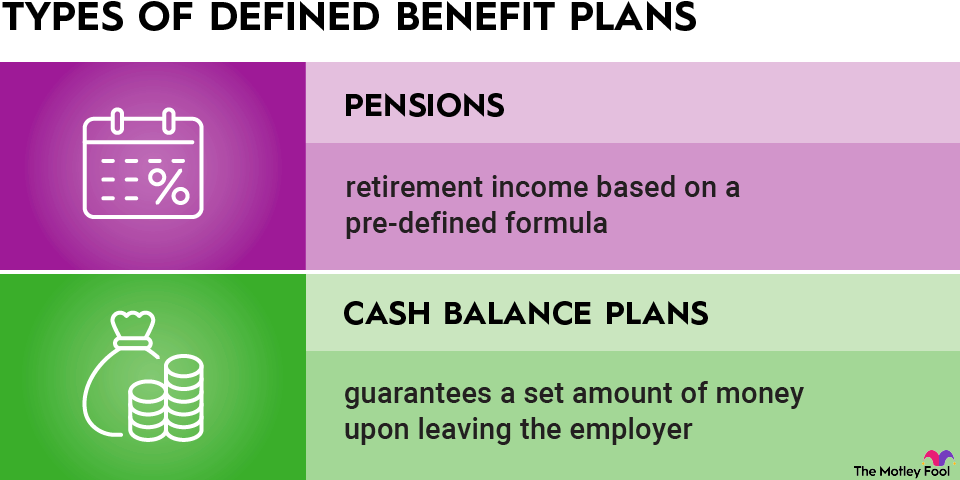

Types of defined benefit plans

There are many types of defined benefit plans. They include:

- Pensions: These provide retirement income based on a pre-defined formula. Generally, the formula factors in your years of service with the employer, as well as total earnings. Once an employee reaches a certain age specified by the plan, they begin receiving payouts that typically continue until their death. Some pensions also allow for benefits to transfer to a spouse or other beneficiary once the employee dies.

- Cash balance plans: These guarantee employees a set amount of money upon leaving the employer, rather than a guaranteed monthly income. Years of work with the employer typically determine the amount an employee will receive.

Employers take on the investment risk with defined benefit plans, as well as the responsibility for making and managing employee contributions. These plans substantially differ from defined contribution plans such as 401(k)s, which do not guarantee employees will receive any set amount of funds upon retirement. A lifetime income guarantee makes defined benefit plans desirable for employees but risky for employers.

Defined benefit plan example

Every defined benefit plan will have its own formula for calculating benefits. In one formula, employers pay a set dollar amount -- such as $100 per month in pension funds -- for every year an employee worked for the company. That would mean an employee who retires after working for 10 years would receive $1,000 in monthly benefits from the pension plan.

More commonly, your employer could also base your payout on your average income during your time of employment or your final average salary (often the average of your last five years of earnings). These formulas often use a salary multiplier to determine payouts.

For example, suppose you earned $50,000 per year, or about $4,167 per month on average. You worked for 30 years, and your pension has a 2% salary multiplier.

Your pension plan would pay you 60% of your average monthly income (30 years of service x 0.2 = 0.6).

You'd receive a monthly benefit of $2,500 ($4,167 x 0.6).

Defined benefit plan rules

Defined benefit plans don't usually require employees to contribute any funds to the plan. Instead, they are funded by the employer. However, some defined benefit plans may have voluntary or required employee contributions. Since employers manage and make contributions, they get to decide who qualifies for the plan and when and how you receive your payout -- but they must operate within U.S. Internal Revenue Service (IRS) and ERISA, or Employee Retirement Income Security Act of 1974, guidelines.

Pension plans can have vesting schedules, just like 401(k)s or other employer-sponsored retirement plans that offer matching contributions. If you leave your job before you're fully vested in the plan, you'll forfeit some or all of your pension.

Each company sets its own vesting schedule. However, if you don't think you're going to be with your employer for more than a few years, you may get more benefit from a 401(k) than you would from your company's pension plan. That's because you could contribute to your 401(k), invest the funds, and take your account balance with you after leaving (minus any employer matching contributions that hadn't yet vested).

You typically can't withdraw funds from your pension plan before the plan's normal retirement age, often age 65, but the exact age you may begin distributions will vary by plan. Some plans permit participants who are not yet eligible for distributions to take loans from their pension plans if they need cash, but, just like with 401(k) loans, it's up to employers decide whether to allow this.

Your employer also dictates how it distributes benefits to you, within IRS and ERISA guidelines. Most pensions provide a regular monthly payment for the rest of your life. This is similar to an income annuity that offers a guaranteed monthly income, but the money comes from an employer rather than from an insurance company.

However, some employers give employees a lump sum instead. You may owe taxes on distributions, depending on how your plan is structured, so a lump sum might not be the most desirable payment method because it could raise your tax bill considerably for that year.

Your employer should provide you with details about these rules and other important pension terms so you know what to expect. If you have any questions about the plan, direct them to your company's HR department.

Defined benefit plan pros and cons

There are some significant benefits of defined benefit plans for employees:

- You'll receive guaranteed income: You won't have to worry about your investment account running dry during your lifetime. And, in some cases, a spouse or designated beneficiary may even be entitled to continue receiving part or all of your pension after you die.

- Your employer takes on the investment risk, not you: Your employer guarantees you a set amount of money and must provide it. If the money they contribute and invest isn't enough, they still have to provide pension funds. Most pension plans are also covered by a federal guarantee, so you still get your pension funds if your employer is unable to pay as promised.

- Your employer manages and makes contributions for you: You don't have to decide how much to contribute or where to invest your retirement funds.

There are also some disadvantages:

- Defined benefit plans are becoming rare: It can be difficult to find a position that provides one, especially in the private sector.

- You have less control over how much money is contributed or how much you receive in retirement: With a 401(k) or defined contribution plan, you decide how much to invest throughout your career, and you determine your withdrawal schedule (as long as you comply with required minimum distribution rules). You have much less control over when and how you become eligible for pension funds or when you receive your money.

- You may need to work for your employer for a long time to receive significant pension income: If you tend to job-hop, you may not become fully vested in a company's pension plan or you may receive only a small monthly amount.

Related retirement topics

Defined benefit plan vs. defined contribution plan

Defined benefit plans provide a predetermined payout. Defined contribution plans require or permit employees, and sometimes employers, to make contributions up to an annual limit. The actual payout in retirement depends on how much participants choose to contribute and how their investments perform. Common types of defined contribution plans include the 401(k) and the 403(b).

Defined contribution plans shift more of the savings burden to the employee, and that makes these types of retirement accounts less risky and less expensive for employers. That's why we've seen defined contribution plans rise in popularity over the past few decades while defined benefit pension plans have fallen out of favor.

Employers may still contribute money to defined contribution plans, but this often takes the form of a company match, where the employer will only contribute money if the employee does so first. Even then, employers will generally only contribute up to a certain amount.

Both types of plans can help you save for retirement, and some employers may enable you to have one of each so you can make personal contributions to your defined contribution plan while your employer contributes to your pension plan.

Whichever type of plan you are offered at work, make sure you understand all of its rules so you can get the most out of it. If your company offers a pension plan, ask about how it calculates your payout, its vesting schedule, and whether you'll receive money as a lump sum or a monthly payment so you can plan accordingly.