You can choose to retire whenever you want. However, considering what your finances will look like after you retire is a smart way to approach your decision.

With that in mind, here's a guide to some of the biggest concerns to keep in mind as you decide when you'll be able to comfortably retire.

Will you have enough income after you retire?

This is the No. 1 question that will determine whether you're ready to retire. Despite the popular misconception that you need to aim for a specific dollar amount in savings (like $1 million), the real question is how much income you'll have.

In other words, someone who has a large monthly pension but little in savings might be in better shape than someone with a few hundred thousand in the bank.

The average American should expect to need about 70%-80% of their pre-retirement income to sustain the same quality of life after retirement. The percentage can be higher or lower depending on your particular retirement vision, but this rule of thumb is a good starting point.

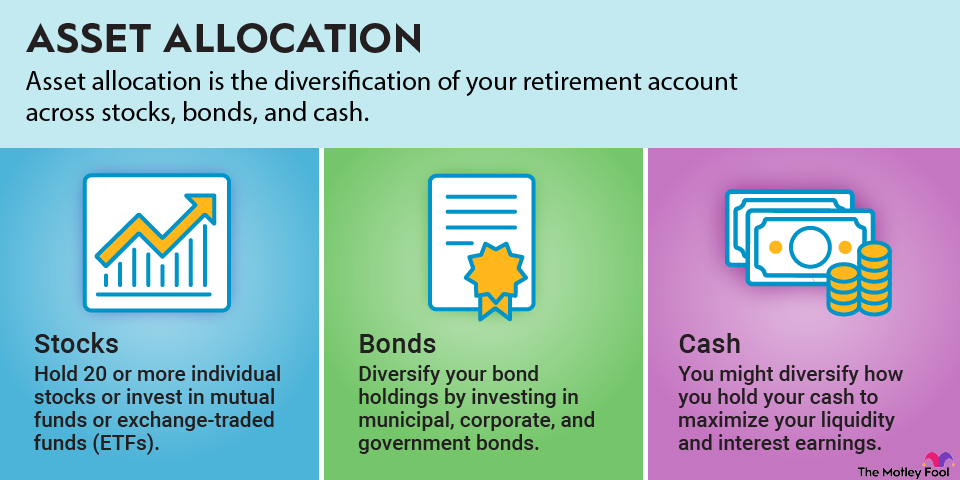

In retirement, your income can come from Social Security, other fixed sources such as pensions and annuities, and of course, your savings. So, the first step is to determine where your retirement income will come from. Do you have a 401(k)? A traditional or Roth IRA? Money in a standard savings account?

How much do you need in savings?

Here's a quick calculation. Most retirement planners agree that you'll need about 80% of your pre-retirement income to sustain the same quality of life after you retire, so:

- First, take your current household income (pre-tax) and multiply it by 0.80.

- Divide the result by 12 to get an estimate of your monthly income needs in retirement. Keep this amount as is to simplify or adjust it higher or lower according to your retirement ambitions. For example, if you plan to travel the world after you retire or pursue an expensive hobby, you may want to plan on additional income.

- Next, subtract your estimated Social Security benefit, as well as any pension income you expect.

- What's remaining is the amount of income you'll need to generate from your savings each month, so multiply by 12 to determine how much you should plan to withdraw from your savings each year.

A standard rule of thumb says that you can reasonably expect to withdraw 4% of your savings in your first year of retirement, and increase this amount for inflation in subsequent years, without having to worry about running out of money. While this rule is admittedly not perfect, it is a good estimate of retirement readiness.

To apply this rule, simply multiply the amount of retirement income you'll need from savings each year by 25. So, if you determine that you'll need $30,000 in annual retirement income from savings, you should aim for a $750,000 nest egg before you quit your job.

Related retirement topics

When can you retire?

The bottom line is that you'll be able to comfortably retire when the income streams you create -- Social Security, your savings, and any other sources you might have -- are enough to support your desired standard of living after you leave your job.

Of course, there's no one-size-fits-all answer here. Many retirees plan to travel the world after they retire, while others are perfectly content with living a simple (read: inexpensive) life.

If you aren't sure if you're on track for the retirement you want, it's a smart idea to consult a financial planner who can assess where you stand and suggest a savings and investment plan to get you where you want to be.